Recent

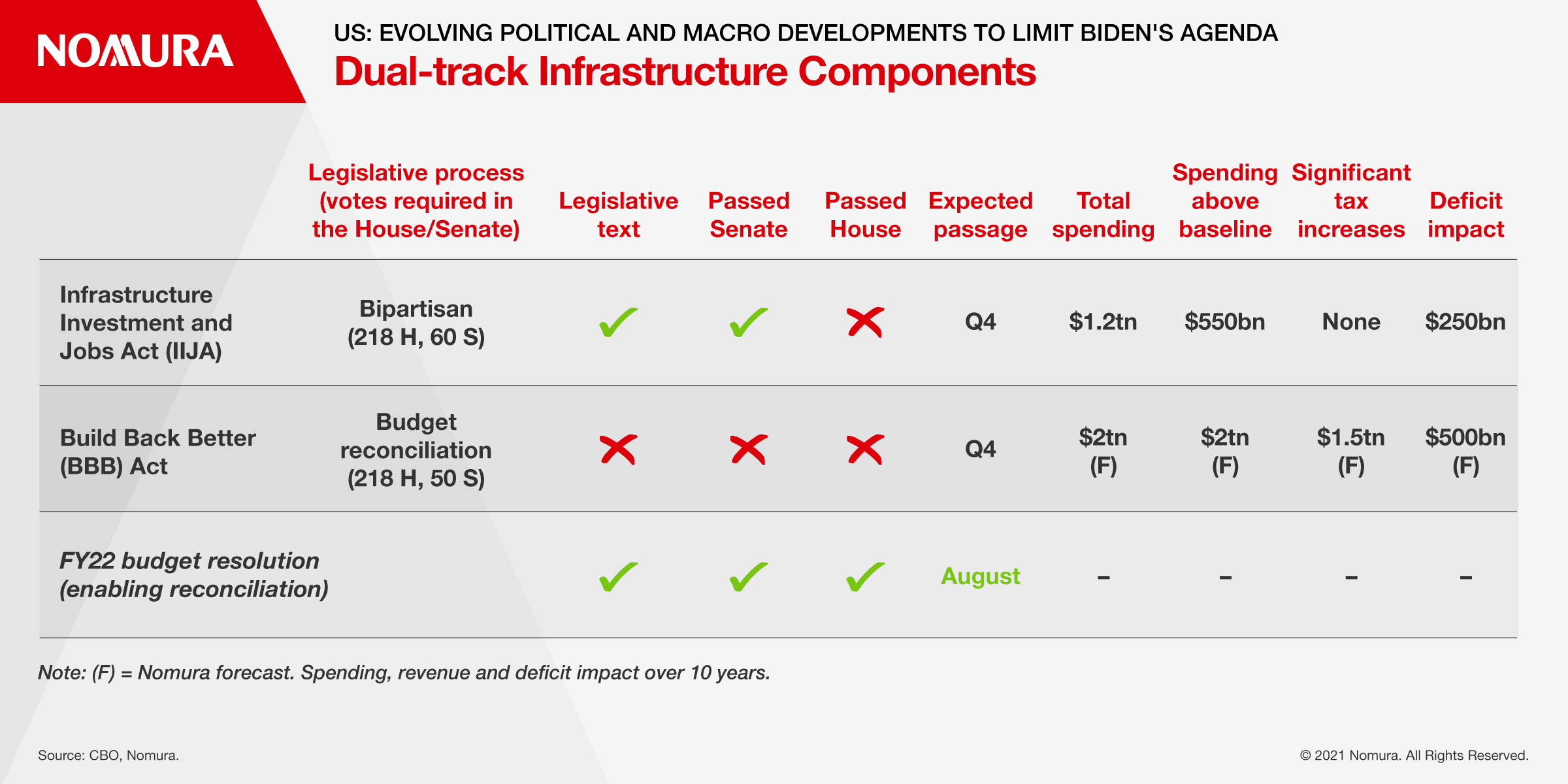

political and economic developments suggest momentum for enacting Biden’s

economic agenda has waned considerably since earlier this year. As a result, we

have lowered our assumption for the total size of the Democrat-only

infrastructure initiative to $2tn in spending over 10 years, down from $3tn

previously.

At the same time,

Democrats have shown a larger appetite for offsetting higher spending by

increasing taxes on corporations and high-income individuals. We expect higher

taxes to raise about $1.5tn in new tax revenue over 10 years, up from $1-1.25tn

previously.

Altogether, given our smaller deficit assumption over 10 years of $500bn, down from $1.75tn previously, we have lowered our 2022 and 2023 real GDP forecasts by 0.2pp and 0.3pp to 4.4% and 1.8%, respectively. We continue to expect growth to slow meaningfully in late 2022 and early 2023 as infrastructure investment fails to offset fiscal drag from COVID relief.

Importantly, uncertainty is unusually elevated. The situation with infrastructure negotiations remains fluid, and a larger or smaller package, with more or less tax revenue than we assume, is quite possible.

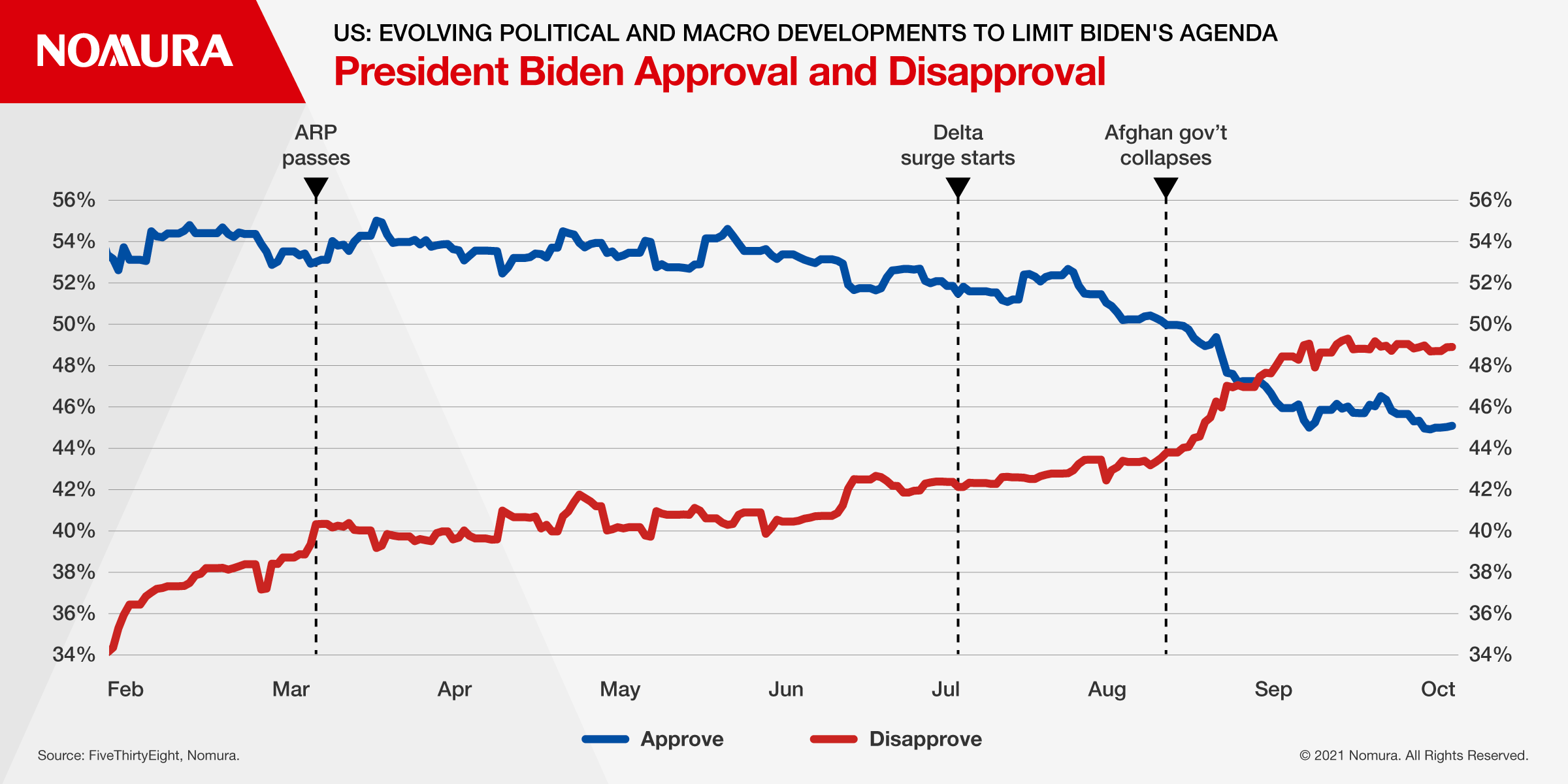

Over the

past six months, the political and macro environments have changed in

significant ways, limiting President Biden’s ability to enact his broad agenda.

First,

relative to when the $1.9tn American Rescue Plan (ARP) was enacted in March

2021, President Biden’s approval rating has dropped sharply from around 54% to

below 46%, driven by the resurgence of COVID-19 and fallout from the withdrawal

from Afghanistan. With waning public support, President Biden’s ability to

unify members of his party behind his broad agenda has weakened considerably.

Second, the

US recovery has continued at a brisk pace despite the resurgence of COVID-19

and expiration of fiscal support such as pandemic-related unemployment

benefits. Savings accumulated during the pandemic might help consumer spending

remain resilient. The urgency for passing additional fiscal relief has declined

notably, with supply bottlenecks now the dominating economic concern among

policymakers.

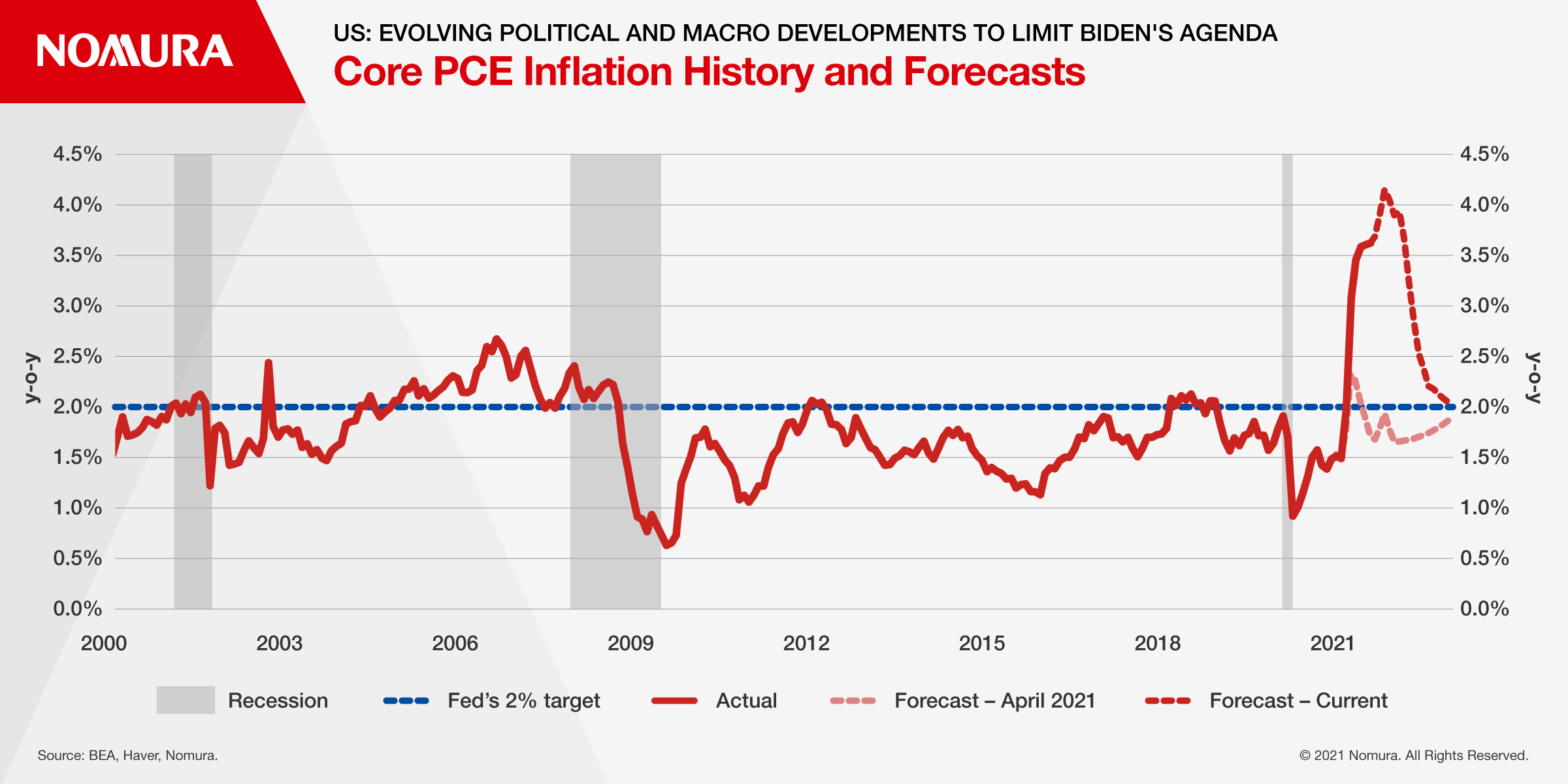

Given

still-strong demand and significant supply disruptions, inflation has risen

much more than expected. Moderates like Senator Manchin (D-WV), who were

somewhat reluctant to embrace the $1.9tn ARP, are now facing a macro

environment that is much less conducive to additional fiscal support, even if

the spend-out rate is slower than pandemic-related spending.

At a

minimum, the urgency that characterized pandemic-related support during the

early days of COVID-19 does not apply to the types of broad reforms being put

forward by the Biden administration.

Against this backdrop, intraparty disputes among Democrats have worsened. Progressives continue to push for $3.5tn or more in spending over 10 years covering broad reform across medical care, family support, education and clean energy. Moderates acknowledge the need for additional infrastructure investment and other policy changes, but have continued to point to significant stimulus already enacted and a less conducive macro environment when justifying smaller topline spending proposals of $1.5tn or lower.

Given historically narrow majorities in both the House (Democrats can afford only three defections) and Senate (Democrats cannot afford a single defection), these disputes are likely to take another few weeks, and possibly months, to resolve. Ultimately, we believe progressives are likely to settle for around $2tn in spending rather than not pass any meaningful legislation ahead of the 2022 midterm elections (see discussion below). Our base case remains passage in Q4 2021, but a delay into early 2022 is a rising risk.