Client Story

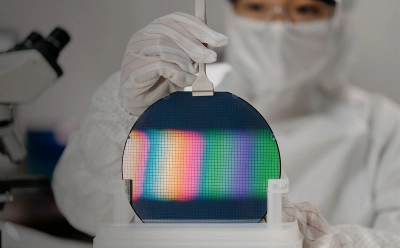

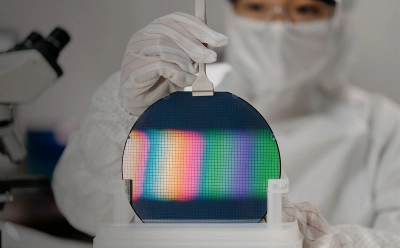

How a Unique Financing Reduced Costs for Taiwan’s GlobalWafers

GlobalWafers, the world’s third biggest silicon wafer maker issued EUR345mn of Exchangeable Units.

2 min read | March 2024

Explore how our truly integrated, cross-asset platform and range of advisory, underwriting, risk solutions and capital-raising services to corporate, institutions, governments and public sector organizations delivers results in markets East and West.

Client Story

GlobalWafers, the world’s third biggest silicon wafer maker issued EUR345mn of Exchangeable Units.

2 min read | March 2024

Client Story

Amp Energy, a global renewables developer, secured a unique $350 million credit facility that could double in size to help it develop solar projects spanning the globe.

3 min read | March 2022

Client Story

ESG investment in Japan is taking off, attracting intense demand from institutional investors. Financing ESG projects has moved from simple green loans to a highly diversified range of products, in which Nomura has a long history of innovation.

4 min read | August 2020

Client Story

Asian M&A shows no sign of abating — even despite the fluctuating geopolitical environment. As the only global investment bank anchored in Asia, Nomura is strongly positioned to advise companies aiming to close significant, value-accretive transactions that cut across borders and jurisdictions.

2 min read | January 2019

Client Story

Despite a difficult year, investors remain keen to use alternative risk premia strategies. However, current approaches may be less diversified than they appear, especially given cross-contamination in cash equity factors. A more diversified approach making use of fixed income has led to better returns and a more resilient portfolio

2 min read | December 2018

Client Story

As mainstream markets evolve, structured products that focus on volatility are becoming more central to risk management and investment. Traditional products, such as long-only equities or bonds, are no longer a sufficient means for investors to achieve their goals.

1 min read | September 2018

Client Story

Nomura’s structuring apportioned risk between the various counterparties while ensuring that there was a simple contract to present to the Chinese regulators.

3 min read | August 2018