-

S2G Ventures' goal is to build companies that are profitable with strong cash flows and syndicates that have similar alignment

-

The Inflation Reduction Act will have an indirect impact on the food system via greater deployment of renewables

-

Sanjeev believes electrolysers will become more efficient and scaled so that without subsidies they can substitute natural gas to make green hydrogen

What first sparked your interest in sustainability?

I’ve been interested in sustainability from a young age. I grew up in India and went to university in the UK to study development economics, the core of which is energy and the environment.

Sustainable investing caught my attention around 2002 when I was involved in the tech, media and telecoms sector. I saw firsthand how the deployment of innovation, particularly in the emerging markets, allowed millions of people to leapfrog fixed lines and go straight to mobile. It was a function of innovation, business motivation, policy and societal buy-in but most importantly a deep capital market that developed and funded it.

I joined the investment side in 2003 and have been working with sustainable companies ever since.

How concerned are you about climate change and the pace at which the world is collectively trying to solve this problem?

I think it’s an existential risk that has a long tail meaning its effects could be felt many years from now. The problem is that in and of itself, I don’t believe it’s going to motivate action in the timeframe that we need.

In my view, this means we need more storytelling around the economic fundamentals that this is a productivity thesis and a commodity transition, and how the solutions to climate change are more efficient, less volatile, and more profitable.

The last 300 years of productivity can be crudely summarised as the railroads, electricity, oil, polymers and computing. All of them had innovation at their core that led to a business model that then led to policy and societal buy-in with funding from the capital markets.

Railroads had the Bessemer steel process while computing had semiconductors and electronics. Railroads were funded by the bond market and computing had venture capital.

The future growth of the world is based on an aging demographic. The situation requires us to frame it as a resource productivity problem, which I believe is the 5th productivity opportunity in the last 300 years. By 2050 we will have the thermodynamic demand of 10 billion people for cars, water and other resources, which will likely require a new generation of commodities and infrastructure because the existing systems will be mostly outdated given the increase in demand.

I believe we need to figure out how to tackle the challenge of resource productivity in a way that is compelling, and at the same time, helps climate mitigation and climate adaptation.

Why did you and your partners set up S2G Ventures and what are the most important factors you consider when making green investments?

I’m a refugee of cleantech 1.0 and I think one of the reasons it didn’t take off was a lack of policy drivers and minimal capital markets support.

When we set up S2G I was looking for a sector where policy signals were not an immediate requirement and we thought of Food and Ag because the consumer was transitioning. Millennials were the largest consuming class in US history at the time and now Gen Z is the largest consuming class in the world in generational terms, and they were behaving differently about

how they thought about food systems.

That was an even more profound demand signal in our view than the policy signals, hence our focus. Secondly, it was very under penetrated when we launched. We are one of the largest dedicated global allocators into this sector which just shows you how immature the space was in terms of risk capital.

My entire career has been around what I call ‘tough tech’: The commodity industries, low margin, capex intensive, regulatory sensitive with highly concentrated market structures characterised

by oligopolies. And then limited rinse and repeat management teams and limited exits. So, we built the firm knowing that Food and Ag was our cornerstone and anchoring point for these reasons. But we would go into other verticals like oceans and energy.

When making green investments I consider a few key factors: 1. Is it solving a problem that is needed? 2. Do we have a conviction that the technology can reach commodity parity with the incumbent? and 3. Having or building a great team to execute the strategy.

What are some of the pitfalls of investing in firms focused on green technologies?

I would cite the following four perspectives: 1. They never go from R&D to commercialization for various reasons; 2. The product is either risk-off or takes a long time for adoption; 3. It’s a capital-intensive business which works in a 0% rates world but doesn’t work in the 5% rates world; and 4. If you’re reliant on other market participants, syndicate risk is probably the number one risk. I’ve been doing this for 21 years through three cycles as a professional, 01, 09 and now. In each of those cycles, the deciding factor wasn’t the management team, stage of business or value proposition but whether the syndicate had the staying power and desire to get to the other side of the volatility.

Whether the volatility is execution-driven on a micro or macro level, I have seen that many of the demonstrated winners have been syndicates that have a longer-term mindset. For that reason, we are becoming more thoughtful about ensuring syndicate alignment.

S2G has a focus on Agtech. Are you concerned by the sector’s recent drought in investment?

Food and Agtech is going through its cleantech 1.0 moment. Peak to trough, funding is down 70%, and it doesn’t have IRA support, which is mitigating the more difficult economic conditions in other industries.

I believe the companies that made it through cleantech 1.0 did very well, their competitors went out of business. We saw them focus more on core products, core geographies and becoming more capital efficient. They concentrated on margin as opposed to growth so to me the survivors of this cycle will do very well. It’s very painful, particularly over the last 18 - 24 months but I do think that for the system as a whole, it should be net healthy because the strong will survive and thrive on the other side.

How much of a tailwind is the Inflation Reduction Act for the work you do?

We see our core areas of Ocean, Energy and Food & Ag as one transition rather than three. Historically, commodities were relatively siloed but now what happens in natural gas affects fertilizer and what happens in shipping can impact multiple sectors. They all have similar industry characteristics in terms of margin, capital intensity and regulatory exposure.

We try to take a systems view of commodity flows across the core needs of humans which are calories, electrons or energy density and water. Those are three things in addition to shelter and

clothing which humans need every day, and they are becoming more interconnected because of geopolitics and innovation.

The IRA will have an indirect impact on the food system via greater deployment of renewables as those renewables will colonize not just transportation but also petrochemicals and fertilizer and eventually that flows through into food.

I also believe very strongly that the world over the next 40 years will be vastly different to the last 4 decades. We are moving from a world of relative moderation in interest rates and inflation, a

period of globalization and a demographic dividend provided by the baby boomers to geopolitical instability - a 30-year high in the number of conflicts in the world, not just Ukraine and the

Middle East, - and economic volatility.

But I believe the green transition offers a hedge to that volatility by decentralizing our systems. It will, in my view, de-commoditize our reliance on commodities that have been turbulent for geopolitical and economic reasons.

The SEC recently unveiled its final climate rules. To what extend do you think they are weakened by not including scope 3 emissions?

They say America innovates and Europe regulates, and I think Europe will continue to play that role.

While it is important to measure scope 3 for risk and compliance reasons, I believe what we really need is the fundamental material science, computation power, engineering and unit economics to drive change. I think we get lost in policy driven disclosures as a way to make progress when that’s far from being the entire story.

Will the ESG backlash in the US slow or derail efforts on climate?

I believe we need to adopt a post-ESG mindset as the world is potentially headed toward stagnation driven by low growth and high inflation. We need to progress from green premiums to green discounts, which means productivity that’s cheaper, faster and better in my view. It takes innovation, business motivation and capital markets that are severely lacking for some sustainability sectors. From my perspective, you can be anti-ESG but you can’t be anti-productivity.

Who will be the winners and losers in the green transition?

I believe the winners will be whoever can stay alive the longest by managing cash flow while offering productive and profitable solutions to the existing commodity system. It’s hard to say who the losers will be but there will likely be many. The beauty of American capitalism lies in its tolerance for failure which creates companies like Google, Microsoft and Nvidia.

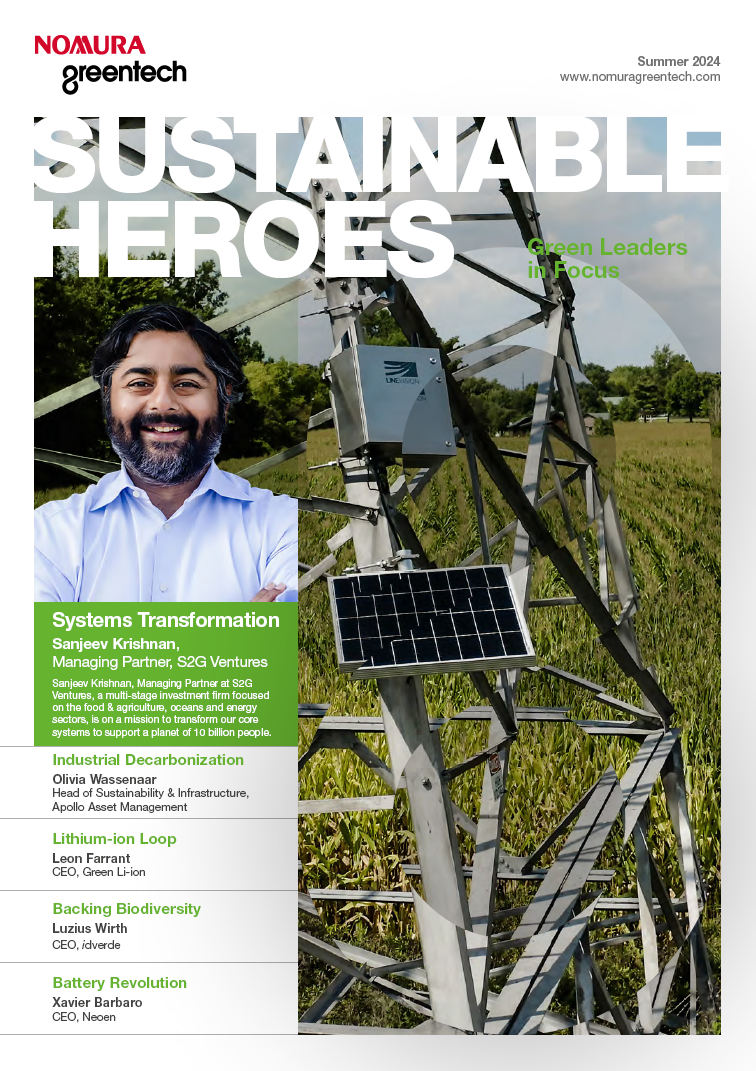

Contributor

Sanjeev Krishnan

Managing Partner, S2G Ventures

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.