-

Battery manufacturers generate a significant amount of waste, between 40% and 50% in the early stages of production

-

EU regulation has set a target for lithium recovery from waste batteries of 50% by the end of 2027 and 80% by the end of 2031

-

Green Li-ion developed a technology that makes any type of lithiumion battery recyclable

What first sparked your interest in sustainability? Tell us about your career journey.

It was really born out of growing up in Kenya, where we had to take our own domestic waste to landfills. I remember seeing more and more fires in the landfill and discovered that the contributor in most of these instances was lithium-ion batteries.

My career started in oil and gas, which drove me to do something better for the environment and maybe pay some penance. Traditional energy wasn’t conducive to my largely off-grid rural upbringing, but it was a means to an end, and I was looking for an opportunity to do something more sustainable.

After building a few companies in oil and gas services and selling a sustainable energy company, I had the great fortune to meet my Co-Founder at Green Li-ion, Dr. Reza Katal, who was a scholarship PhD here at the National University of Singapore. By the time I met him, he had worked for ten years on lithium-ion battery recycling, and that started our journey into commercializing his intellectual property into the modular recycling plants we produce today.

How serious is the problem of climate change? And how important is the role of batteries in the energy transition?

It’s critical and means everything to preserve our children’s livelihoods. If we can’t keep climate impact to a minimum and start to unwind all the damage we have inflicted on the planet, then there won’t be much of a world left.

When I look at the energy transition, it takes a small amount of digging to realize that all avenues other than nuclear and thermal require batteries and energy storage. It’s then a short hop to realize that lithium-ion batteries are not as sustainable as we’d like them to be, yet they are everywhere. You find them in anything that’s chargeable, from laptops and smartphones to EV batteries, stationary storage, and data centers.

Mining finite battery materials is very costly to the environment, so when I saw that we could impact this space, I threw everything at it.

Green Li-ion is trying to make battery recycling commercially viable. Tell us about how you got started and what the obstacles are to realizing your goals?

In 2009, my partner, Dr. Reza Katal, was in between two of his Master’s degrees (he has six degrees, including a PhD) and was working in lithium-ion battery recycling in Europe, which was in its infancy. His managers challenged him as a junior chemist to extract only the cobalt from the battery material for use in cell phones; after some questioning, he realised that the materials were going to China to make cathodes for batteries. The nickel, lithium, and manganese were being thrown away, so he saw an opportunity to make something more valuable while reusing everything to create pCAM or precursor cathode active materials.

He started working in his spare time on pCAM solutions and wrote patents, which kickstarted our IP journey. We built, engineered, and commercialized the product when I met him ten years later.

As most of the world’s batteries are end-of-life products that go into landfills, we laid out a vision to create a circular economy around lithium-ion batteries.

Battery recycling, as it currently stands, isn’t profitable for the private sector. Chinese companies recycle most of the 5% of batteries that do get recycled because they are subsidized and supported by the government.

We developed a technology that makes any type of lithiumion battery recyclable – it’s very important that it is agnostic to whichever chemistry is used. We built and converted the recycled product in one step to battery cathode material that can be dropped straight back into a battery cell, which has made it more commercially viable.

Due to its modular nature, it also reduces the need for transport. The final outcome is a specialized chemical worth two to four times more than the individual commodities that can be separated out of the battery. We are taking waste all the way through to battery-grade cathode and anode material to close the loop and play our part in helping the world recycle more. The most common battery recycling model involves spending $500 million on a large facility as an end-to-end solution. However, these large central facilities can lack the flexibility to adapt cost-effectively to changing battery types and chemistries.

What are the supply chain challenges connected to recycling batteries?

The supply chain challenge has a micro and macro side. The US Inflation Reduction Act and EU green initiatives are creating an influx of investment in collecting and crushing lithium-ion batteries or battery waste.

On the flip side, there is an influx of investment from all of the battery gigafactories and battery cell manufacturers, which is where the battery demand is coming from. Their batteries need to be produced in America in order to qualify for IRA subsidies.

It’s working, but there’s a considerable gap from a supply chain perspective. Crushing and shredding batteries leaves a product called black mass, which consists of precious and non-precious metals absent organics and plastics.

However, in North America and the EU, there is no solution to bring that metal to battery grade so that the recycled material can be dropped back into those gigafactories and cell manufacturers. As a result, spent batteries travel 15,000 miles to Asia to be refined and turned into pCAM, which is then sent back to either continent for consumption.

Green Li-ion creates small modular plants about the size of a small house, which is relatively small in context. These can be deployed wherever the battery waste occurs.

Our US plant in Atoka, Oklahoma is the first commercial-scale producer of pCAM, plugging that critical production gap. This reduces the transport and carbon emissions of the materials moving around the world while also improving usability and yield loss. We have sold eight plants across North America, Europe, and Asia. Our units can process 4–6 tonnes of end-of-life batteries per day.

Our technology has a lower carbon footprint than anything currently available in the industry. It has 90% less environmental impact than raw material production from primary sources and a 77% lower carbon footprint than any of our competitors using traditional metallurgy.

We sell and license our machines to recyclers, gigafactories, and cathode producers. Cathodes make up the majority of a battery’s weight, value, and brain.

For battery cell producers, we can install our technology on their production line to automatically take their waste, remanufacture it back to their grade of cathode and anode material, and reintroduce it at the start of their production process.

As most of the metals used in EV batteries are mined outside of Europe and the US, does that boost the case for businesses involved in battery recycling?

The US is moving fast to try to vertically integrate or in-house its battery materials and battery production. The challenge is that many of those mines take time to come online, and they still have battery waste.

The missing link is converting the crushed material back into specialty chemicals that can be used directly in cells.

EU regulation has set a target for lithium recovery from waste batteries of 50% by the end of 2027 and 80% by the end of 2031. Companies require a Green Li-ion type of technology at a commercial scale to reach those goals. The industry needs many innovators to contribute to recycling to meet demand.

Do you believe we will have to source battery minerals from asteroids in the future to keep up with demand?

Up to 80% of the metals and minerals needed for battery production can be sourced from recycling. Putting aside the fact that commercial asteroid mining is still more science fiction than reality, I believe we should avoid mining asteroids until we know we’re running out.

Mining these critical metals from asteroids and seabeds would require an enormous amount of capex compared to reusing the materials that we already have and are throwing away. Extracting minerals from landfills is orders of magnitude easier than mining seabeds or asteroids.

What kinds of breakthroughs can we expect to see in battery recycling over the coming years?

Ideally, batteries should be rented or leased and never leave the ownership of a company that assumes the responsibility of recycling them because batteries can be remanufactured an infinite number of times. This is something novel and unique to batteries, so we should change how they are consumed.

What’s the biggest lesson you have learned from being a cleantech entrepreneur?

The hardest part is raising capital and having people believe in you. You can have the best technology in the world but I can’t underplay the requirement for large amounts of funding.

You’re sure to fail, even if you’re the best. Conviction certainly helps convince potential backers.

We have fantastic investors, ranging from the biggest energy companies in the world, such as Petronas and Equinor, to battery manufacturers and recyclers.

We also have traditional climate tech VCs and people who wantto make a positive change, record sustainability goals, and impact financial returns for their LPs.

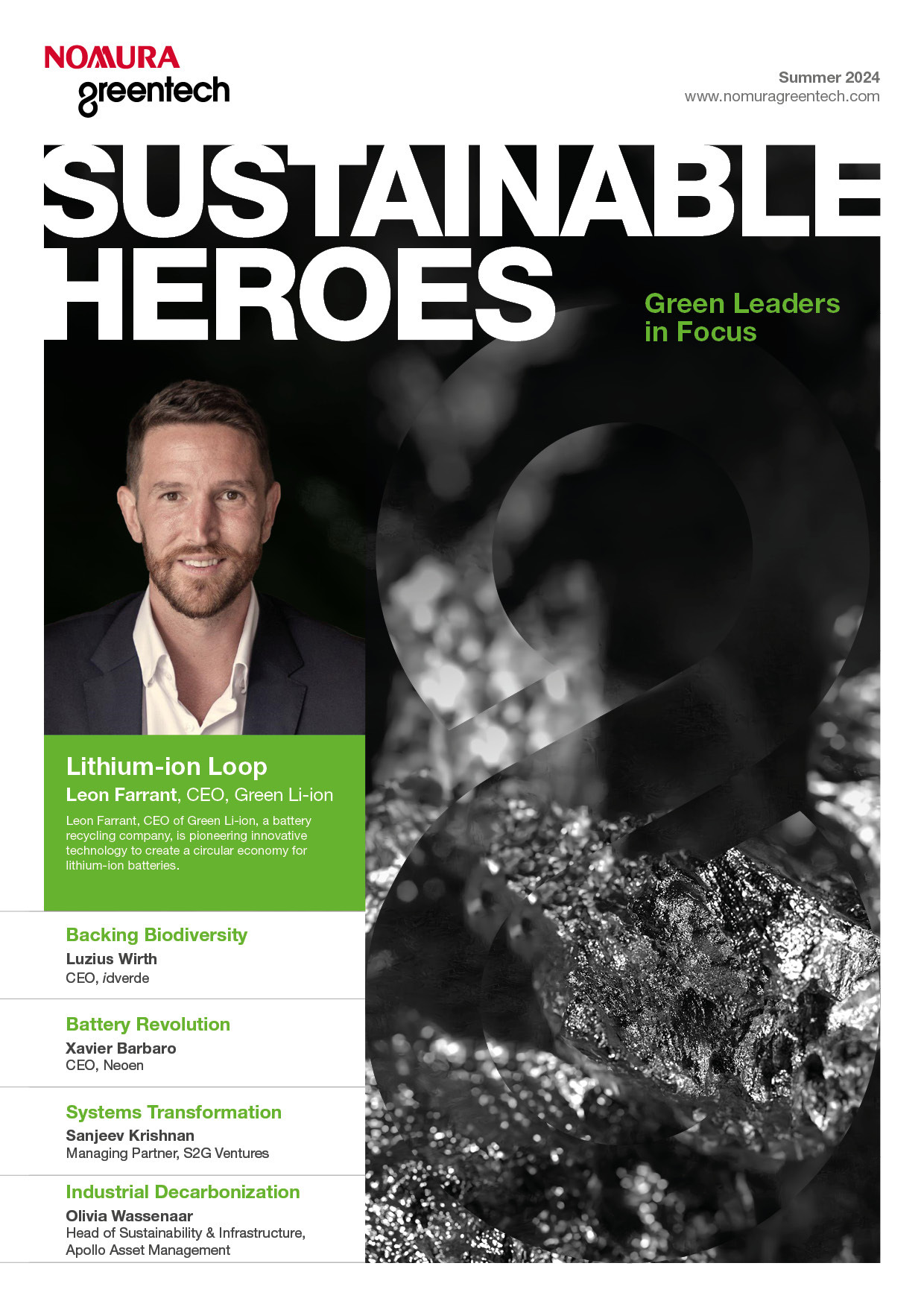

Contributor

Leon Farrant

CEO, Green Li-ion

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.