This article was produced in collaboration with

Investment in high quality human capital development programmes is the bridge between a diverse workforce and an inclusive one.

In articles five and six in our series The ‘S’ Factor in East Asia, we explained how raising the proportion of female and disabled employees within organizations is not only the right thing to do, it improves business performance, providing an attractive long-term investment.

However, returns are affected not just by increasing the number of female and disabled workers, but on including them within core roles where their contributions are put to good use, and leadership potential activated.

Like their counterparts across East Asia, South Korean companies are a long way from achieving this step-change. Indeed, even as Korean companies develop, the rest of the world is changing faster.

To reiterate, the whole of East Asia is facing a long-term labour and skills shortage due to a confluence of demographic and developmental pressures. Employing more people from marginalized and minority communities can help sustain a high quality workforce.

However, most South Korean companies still lack the ability to imagine how the unique perspectives, experiences, and creative capabilities that these workers bring can revitalize employing organizations for a new era and open up new product and service opportunities.

Diversity and Development in South Korean Companies

We consistently assert that the maintenance of high quality employment standards provides the foundation-stone for the whole ESG framework. It is the employees who, ultimately, possess the motivations, knowledge and creativity to implement the innovations that place companies onto a sustainable footing for a higher business performance pathway.

Hence, investment in high quality human capital development programmes for a new dynamic era of inclusion is not only essential for unlocking the diversity dividend, it provides dividends across the full range of the firm’s activities.

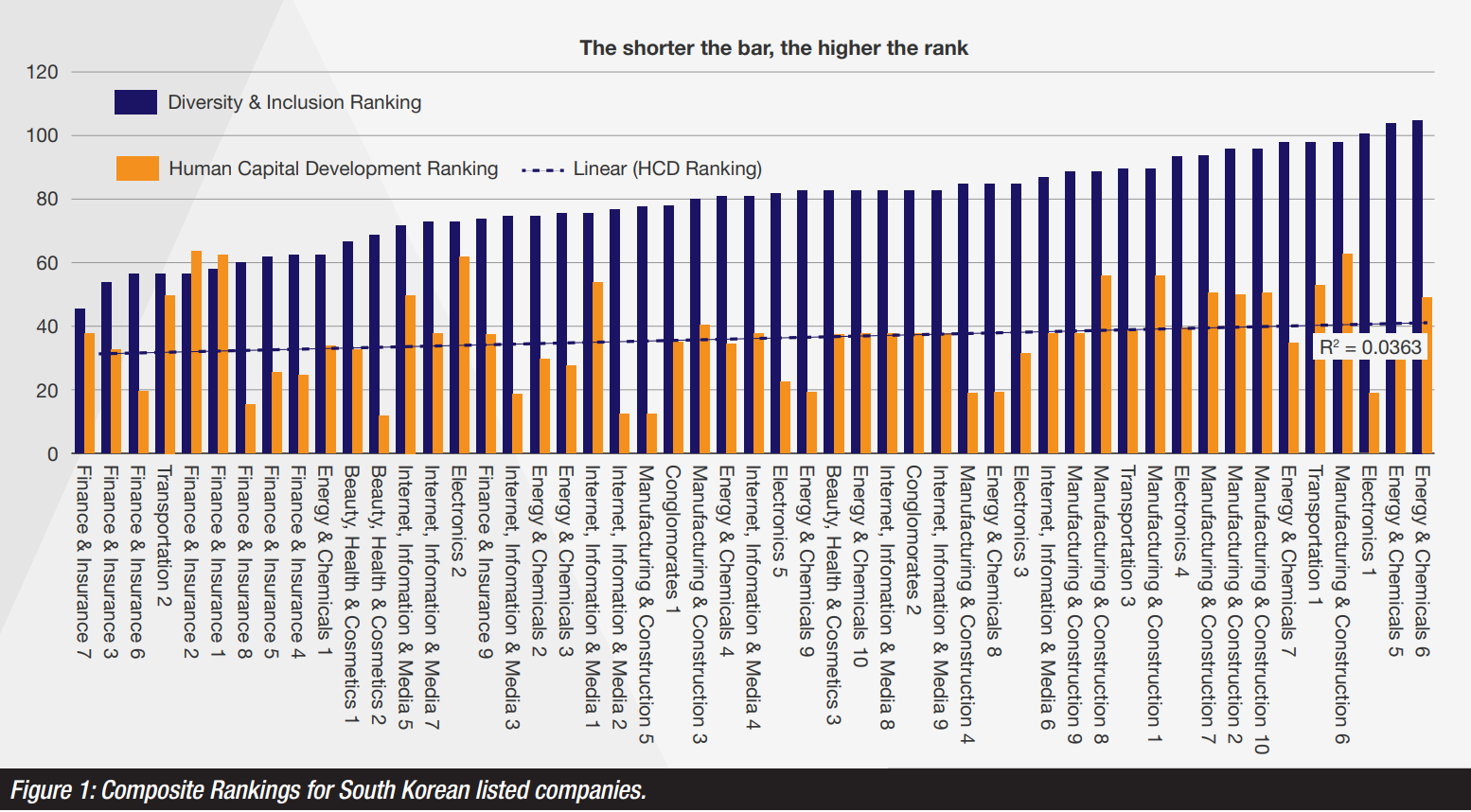

In figure 1 we compare composite indicators for diversity and inclusion (D&I Ranking - Blue - 6 indicators) and human capital development (HCD Ranking - Orange - 2 indicators) for the 50 largest companies listed on the South Korean Stock Exchange. Companies are presented in ranked order, left to right, along the D&I composite index, with each company’s HCD composite index placed alongside. As this is a composite ranked index, the best performing companies accumulate the lowest scores, and therefore show the shortest bars on the chart. Companies are identifiable by industrial category only.

Finance and insurance companies present the highest levels of diversity among the group, with energy and chemicals, and manufacturing and construction, showing the lowest, placed towards the right hand side. This is to be expected, given that women and disabled workers tend towards a preference for office work, and energy and chemicals and manufacturing and construction are traditionally male employment domains. Indeed, women still face distinct discriminatory practices in these industries in South Korea.

Nevertheless, placing the two composite rankings side-by-side shows that investors with a strong ESG mandate might need be careful when relying on the diversity data alone, since there is a low correlation between the D&I and HCD rankings. A company showing higher levels of diversity does not guarantee, therefore, that it will be unlocking the diversity dividend that its employment composition offers potential for. Here’s why.

Equity as the Bridge to Inclusion

The progression from diversity to inclusion is best achieved if mediated by equity. Meaning that all employees have equitable access to opportunities for self-development and advancement free of prejudice and discrimination. While increased diversity is a necessary beginning, equity provides the bridge to inclusion, which is where the real business gains are achieved.

Our data shows that South Korean companies, and their investors, should be mindful that diversity, equity and inclusion are each essential and distinct yet mutually interdependent concepts, as expressed by the acronym DEI. Together they form the ideational basis for rigorous, fair, transparent, and effective employment standards.

The key message we convey is that it is not enough for companies just to employ a larger proportion of minority and marginalized groups, if in general those employees are routinely and unfairly assigned low-productivity peripheral tasks. In these circumstances diversity may even become harmful. To activate the diversity dividend companies should draw from women’s, disabled, and other minorities’ unique experiences, abilities, and creativity, and placing them in productive and leadership roles. But, in order to do that companies need to offer them the full range of training and development opportunities. Investors need to be aware of which companies do, and don’t do, these things.

Crucially, this requires companies in East Asia to rethink their working patterns and expectations for all employees. By definition, therefore, for women to achieve equality with men, men also need to achieve equality with women. That means a comprehensive realignment of the interface between work, home, leisure, and rest so that every employee has equitable rights and duties towards each of these essential life domains.

This realignment is not a zero sum game, however. Indeed, equality between women and men, if implemented intelligently and compassionately, should benefit men as much as women, but in different ways. Changing expectations over the length and flexibility of working hours should release men for inclusion in other life domains, for example. In many cases this will unleash new creative impulses and inspiration in their work.

Conclusion: Unlocking the Diversity Dividend

People from minority backgrounds sometimes lack the basic attributes for securing employment and successful career development that majority employees often take for granted, because of their different experiences while growing up and reduced educational opportunities. This is usually not their fault. Moreover, we are entering a new era in human experience, with the dawn of the Anthropocene era. We have no idea what the future will be like, but we know that it will not be the same as the past. The requirement to understand the three pillars of ESG as a single interdependent and interlocking edifice will only grow.

Employers need to think clearly about how employees can contribute to invigorating their companies for meeting the challenges and opportunities of a radically different 21st century. Prejudice against employees from minority groups is often hidden, deeply rooted in unconscious, ingrained, and implicit biases, and acted out via subtle but effective barriers to advancement.

For diversity to be transformed into inclusion, employers should implement an equitable human development framework that provides the personal development opportunities to enable all employees to realize their potential, even as they have lacked those opportunities in the past. This will require standard employees to understand and acknowledge their own contributions to the maintenance of prejudice and inequality within their companies, and how they can adjust to take advantage of the opportunities in front of them.

Without Equity, Diversity will not deliver Inclusion, which in turn will not provide sufficient returns for investors. For women to be treated as equal to men, men must be treated as equal to women, for example. This requires a revolutionary approach to adjusting male as well as female work. This is the core essence of the notion of equity as a bridge to inclusion, and unlocking the diversity dividend.