Insurance companies have been more active in the market for credit and government bond repacks this year as their quest for yield leads to a rise in issuance.

Despite yields on regular government and corporate bonds being elevated, Nomura has seen an increase in demand for more complex structures on the SPIRE platform in the first quarter compared to the same period a year ago.

After a steep rise in rates in 2023, insurance companies are under pressure to offer more competitive life products to their annuity customers who could choose to leave money on deposit instead of continuing with their existing policies or taking out new ones, explains Marco D’Agostino, Co-Head, Global Markets Solutions Sales EMEA at Nomura in London.

“Activity is picking up,” he says. “Insurance companies are using repacks for yield enhancement, diversification of risk and to differentiate their offering.”

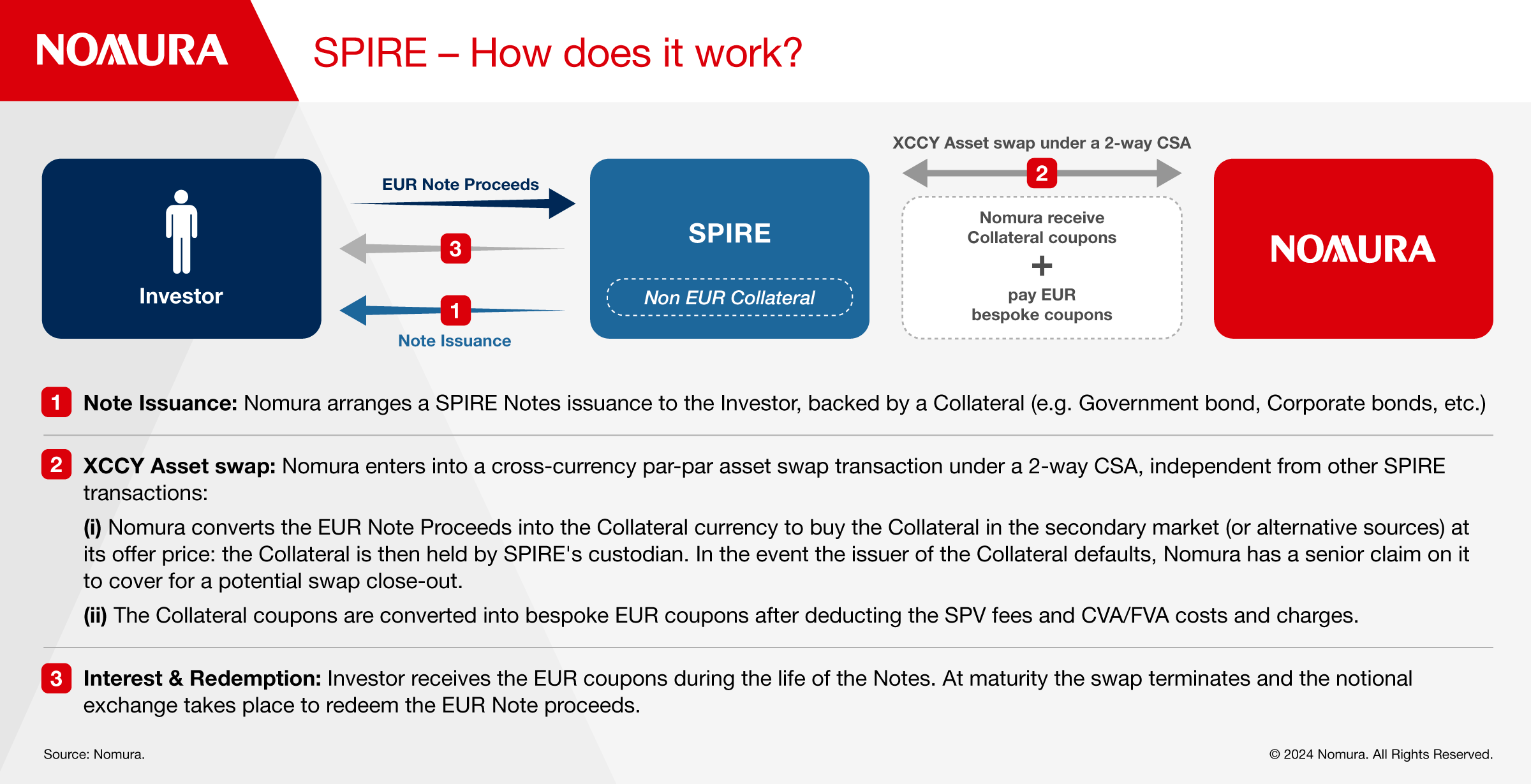

Repacks or repackaged transactions are structured notes that combine a debt security and a derivative, offering access to a broad variety of assets and payoffs.

Historically, insurance companies have turned to repacks to match their liabilities but D’Agostino says that in the current environment they are using them more creatively. One way is to capture the illiquidity premium - the additional return received for the extra risk of tying up capital in a less liquid asset. They will typically buy a bond and overlay a swap to change the currency and coupon or add callability features to maximize return on invested capital.

Natalia Cermeno, Head of Rates Structuring and ESG Structuring at Nomura in London explains that fixed callables are also popular as rates are high. Nomura recently priced a callable fixed note for a European insurer on a government bond. She says that the client choosing to sell a call – giving Nomura the right to terminate the trade before maturity – can generate a yield pickup of 30-70 bps depending on the trade specific details.

Cermeno says that other clients have sought to repackage government bonds linked to inflation, which have been trading at wider levels when compared to their equivalent nominal bonds.

Unpacking a Repack

In simple terms, a repack gives investors an off-the-shelf solution to transforming government and corporate bonds (as well as other assets like loans) into different risk profiles, payoffs, and currencies that better suit an investor’s specific needs.

As an example, euro denominated investors, buying a foreign currency asset themselves would typically have to overlay a cross-currency swap to convert the cashflows back into euros. While cross-currency swaps are typically inexpensive and liquid to enter and exit, they are derivatives that sit on the balance sheet leading to volatility and operational and collateral management complexities for investors explains Ben Hammond, Managing Director in Credit Structuring at Nomura in London.

To mitigate those challenges, the investor could instead choose to buy the foreign currency asset and cross-currency swap, wrapped together in a “repack” bond. The repack is issued by a special purpose vehicle (SPV) which houses the asset and swap and takes care of the collateral management leaving the investor with just a bond on its balance sheet.

Within the SPV construct, the margining of the derivative is effectively automated for the investor as it doesn’t require their input. A credit support annex (CSA) typically exists between Nomura and the SPV, where the SPV would post Nomura the asset being repackaged to the extent the present value of the swap is in favour of Nomura and Nomura would post collateral (usually certain government bonds pre-agreed with the investor) if the present value of the derivative is in the SPV’s favour, says Hammond.

The main disadvantage is that it comes at an extra cost, but on market-wide SPV platforms like SPIRE which have encouraged product standardisation, these costs are still attractive for investors.

The operational efficiencies of using an SPV have become more important in the wake of the UK’s Liability-Driven Investment crisis last September when pension firms had to post margin as rates suddenly spiked and the value of their portfolios diminished, says D’Agostino.

Insurers and Capital Charges

Another important consideration for insurers is the issue of capital charges under the pan-European insurance regime Solvency II. Most European insurers need high yielding zero SCR (Solvency Credit Risk) assets, which have a 0% capital charge under Solvency II rules. These assets are typically bonds issued by EU sovereign governments, local regions, supranationals, and AA/AAA rated non-EU sovereigns. Other examples include UK gilts and gilt linkers denominated in sterling.

“European investors have started to embrace UK credit again after a period post-Brexit when credit lines may have been restricted for some,” says Hammond. “Another factor driving their behaviour is Gilt nominal and Gilt linkers have been grinding wider over the recent past providing better investment opportunities.”

Inverse Floater

Cermeno says that with developed market interest rates expected to fall later this year, some insurance clients are weighing up inverse floaters, which can achieve higher yield as central banks look to cut interest rates.

East to West Repack

Nomura’s large credit flow trading franchise in Asia and Japan has allowed it to explore sourcing assets from Asia-Pacific and repackaging them for European clients via the Samurai market – yen-denominated bonds issued in Tokyo by non-Japanese companies – says Hammond.

“The rationale for investors is that they generally buy euro-dominated debt, but these repacks provide a decent yield pickup for the same underlying risk,” he says. “The repackage is very versatile, it’s almost weatherproof when using it as a tool rather than implementing a view.”

To gain further insights into credit and government bond repacks, please contact Marco D’Agostino, Natalia Cermeno or Ben Hammond.