Japan’s regional banks, faced with the prospect of earning near-zero returns in the nation’s sluggish government bond market, have resorted to all manner of cross-border instruments over the years in their hunt for yield. The latest innovation – zero-day options tied to the S&P 500 index.

Even as the Bank of Japan makes tentative steps to emerge from a 15-year period of zero and negative rates, regional banks servicing farming cooperatives and local industry need to earn a certain yield to make the business of banking work. They can’t simply leave money on deposit at the BoJ. Net interest margins – the difference between what banks lend money out at versus what it costs in deposit interest - have been squeezed for years amid tepid demand for loans owing to a stagnant economy.

To put their excess lending capacity to work, regional banks have relied on achieving yield from credit or bonds and for several years they have invested heavily in US dollar denominated fixed income assets, which offered a return without being expensive to hedge, says Hiroshi Shikano, Head of Global Markets Japan Structuring at Nomura in Tokyo.

“The dollar yield curve was steep meaning Japanese institutions could buy 10-year U. S. treasuries, spend some money hedging the coupons into JPY, given that short term U.S. dollar rates were low, and still achieve an attractive income,” says Shikano.

But after the Federal Reserve started hiking interest rates 18 months ago, the dollar interest rate curve flattened which means hedging the currency risk wipes out the returns.

Necessity being the mother of invention, Japanese institutions shifted to selling volatility – betting on market calm - to achieve yield, initially targeting the most liquid equity indexes, one month call options on the Nikkei 225 and S&P 500. A boom in this strategy subsided after volatility decreased and premiums declined meaning clients could no longer achieve enough yield.

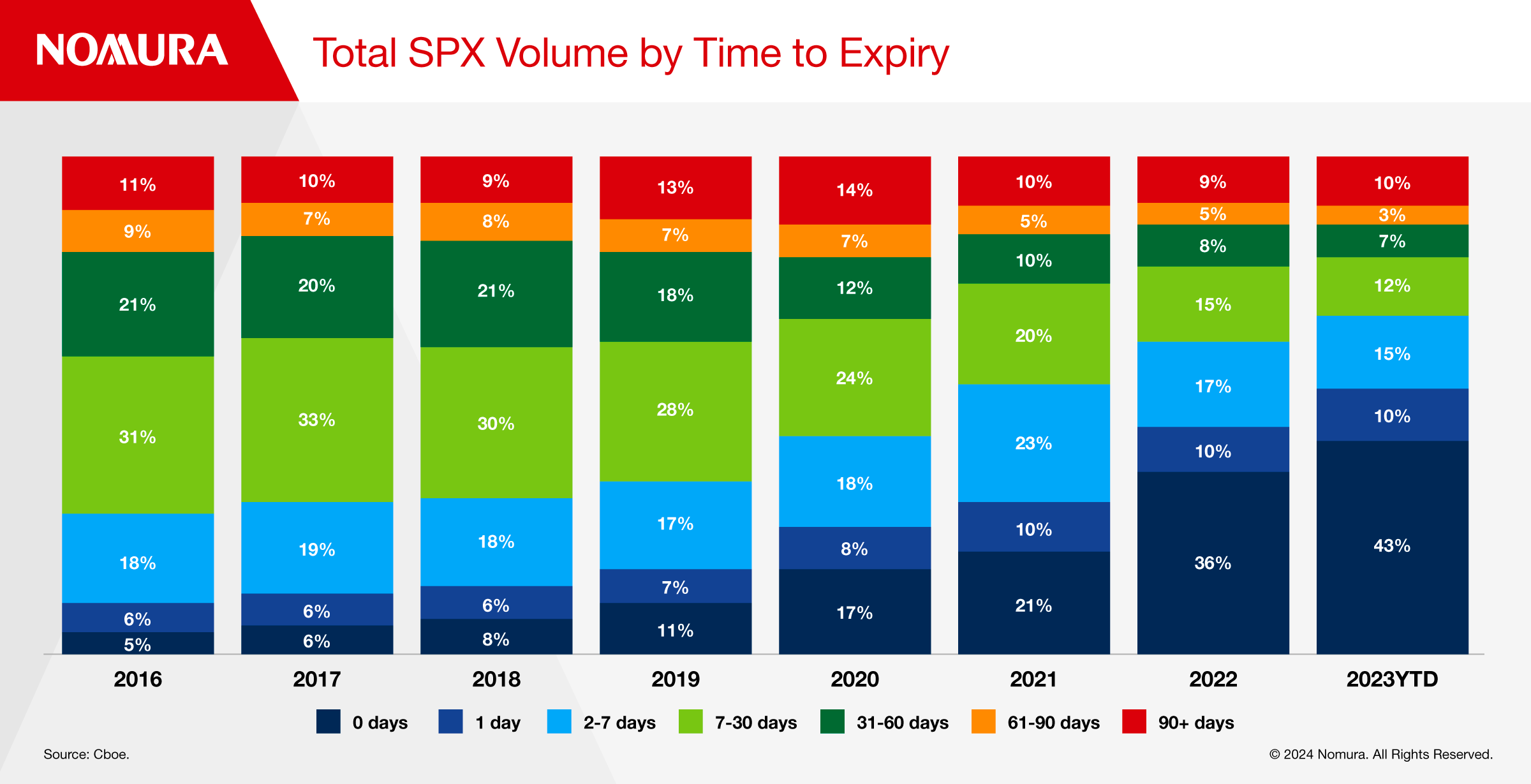

This unleashed creative forces among bank desks resulting in options selling strategies becoming shorter in duration until the current trend of same day options also known as zero-day to expiry, which focus on harvesting the intraday volatility risk premium.

Nomura has established strong execution capabilities in equity derivatives, and is utilizing this expertise to deliver systematic strategies for its institutional client base. Nomura was the first bank to deliver the zero-day strategy in a mutual fund format in Japan, says Shikano.

“For accounting reasons whenever we deliver quantitative investment strategies, Japanese regional banks prefer to invest in mutual fund format,” says Shikano.

“By reducing the maturity of the options, we can compensate for the drop in volatility and clients can keep collecting high premiums,” says Clement Florentin, Head of Global Markets QIS Structuring Asia Pacific at Nomura in Singapore.

Florentin adds that the zero-day to expiry strategy also serves a risk management purpose.

“A lot of market risk these days on U. S. equities happens after the close when company results are released and macroeconomic and global risks are in play,” he says. “By trading options in the U.S. morning and holding them until the close you avoid those risks.”

The number of markets with one day to expiry options currently covers S&P 500, NASDAQ, Russell 2000, the Euro Stoxx 50 and some ETFs

Shikano explains that Nomura is working on similar fund-format strategies linked to several markets including Euro Stoxx 50 and Nikkei 225 to have a complete global offering for clients.

Nearly half of all options volume on the S&P 500 is now traded zero-day after a 58% annual increase in zero-day options trading on the US benchmark index since 2016, according to Cboe data.

“As Japanese interest rates are likely to stay relatively low, regional banks will continue to need higher returns, so we foresee further demand for systematic volatility selling strategies,” says Shikano.

To gain further insights into zero day options please contact Hiroshi Shikano or Clement Florentin.

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.