Technology | 5 min read March 2019

Japan in focus | 4 min read | June 2020

Japan in focus | 4 min read | June 2020

Blockchain technology is gaining traction in finance. Also referred to as distributed ledger technology, it allows data to be stored in “blocks” of information that are then linked with other blocks to form a “chain.” Because of its decentralized nature, blockchain is considered to be transparent and secure. As many industries explore the possibilities that blockchain offers, the financial services sector is mainly focused on how this technology can be used for settlement services and securities transactions.

In March, 2020, Nomura Research Institute (NRI) announced Japan’s first bond offering leveraging blockchain technology. The offering was made through “ibet,” a new open source blockchain platform developed by BOOSTRY.

BOOSTRY is NRI’s joint venture with Nomura Holdings. The two companies first collaborated on blockchain technology in 2015 as part of ongoing efforts to incorporate advanced technologies into finance. In addition to developing infrastructure to facilitate the trading of securities, BOOSTRY aims to support fundraising in online capital markets through its consulting services and provide a new, seamless investment experience for its clients.

Structure of the offering

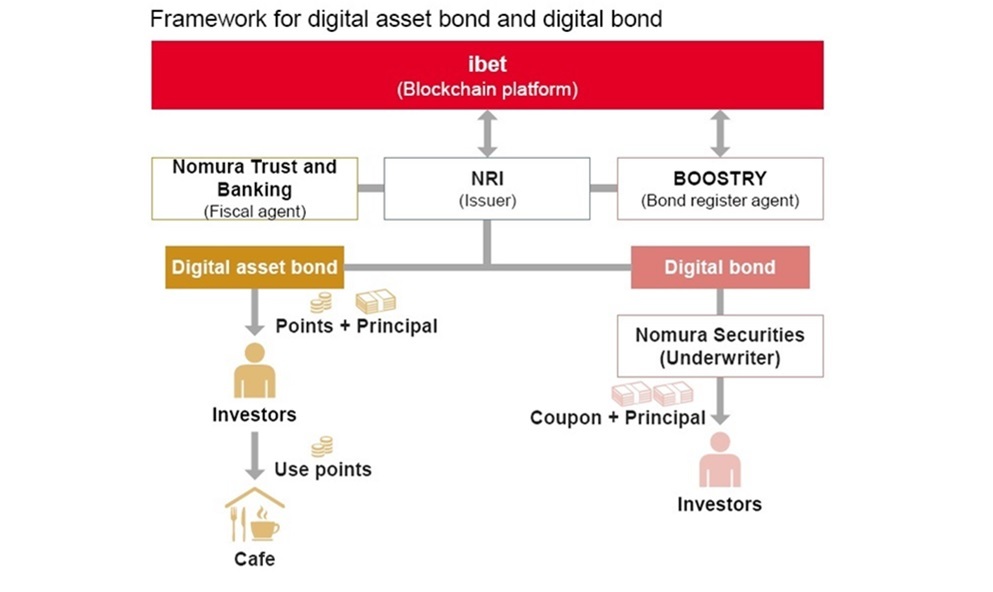

The offering comprised two bonds: a digital asset bond and digital bond. The digital asset bond was sold directly to investors by NRI, while Nomura Securities underwrote the digital bond. Nomura Trust and Banking served as fiscal agent on both bonds, and BOOSTRY was bond register agent in addition to providing its ibet platform.

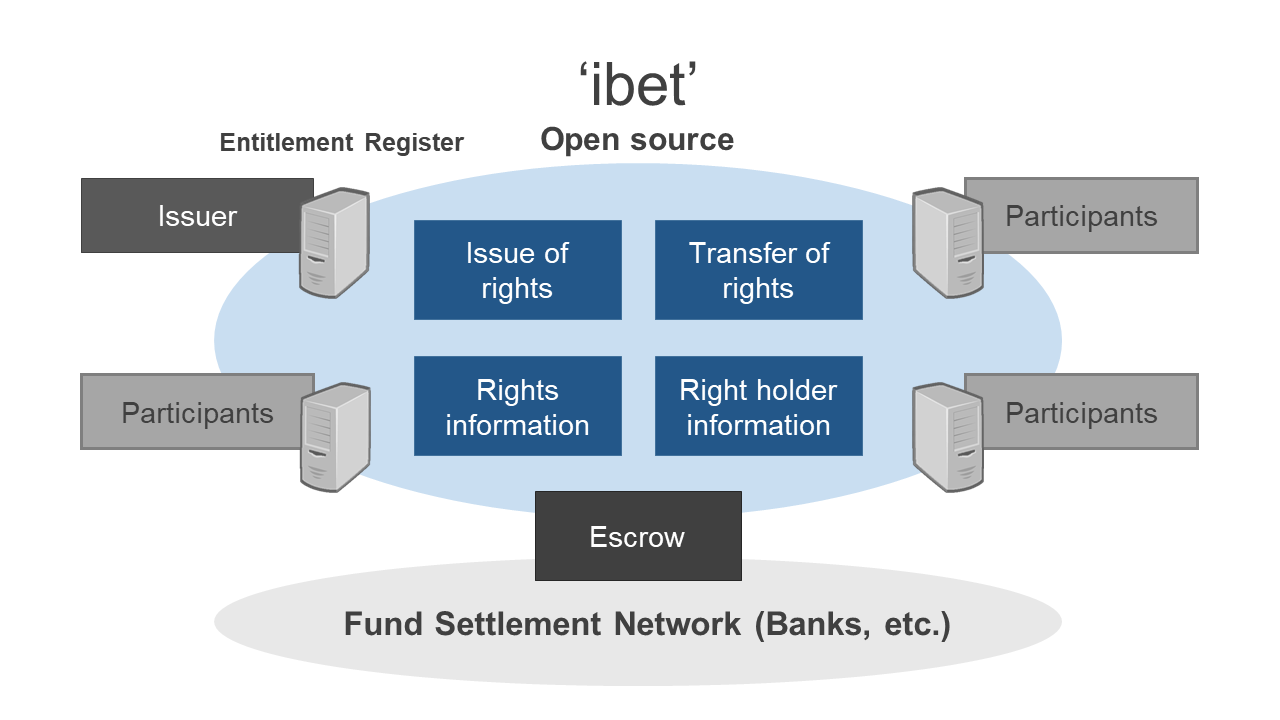

The entire settlement process involves linking ibet with the entitlement registry and the fund settlement network. There are approval nodes, which are mainly operated by financial institutions, issuers, and tech companies, and user nodes operated by investors and service providers.

The bonds offer several advantages. Since the bond registers for both bonds are managed through ibet, investors are able to keep track of bondholders, something that is difficult with traditional bonds. The digital asset bond has an additional two-fold benefit. First, by selling directly to individual investors, issuers can develop a stronger relationship with investors. Second, by offering investors non-monetary return in the form of points that can be redeemed at cafes, the bond contributes to increased consumption.

Hiroshi Yamada, Capital Markets Department, Nomura Securities, says: “On the investor side, since return on bond investments has been limited to money in the past, having a wider range of return options may serve as an incentive for them to hold bonds for a long period. For issuers, depending on the nature of the return, it is possible to reduce funding costs. This will encourage investors to hold bonds for a longer period of time and lead to more stable corporate bond prices in the secondary market.”

How does this offering compare to offerings overseas?

Toshinori Sasaki, CEO of BOOSTRY, says there are many similar cases overseas. “For example, tZero's issuance and distribution of preferred shares in the United States and the World Bank’s issuance and distribution of bonds in Australia are two cases in which blockchain was used to issue and manage securities. Generally speaking, blockchain technology is used to reduce the costs and time required for an issuance. In the case of NRI's digital asset bond, the issuing company is able to sell securities directly to individuals and offer non-monetary rewards leveraging our ibet blockchain platform.”

He continues, “As individuals can directly hold corporate securities, we believe this will help enhance the functions of the capital markets. In other words, whereas a typical offering helps increase the number of transactions by existing capital market participants, the structure used in this case will help increase the uses of the capital markets.”

The digital asset bond provides funding through the capital markets and represents a new form of collaboration between marketing and finance. The digital bond is expected to contribute to more agile fundraising through new financial services such as digital currencies.

BOOSTRY has partnered with Fujitsu to provide an interconnection platform service that enables seamless execution of multiple transactions across different platforms. Set to launch in the second half of the 2020 fiscal year, the collaboration is expected to include a wide range of companies and industries. Together, BOOSTRY and Fujitsu are working to create a new world of digital asset transactions, and contribute to the development of the token economy.

Hiroshi Yamada concluded: “Our goal through this offering is to contribute to the development of Japan’s capital markets in order to create value and help resolve social issues. We will continue to leverage Nomura’s robust network and collaborate with external partners to develop new services in the capital markets and respond to the diverse needs of our clients.”

CEO, BOOSTRY

Capital Markets Department, Nomura Securities

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.

Technology | 5 min read March 2019

Economics | 4 min read August 2018

Technology | 2 min read October 2019