Economics | 13 min podcast March 2019

Economics | 4 min read | April 2018

Economics | 4 min read | April 2018

But its impact on the more than 80 countries it encompasses is likely to be greater still.

For investors, BRI presents significant opportunities. However, the sheer scale of the project – and its decades-long timespan – makes it important to prioritize certain countries and sectors. Our report puts the Initiative in perspective and offers valuable insights.

What is BRI?

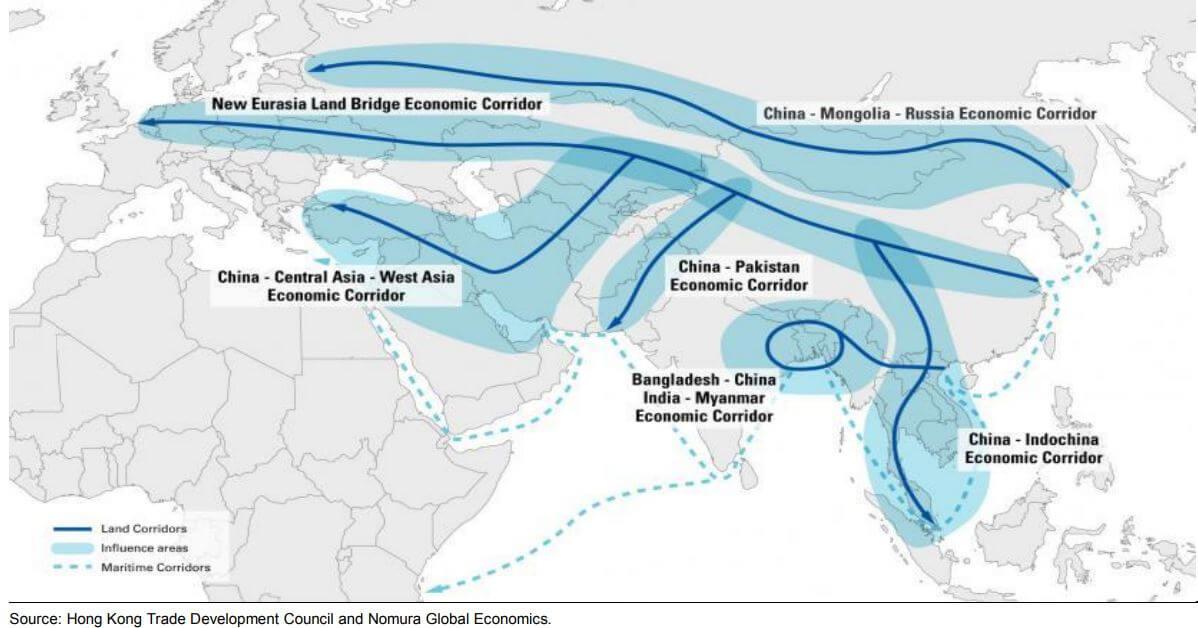

The BRI combines land-based ‘belt’ projects, such as roads, bridge, rail links and pipelines, in six economic corridors with sea-based ‘road’ projects such as ports. It covers China’s nearest neighbors as well as countries in South Asia, the Middle East, Africa and Central and Eastern Europe.

Six economic corridors (the belt) and the Maritime Silk Road (the road)

What will China get from BRI?

A GDP boost: It helps China address manufacturing overcapacity issues and increase exports. This should accelerate China’s real GDP growth by at least 0.1 percentage point annually over the next decade.

A move up the global value chain: BRI makes it easier for China to relocate its low-cost manufacturing to other low-cost countries. At the same time, it can upgrade its production to high value-added products.

An extension of soft power: As the US turns more inward-looking, China is strengthening its credentials as a champion of free trade. BRI extends its foreign policy soft power and elevates its global status.

Stronger geo-strategic advantages: New economic corridors through Pakistan and Central Asia give China alternate routes to source commodities. This reduces its reliance on South China Sea routes for trade.

How will BRI countries benefit?

Accelerated development: Increases in investment, trade, tourism and integration are expected. Pakistan, Bangladesh, Malaysia and the Philippines are especially likely to make gains.

Regional trade integration and large foreign direct investment inflows: Chinese manufacturing may shift to low-cost economies, increasing investment inflows and integrating them into the global value chain.

Boost potential growth: Large-scale physical infrastructure investment should deliver faster economic growth and could potentially fast-track BRI countries towards digitization.

What are the risks?

Financial: China’s financial sector is weak, with high domestic debt. Infrastructure projects may have long payback periods, uncertain returns and potential default risk due to regulatory or political risk in the recipient economy.

Debt sustainability: Large loans taken at a commercial rate could result in debt distress for smaller BRI economies if a project doesn’t generate sufficient returns.

Public opinion: The benefit of projects to recipient economies may not be clear given the use of Chinese funding, construction materials and workers. This, combined with sovereignty concerns, could trigger a public backlash.

Balance-of-payment: There could be pressure on BRI countries’ balance of payments due to a sharper rise in imports from China than exports to China (worsening trade deficits), debt repayments and repatriation of profit (capital outflows).

Geopolitical tensions: Tensions with India could escalate, threatening the Bangladesh-China-India-Myanmar (BCIM) trade corridor. Tensions in the South China Sea could resurface after Philippines President Duterte’s term expires in 2022.

We believe these are manageable risks – China’s own investment-led development has taught it valuable lessons. Its focus is on using new multilateral funding institutions to promote the role of market forces and best execution of public-private partnerships.

How to play BRI

Country focus

We think the biggest beneficiaries in South Asia are Pakistan and Bangladesh. Among major ASEAN countries, Malaysia and the Philippines stand to benefit the most.

Outside of Asia, industrialized countries could benefit from increased demand for their capital- and technology-intensive manufacturing goods. Infrastructure activity could benefit resource-rich economies, such as Australia and Indonesia.

Sector focus

Chinese infrastructure, financials and consumption equity proxies will benefit. We’ve identified a basket of 10 Hong Kong/China-listed stocks with meaningful BRI exposure. BRI also supports our longer-term view of Renminbi appreciation, as it benefits China’s push towards renminbi internationalization.

For ASEAN equites, BRI is positive for contractors, tourism, last-mile delivery and hospitals. However, strong competition from Chinese entrants into the domestic markets also means disruption of existing business models. This could be negative for the likes of Philippine telecommunications companies.

Read the report here for more insights into the Belt Road Initiative and our BRI investment picks.

Chief Economist, India and Asia ex-Japan

Week Ahead Podcast Host and Chief ASEAN Economist

Global Head of FX Strategy

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.

Economics | 13 min podcast March 2019

Emerging Markets | 2 min read February 2019

Economics | 2 min read March 2019