Central Banks | 2 min video November 2019

Economics | 5 min video | December 2019

Economics | 5 min video | December 2019

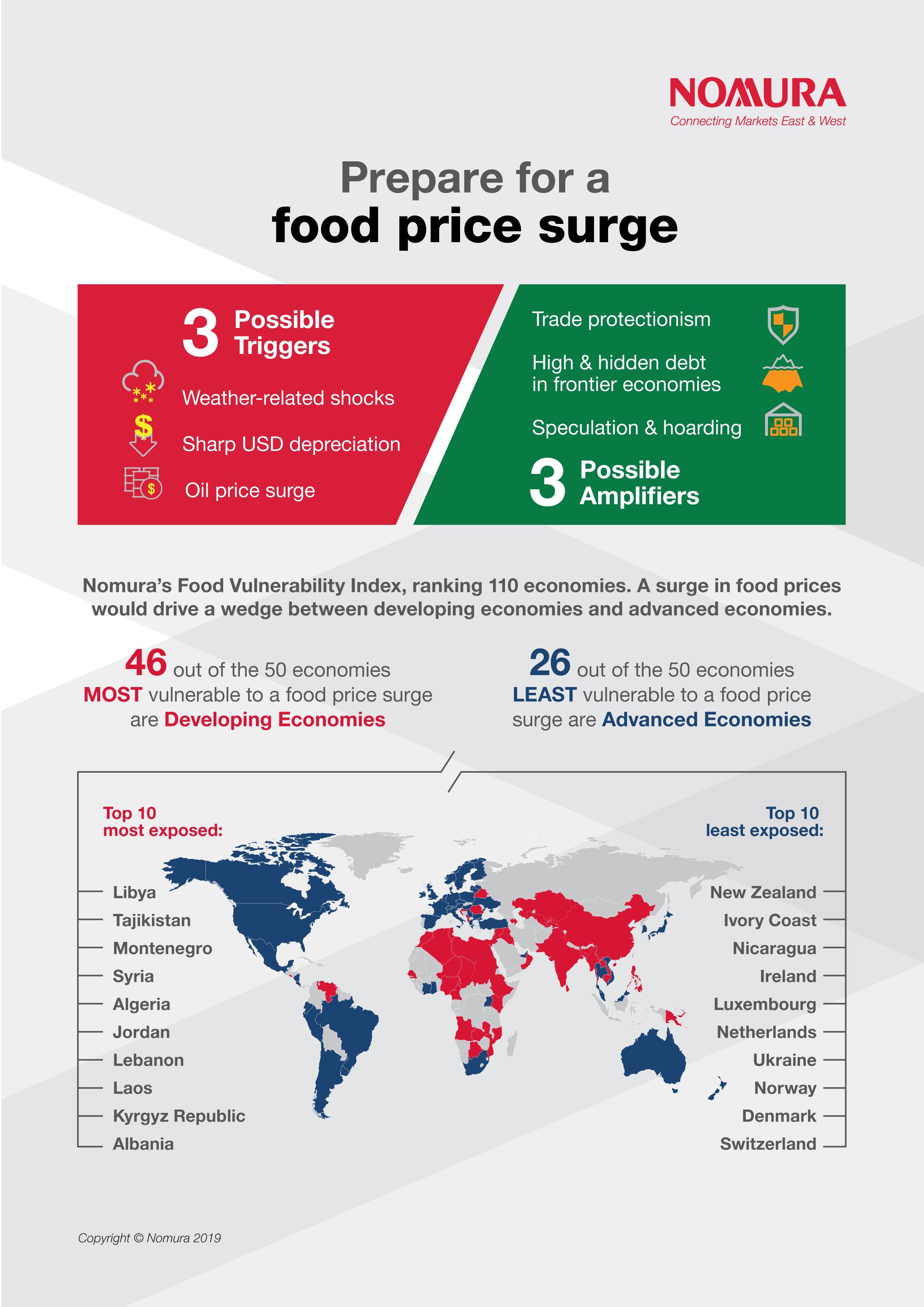

After surging in 2010-11, global food prices have been on a downtrend, but this can quickly change. Structural drivers of food demand – rising EM populations and income growth coupled with an increasing appetite for more protein – remain strong. The supply-side of the food equation is also tightening, as the eight-year trend decline in food prices is disincentivising new agricultural investment at a time of decreasing arable land and water supply. We discuss three triggers for a food price surge and three amplifier effects.

We update the Nomura Food Vulnerability Index (NFVI), which objectively estimates a country’s exposure to large food price swings, depending on nominal GDP per capita, the share of food in household consumption and net food imports. Our ranking of 110 economies highlights Libya, Tajikistan, Montenegro, Syria and Algeria as the five economies most vulnerable to a surge in food prices. The 50 most vulnerable in our NFVI are largely small, frontier market economies that collectively make up 26% of world GDP and a much greater 59% of the world population. The larger economies that are more vulnerable in our NFVI include Bangladesh (ranked #12), Egypt (#16), Nigeria (#17), the Philippines (#23), Pakistan (#32), Hong Kong (#42), Romania (#43), India (#44), Russia (#45) and China (#46). At the other end of the spectrum, the five least exposed to a surge in food prices in our NFVI, and economies that could potentially benefit, are New Zealand, Ivory Coast, Nicaragua, Ireland and Luxembourg.

What to watch out for?

There are three potential triggers for a food price surge, namely weather-related shocks, higher oil prices and sharp USD depreciation. Once a food supply shock is triggered, higher food prices could be amplified by 1) protectionist agricultural trade policies; 2) increased speculation and hoarding by investors; and 3) dangerously high (and hidden) debt levels in frontier economies.

Who is most at risk?

The top 30 vulnerable countries in our NFVI are nearly all frontier economies. The outstanding hard currency debt of frontier economies has tripled over the last five years, and many also owe ‘hidden debt’ to China on non-concessionary terms, putting them at risk of being in a debt trap and constraining them with little fiscal space to protect consumers in the event of higher food prices. We found that many of these most vulnerable frontier economies in our NFVI are also ranked among the world’s most vulnerable to climate-change induced disruptions. High debt and high exposure to climate change is double trouble for these frontier economies in the event of a food price surge.

Learn more about the factors contributing to a food price surge in our full report.

Head of Global Macro Research

Macroeconomic Research Analyst, Asia ex-Japan

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.

Central Banks | 2 min video November 2019

Focused thinking | 4 min video November 2019

Central Banks | 2 min video October 2019