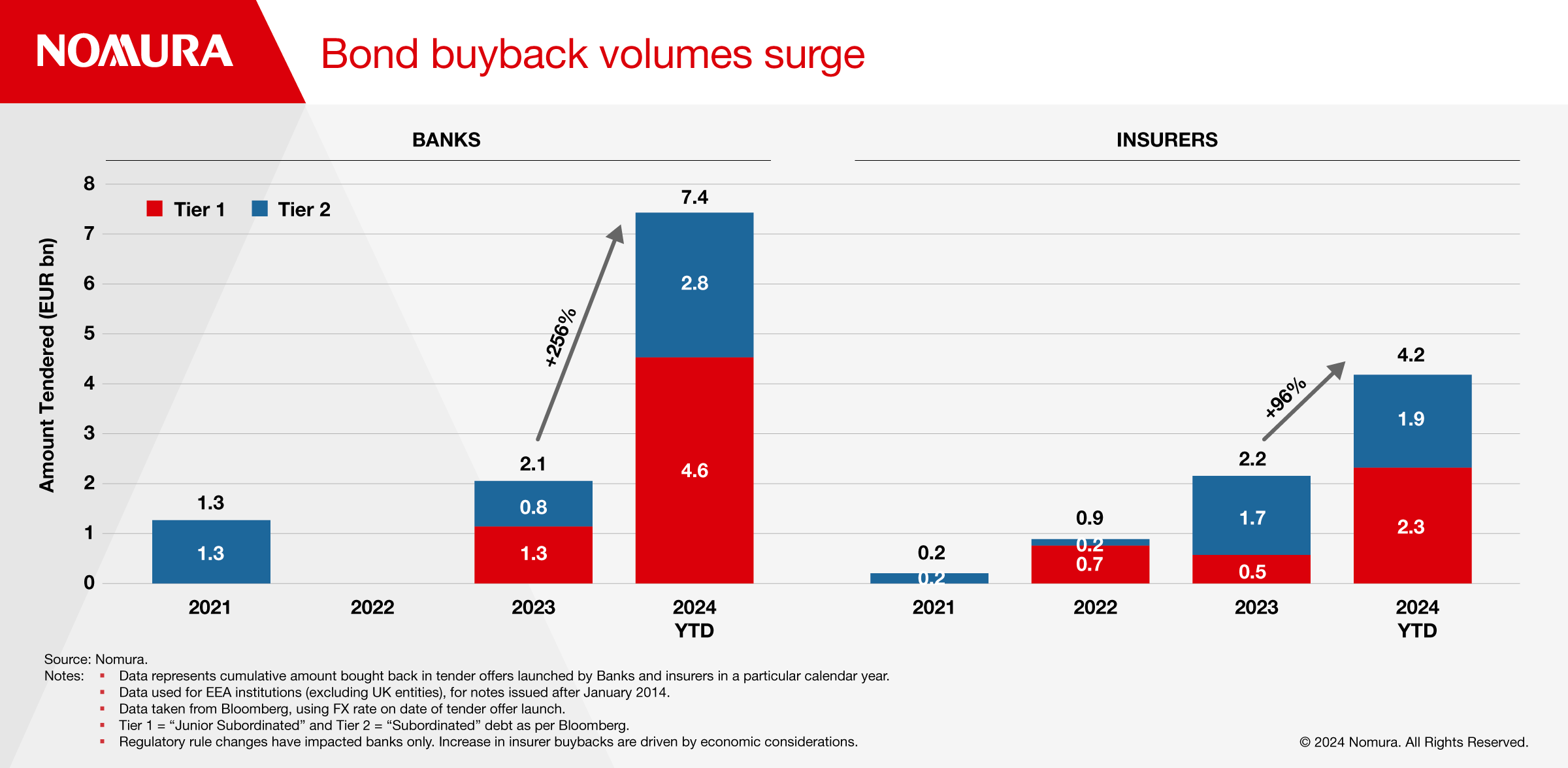

Bond buyback volumes have surged following easing of regulatory rules, paving the way for broader market adoption.

Regulated institutions can only conduct debt repurchases as per supervisory requirements. Ambiguity in the regulatory rules restricted financial institutions from using bond buybacks in the past. However, recent clarifications and a flexible stance in approving buyback requests have opened up the market.

Unlike equities, in debt markets, buybacks are generally linked with new issuance, to refinance and extend the maturity profile.

Banks have bought back 7.4bn euros of regulatory capital instruments so far this year, a 250% increase versus the whole of last year, according to data from Bloomberg.

Regulatory clarification on crucial aspects – for example, timing of deduction of bought back notes from regulatory capital, reinstatement of residual amount – has been welcomed by issuers. Supervisors are also allowing repurchase of regulatory capital within the first five years from issuance, something that was rarely seen earlier.

“Clarification of the regulations is a significant development and has given bank capital issuers more flexibility in the refinancing process,” says Morven Jones, Managing Director at Nomura in London. “We see many banks taking advantage because it makes economic sense.”

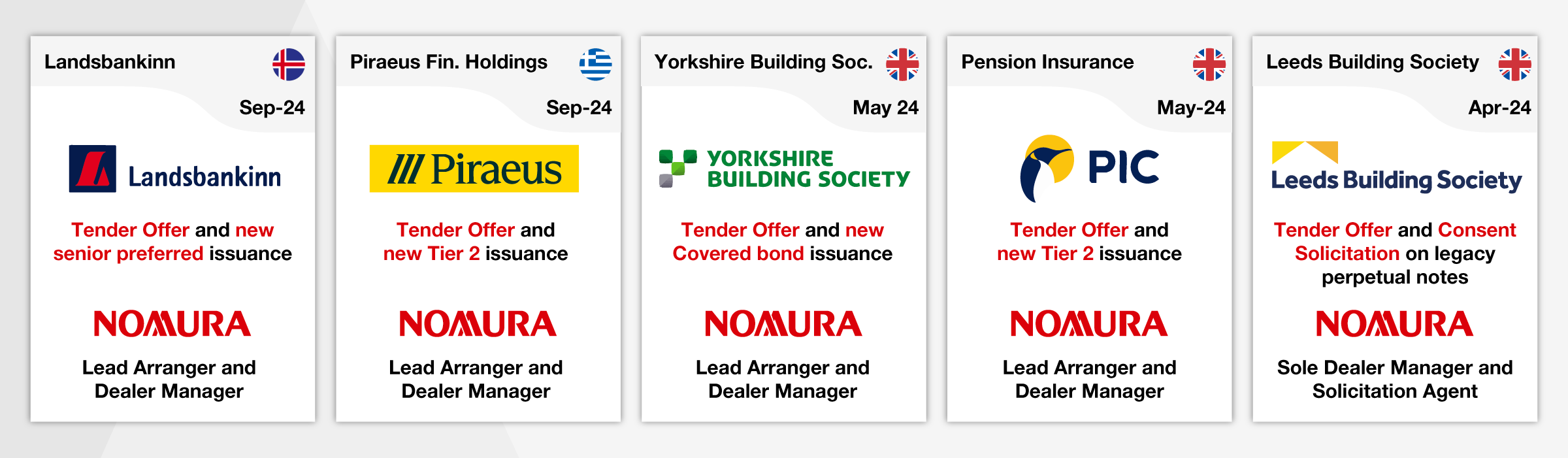

Nomura has been active in this space, working on a wide range of bespoke transactions:

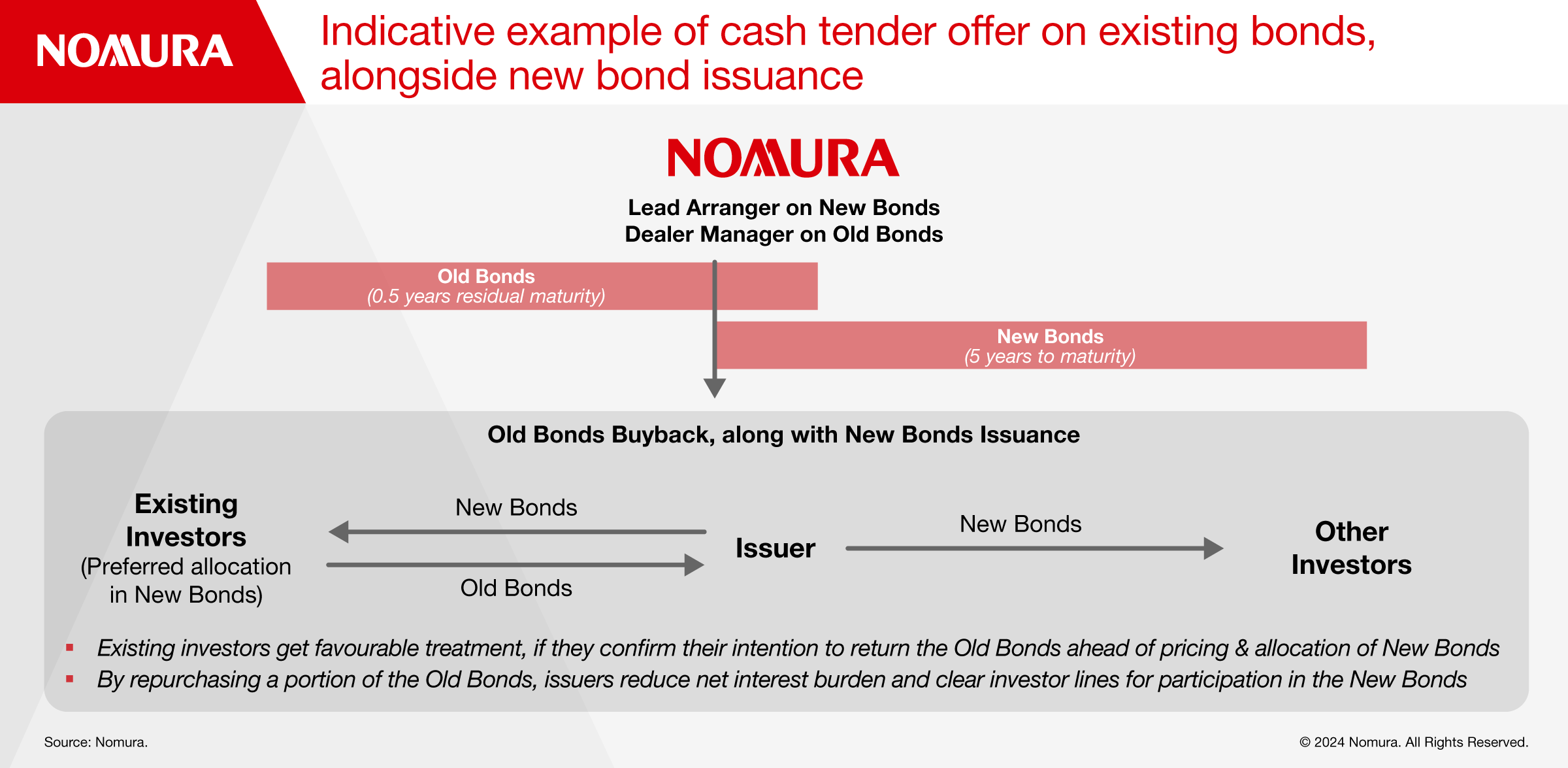

HOW IT WORKS

The conventional approach is to refinance debt ahead of the redemption date, for say another five years, while trying to time the market to get the best interest rate and credit spread. Sometimes, borrowers also have a conflicting objective to wait as late as possible before the debt maturity date to execute the refinancing to avoid over-borrowing or so-called negative carry of interest by re-financing too early.

As they do not need the new cash until the existing debt matures, the further in advance of the maturity day that they borrow, the greater the negative carry. This occurs when the bond proceeds are put on deposit typically at a money market rate of interest while already accruing the interest cost on the new debt, which is at a much higher rate, creating a negative spread between what is earned on the proceeds and what is being paid on the bond.

“The dilemma for a treasurer is to minimise the negative carry and to not leave it too late to execute the refinancing, only to find the market’s not there,” says Jones.

Combining the new issue with a bond buyback can help mitigate this negative carry. This can be done by buying back the existing bonds, and offering a preferential right to existing holders to exchange their holding of the bond for the new one.

While this is common practice in the less regulated corporate sector, financial institution borrowers have not been using the technique due to regulatory uncertainty. They could not do early buybacks, exchanges or retirements of existing capital without receiving the regulator’s blessing, and hence took the conservative approach and refinanced typically six-to-nine months early to avoid risk of market closure near the redemption date, according to Vaibhav Garg, Vice President at Nomura.

Another factor giving added impetus to the bond buyback market is the changing interest rate environment.

“Bond buybacks have become even more important now as the benchmark rates are higher, so the burden of carrying two bonds, the refinanced and refinancing bond, even for a short period, is often more painful than it would have been over the last decade under the ultra-low rates environment” says Garg.

REGULATORY CAPITAL BUYBACK IN PRACTICE

The series of rule changes have paved the way for more buybacks. Garg says that one of the principles of bank capital is ‘permanence’ which requires regulatory capital such as Additional Tier1 and Tier 2 debt to be available for loss absorption if the bank is failing or likely to fail. Consequently, banks cannot unilaterally reduce their capital without seeking regulatory permission.

In the past, regulators required firms to deduct these instruments from their own regulatory capital as soon as they were granted permission for redemption, however, there was no certainty as to if and when the permission would be granted. There was also a potential risk that the buyback process could go against the market abuse rules as issuers may end-up making a pre-emptive disclosure (in the form of deduction from capital) that they have sought permission to buy back something in future, which could have been construed as soft-sounding for a future transaction.

The risk of contravening these rules resulted in a reticence from issuers in seeking permission but recent clarifications have removed this impediment.

Now, under the new rules, the redemption permission generally lasts for one year and issuers need to reduce the capital stock only after public announcement of the new bond.

Over the medium term, Garg sees more European and UK banks optimising their debt issuance programme through buybacks and more actively embracing asset and liability management techniques to manage refinancing.

“In the next one-to-two years we expect to see further activity as a number of banks are waiting for buyback economics to turn in their favour and will jump on the liability management bandwagon as it’s a very efficient mechanism,” says Garg.

To learn more about this topic please contact Morven Jones or Vaibhav Garg.

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate. The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction.

For more information please go to https://www.nomuraholdings.com