Heavy emitting companies are in danger of missing their net zero commitments unless they are allowed to use carbon offsets more flexibly as part of their emissions reductions plans, according to a leading carbon consultant speaking at Nomura Greentech’s Sustainable Leaders summit.

“We’re going to see that a lot of companies aren’t decarbonizing fast enough,” said the consultant at the event which took place under the Chatham House Rule “There’s a lot of challenge right now and it’s like letting perfection get in the way of the good.”

He referred to the recent announcement by the board of the UN-backed Science Based Targets initiative (SBTi) - which certifies whether a company is on track to help limit global warming to under 1.5oC – about potentially permitting companies to use carbon credits to offset emissions from their supply chains, known as scope 3. Currently, companies are only allowed to use them for their residual emissions. Industrials, aviation and energy are some of the sectors with big scope 3 emissions.

“When SBTi came out and said we’re going to allow offsets to be used for Scope 3 mitigation, that was an important signal for the market because without demand there’s never going to be supply.”

The consultant said that if the plans did go ahead, it would be significant as heavy emitters are finding it challenging to decarbonize their businesses via the more direct route of making greener products as those technologies often carry a green premium, which makes them more costly. The ability to use carbon offsets in the meantime could plug the gap.

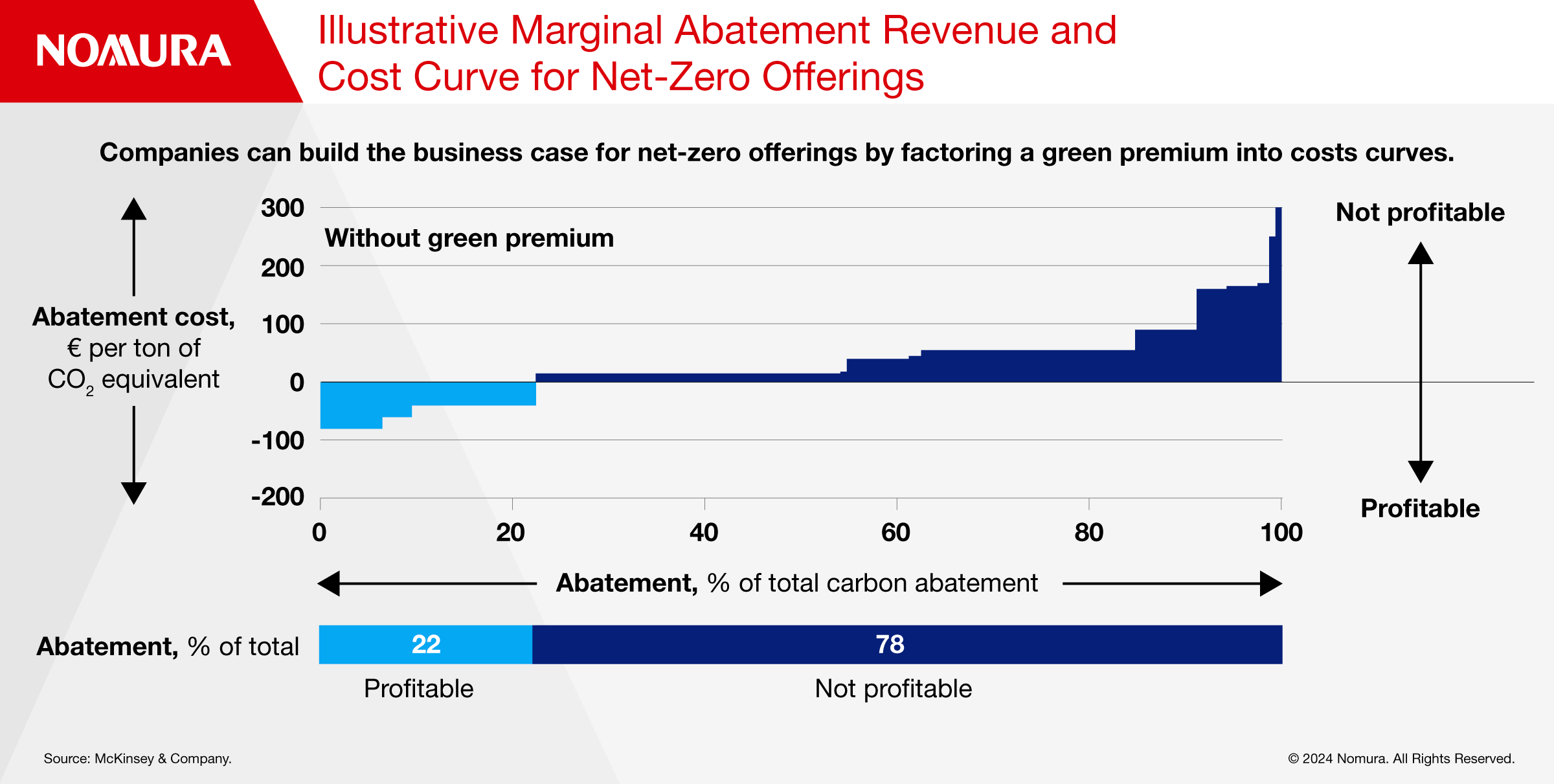

He referred to a McKinsey report that shows only 22% of low carbon products are profitable without a green premium.

He gave the example of demand for Nylon 66 carbon credits in the auto industry, which use the high performance plastic in car airbags and across electric vehicles. Automotive clients are not willing to pay a green premium for a low carbon nylon 66, so his company creates an offset and sells it separately.

Bringing the third party technology and systems together has led to the abatement of 50 million tons of Nylon 66 a year in China with a single project producing 6 million tons of carbon credits annually.

The consultant explained that there’s a big price difference between avoidance credits generated by measures such as planting trees that prevent CO2 molecules from entering the atmosphere and removal credits, generated from technology like Direct Air Capture (DAC) that suck CO2 from the atmosphere. As DAC is novel, it can command $150 to $200 a ton compared to $3-35 a ton for forests and mangroves, he said.

There’s also an anomaly in the system as a cement facility that captures its own carbon would be considered ‘avoidance’ while DAC is classified as ‘removal’, according to the consultant.

“I hope that the use of carbon offsets goes down over time,” he said. “I really believe that it’s a transitional product over the next 15 years because as companies start to mitigate their own emissions their reliance on offsets or investments in external projects will start to reduce.”

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.