Economics | 6 min read June 2018

Economics | 3 min read | June 2018

Economics | 3 min read | June 2018

After decades of double-digit growth, China’s macroeconomic slowdown to more sustainable levels continues to be a key feature of any serious analysis of the global economy.

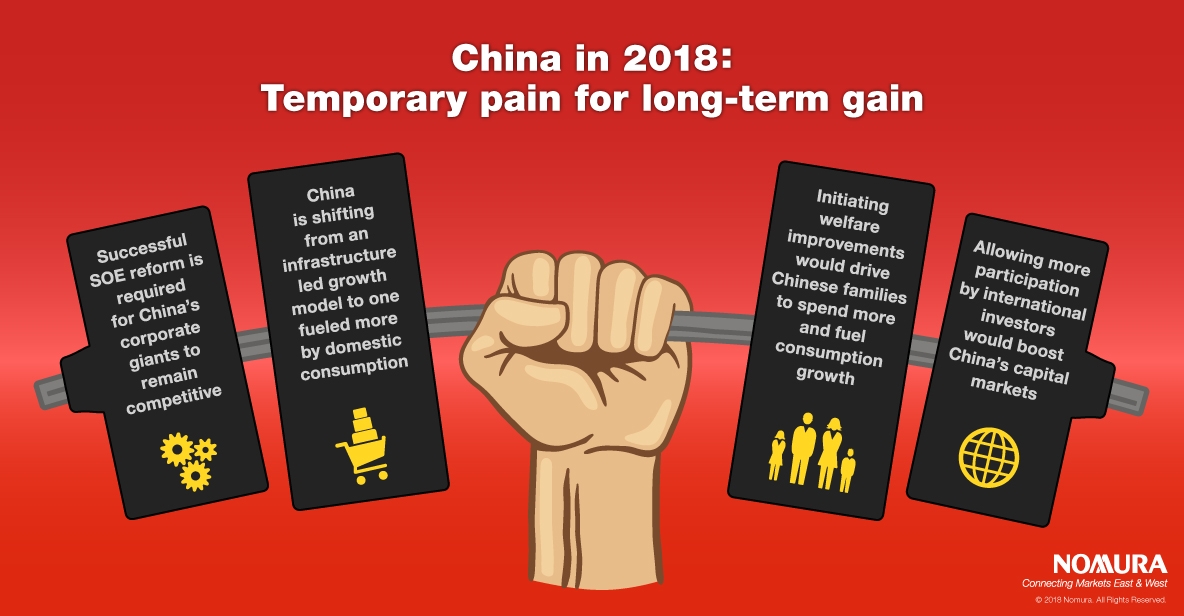

It’s no secret that China’s policymakers have a herculean task on their hands in 2018. They are simultaneously trying to control the spread of excess leverage, improve regulatory transparency, and boost the renminbi (RMB), while they also try to shift from an investment and infrastructure led growth model to one fueled more by domestic consumption.

Delivering results on all fronts would present a challenge in any economy, and it’s no different in China. Due to an inadequate social welfare regime, the world’s most populous nation is still home to some of the highest savings rates in the world – averaging more than 40%. That makes consumption-based growth even harder to achieve.

Slowdown is most likely expected in 2018-19, weighed on by investment, the credit cycle and structural reforms. Even so, an expected GDP growth well above 6% in the near term is still very attractive compared to many parts of the world.

Soaring property

There’s one immediate challenge that’s impossible to ignore in China this year, and that’s property prices. According to our estimates, they've doubled between 2015-17. While the official property index only shows a 17% gain over that time period, secondary-market transaction data reveals far steeper price increases.

It’s true company balance sheets may improve due to increased asset valuations in the short-term. But as prices rise, risks increase – and fears of a reckoning intensify. The end result could be a correction at some point down the road that sends jitters throughout the market, exacerbating China’s already significant slowdown.

Facing the pain of reform

Against this backdrop, China’s policymakers are also continuing their attempts to stop excess leverage from spreading throughout China’s vast, and increasingly diversified economy. With the order to ‘deleverage’ announced from the seat of power in Beijing, credit conditions will inevitably tighten, resulting in lower rates of fixed asset investment in the years ahead.

To emerge safely on the other side of the reform process, China will need to double down on SOE reform and make its huge state-backed companies less bureaucratic; allow more international participation in its capital markets via innovations such as the Stock Connect and Bond Connect programs; and initiate substantive welfare improvements so Chinese families will save less and spend more to fuel consumption growth.

Made in China – a new era?

While the contradictions inherent in reform grab much of the attention, another huge question facing China in 2018 and beyond is whether it can ultimately emerge as a high value service-based economy that produces innovations and consumer brands attractive to people all over the world.

In the next few years, investors should begin to expect more ‘differentiation,’ especially in the area of credit. As China’s credit market matures, more borrowers will default, which – while painful – also represents a move toward more accurate risk pricing and a financial system that prioritizes credible, and transparent valuations.

There will also be more regional differentiation as growth in China’s western and northern regions catches up with the booming eastern shore board. And finally, there will be industry and, importantly, brand differentiation as China’s domestic champions emerge victorious and clinch a slice of the coveted consumer pie.

Whether China will eventually give birth to global consumer brands on the scale of Samsung or Sony remains to be seen. But Asia’s giant is already settling into the rhythm of a more moderate – but higher-value – growth trajectory.

Chairman of Investment Banking, China Region

Head of Investment Banking, China

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.

Economics | 6 min read June 2018

Economics | 2 min read March 2018

Emerging Markets | 2 min read June 2018