Emerging Markets | 2 min read May 2018

Economics | 3 min read | November 2018

Economics | 3 min read | November 2018

Macroeconomic Impact

Oil prices have fallen sharply. This drop, if sustained, will have a greater impact on emerging markets (EM) than developed markets (DM) because EM economies are more energy-intensive, less energy-efficient, and home to the bulk of the world’s largest net exporters and importers of oil. Big moves in the oil price will drive a major divide in the performances of EM economies.

For big oil exporters in the Middle East, Latin America, Russia and Nigeria, the oil price slump erodes export revenues, resulting in deteriorating current account and fiscal positions, and reduced energy sector profits. The subsequent impact on GDP growth can be expected to be negative and the deterioration in economic fundamentals can cause currencies to depreciate, limiting the scope for central banks to ease monetary policy.

On the other hand, for large net oil importers – notably in Asia – cheaper imports of petroleum and related products improve current accounts positions, widens profit margins and, to the extent that companies pass on their lower production costs, reduces consumer price index inflation. Thus, a positive impact on GDP growth can be expected and fiscal positions can improve on stronger revenues and a lower fuel-subsidy bill. Also, for large net oil importers, more space can be created to ease macro policies.

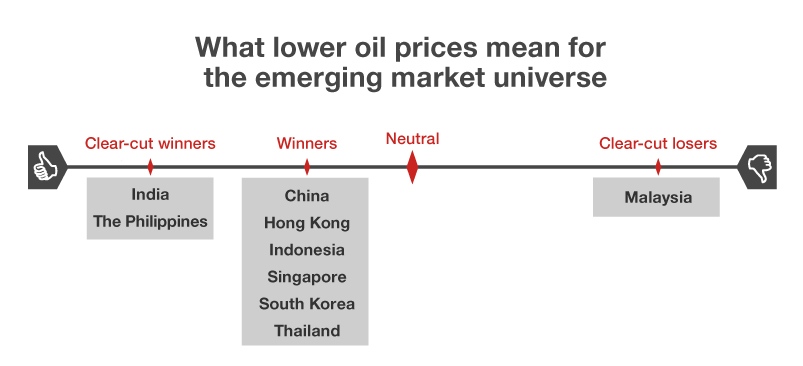

Net imports of petroleum and petroleum-related products (as a share of GDP) and the weight of energy in the CPI are two useful metrics to gauge the relative exposure of an economy to lower oil prices, and drive home the point that there can be big winners and losers in EM. For EM economies that are more export-orientated, the oil price slump would be more negative for net oil exporters and less positive for net oil importers.

Winners and losers

Impact is clearer on rates than on FX

The fall in oil prices is likely to have a mixed effect on EM markets. While things are looking up for EM rates, the same cannot be said for EM FX.

Lower oil prices looks to be positive on EM rates through 1) reduced inflation expectations; 2) scope for some pricing out of rate hikes; 3) stabilization of oil import-dependent EM FX; and 4) support from increased concern over a fall in global demand on slower China growth. The US midterm election results could also impede further fiscal stimulus. This is an important factor for EM rates as stability in longer end of US curve benefits long EM rates positions.

Overall, the view that lower oil prices are being driven by both supply and demand factors adds to the complication on the impact on EM FX. Despite some scope for terms of trade improvements in net importing countries, concerns over global economic weakness could lead to a more challenging capital flow backdrop. Local factors such near-term policy and political risks in India, downside growth and policy challenges that lie beyond trade protectionism in China, and the risk that Bank of Indonesia will start to re-accumulate foreign currency given recent sharp FX reserve losses.

For more insights, read our full report on the effects of an oil price slump here.

Head of Global Macro Research

Global Head of FX Strategy

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.

Emerging Markets | 2 min read May 2018

Economics | 4 min podcast November 2017

Economics | 2 min read August 2018