Price hikes amongst Japanese corporates are having favorable effects on earnings and share prices, as Japan makes further progress in breaking out of its deflation cycle.

CHANGES IN PRICE HIKE BEHAVIOR AS SEEN IN MACRO INDICATORS

One important point from a macroeconomic perspective is that price hikes by Japanese companies have not only been helped along by external factors such as yen depreciation and inbound demand, but are also gradually taking on a self-fulfilling aspect.

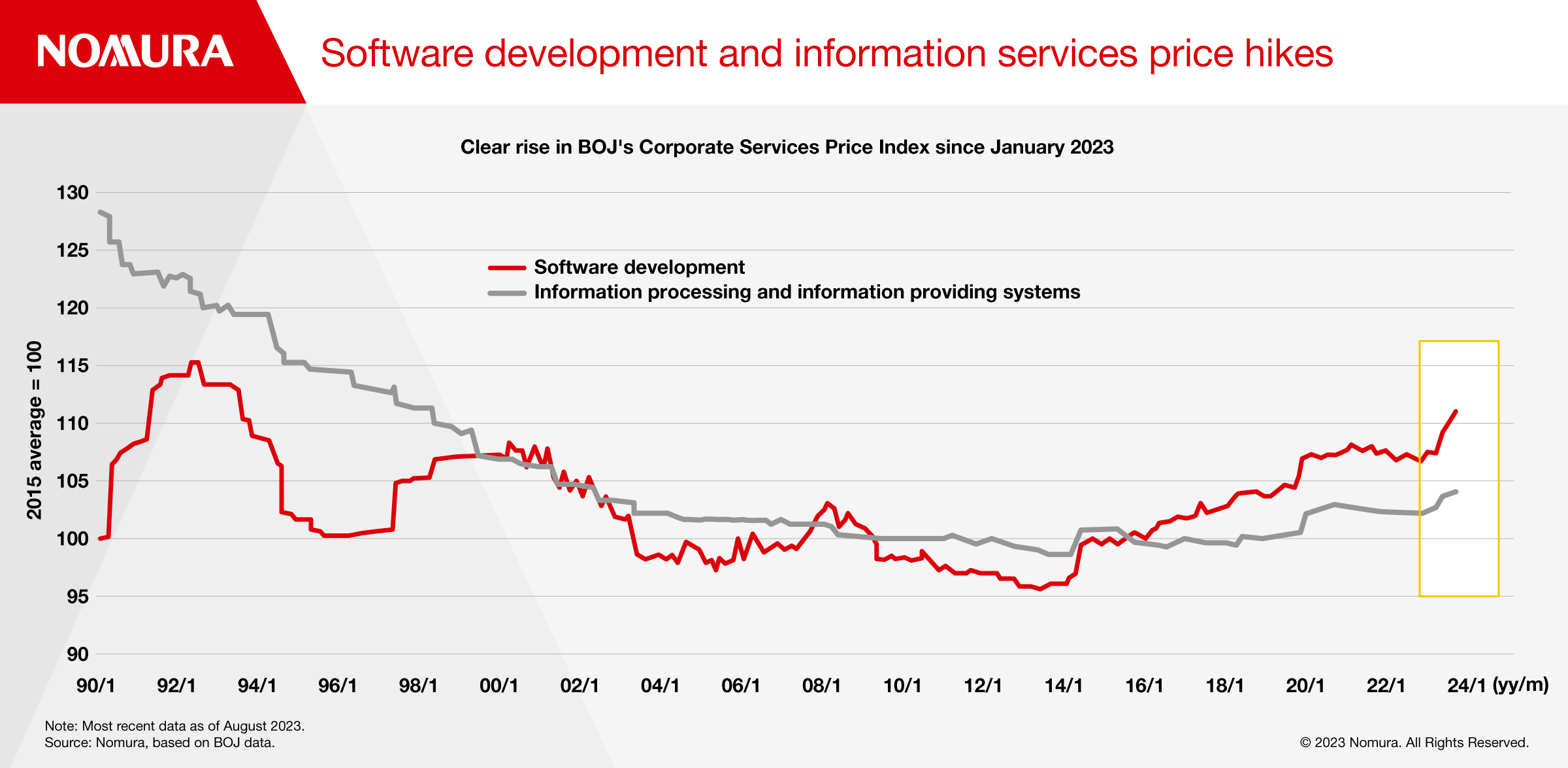

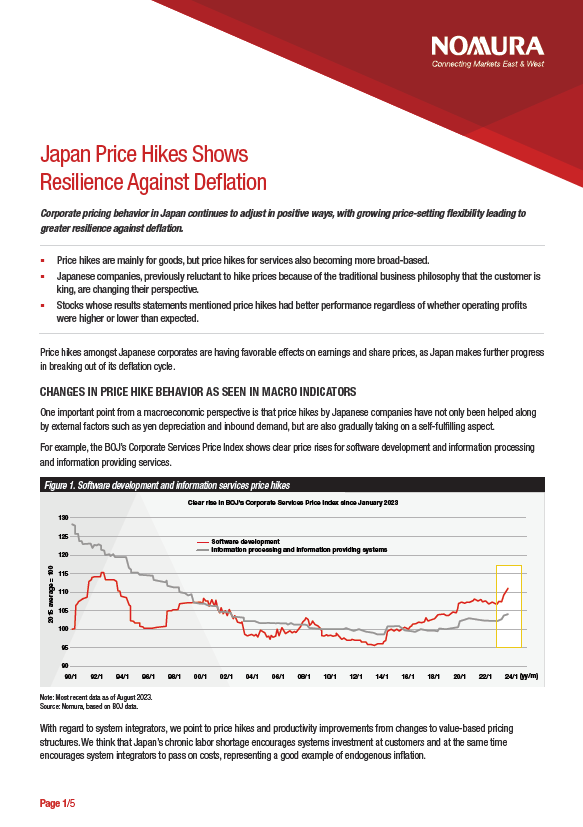

For example, the BOJ’s Corporate Services Price Index shows clear price rises for software development and information processing and information providing services.

With regard to system integrators, we point to price hikes and productivity improvements from changes to value-based pricing structures. We think that Japan’s chronic labor shortage encourages systems investment at customers and at the same time encourages system integrators to pass on costs, representing a good example of endogenous inflation.

PRICE HIKE FATIGUE KEPT IN CHECK

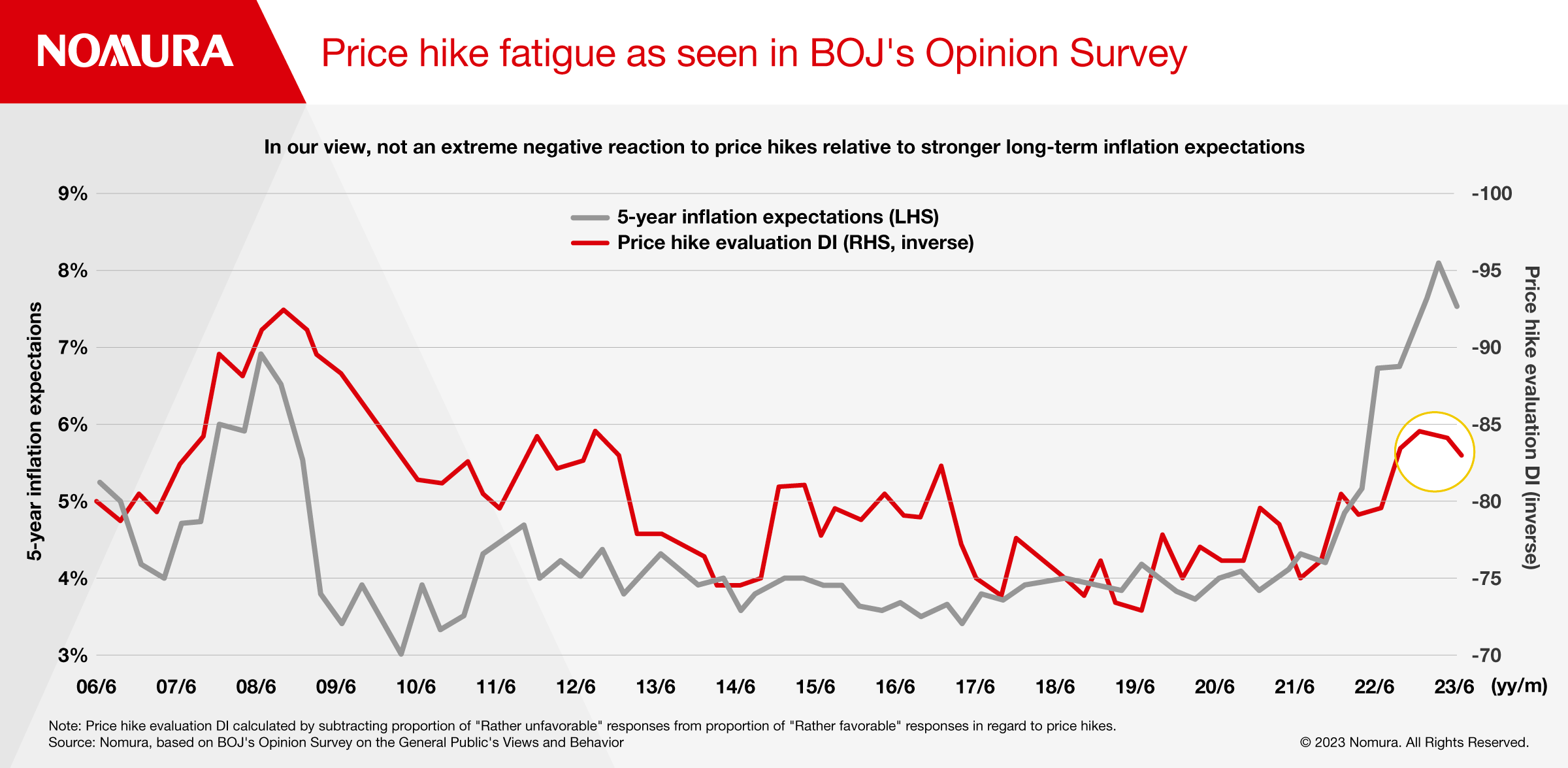

At the same time, price hike fatigue is being kept in check relative to the upswing in inflation expectations.

The BOJ’s Opinion Survey on the General Public’s Views and Behavior included a question on whether consumers think prices rises are “Rather favorable” or “Rather unfavorable”. Calculating a price hike evaluation Diffusion Index (DI) by subtracting the latter from the former, showed a growing negative evaluation through December 2022, but this has declined slightly in the past two quarters.

We think the important point is how this evaluation DI looks relative to the outlook for price levels over the next five years contained in the same survey. This figure settled at around 4% in 2011–2021, but then rose sharply to 7–8%. While the inflation environment is such that it is natural for there to be a rise in the number of “Rather unfavorable” responses relating to price hikes, if anything, we can see that an extreme negative reaction has been avoided.

RISE IN GDP DEFLATOR SUGGESTS CLEAN BREAK FROM DEFLATION

The GDP deflator – a measure of how much a change in GDP relies on changes in the price level - has been rising more strongly along with per-capita wages and core CPI inflation since around 2022. The concept of the GDP deflator is value-added per unit of output for a country’s economy. Since 1998, Japan experienced a protracted period of deflation in which the CPI was stable while percapita wages and the GDP deflator continued to fall.

The rise in all three of these indicators together indicates that wage and price rises are gradually leading to a move out of deflation in the form of vertical (profit margin) growth in the Japanese economy.

TWO TYPES OF FREEDOM TO HIKE PRICES

While Japanese companies appear to have more freedom to hike prices from a macroeconomic perspective, their actual ability to do so varies considerably by sector and company.

Sectors in which breakeven ratios have fallen (improved) such as water transport and employment appear to have been heavily affected by structural changes in the economy during the pandemic, which have made it easier for them to hike prices.

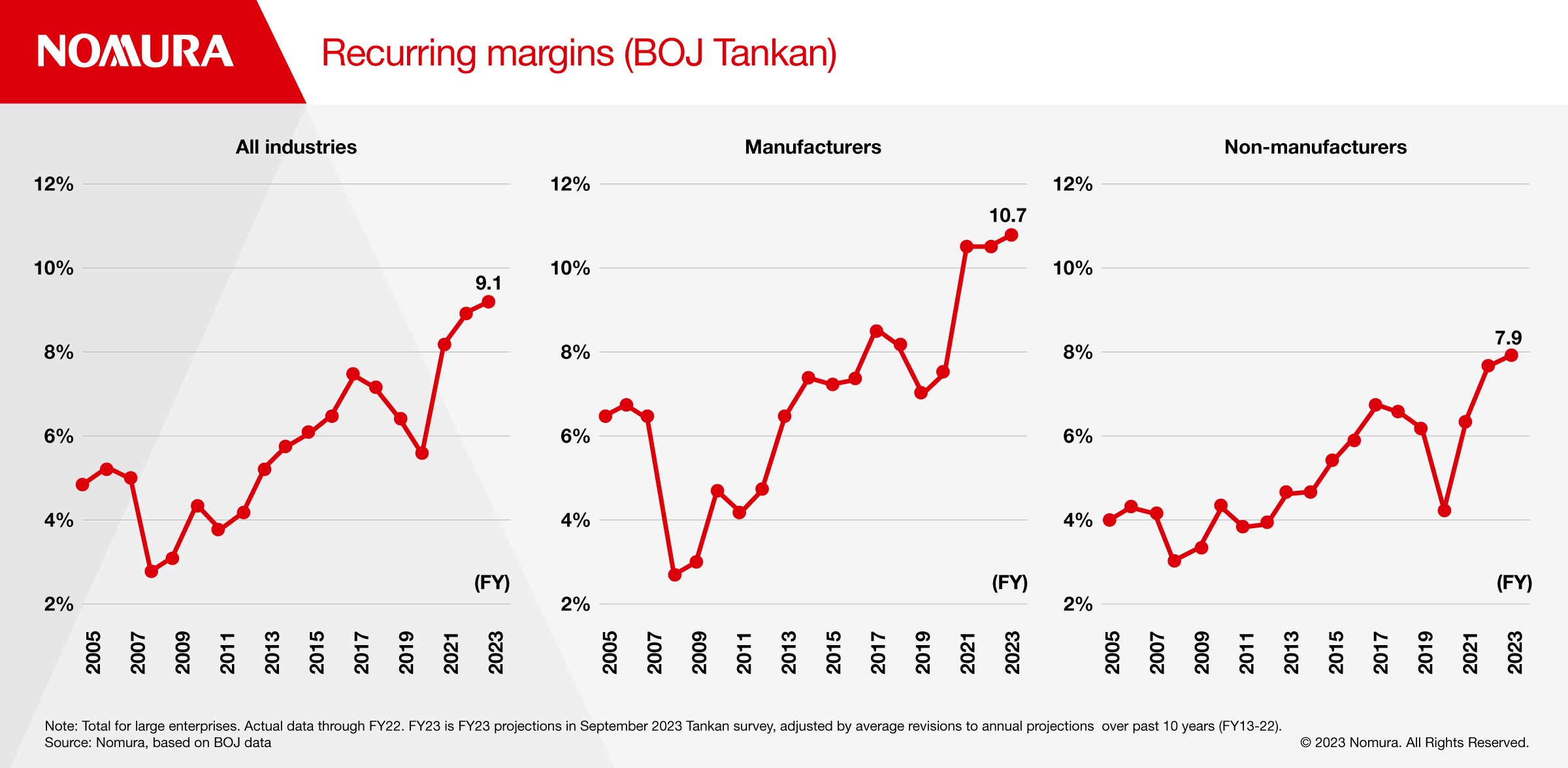

The September 2023 BOJ Tankan (a survey of Japanese companies) indicates that domestic companies will generate the highest recurring margin ever recorded in the current time series data in FY23. We observed two patterns: processing industries becoming better able to flexibly pass on cost increases, and non-manufacturing industries becoming more resilient against deflation.

However, improvements in recurring margins differ from sector to sector. Moreover, the Japanese government provided substantial subsidies to companies during the COVID crisis. As some sectors received higher subsidies than others, the boost that subsidies have provided to margins needs to be removed in order to reveal the underlying picture.

NEW TRENDS IN PRICE HIKES

Interestingly, some sectors have been hiking prices in a traditional fashion, whereas others have adopted new ways to raise prices. Broadly speaking, we identify four patterns: (1) increases in the value added of products and services; (2) changes in corporate attitudes towards price hikes; (3) changes in pricing structures/regimes; and (4) responses to rising costs and higher procurement prices.

MOVING AWAY FROM BASING PRICES ON COST OF GOODS AND SERVICES (COGS)

One approach for companies to hike prices is to increase the value added of goods and services provided in order to be able to charge more for them.

In the food industry, this has meant enhancing premium merchandise as well as factoring in the insights of staff about how pricing should be based on what consumers are prepared to accept rather than on COGS. This has facilitated a radical change in corporate pricing methods.

In IT services, many systems integrators effectively hiked prices by moving away from billing for individual engineers by the month and instead shifting to value-based pricing revolving around the provision of solutions to customers.

In the autos & auto parts sector, one interested party has discussed price competition for battery electric vehicles in China, saying that demand for discounts is unlikely to intensify for power trains and electrification-related products that are key to improved performance.

WEAKENING OPPOSITION TO PRICE HIKES

Second, corporate attitudes towards price hikes have changed. Previously, Japanese companies were reluctant to hike prices unless it was absolutely necessary. As well as being more focused on market share than their Western rivals, Japanese companies may have been opposed to price hikes because of the traditional business philosophy that the customer is king and anything that hurts the customer is bad.

However, Japanese companies have also become increasingly aware that they need to garner appropriate returns in order to keep on delivering high quality products and services in future.

DEVELOPMENTS WITHIN UTILITY-TYPE SECTORS

Third, we have seen changes in pricing structures within utility-type sectors, such as infrastructure, that allow these companies to charge in a manner commensurate to the costs that they face.

In the telecommunications sector, we have seen a string of de facto price hikes at mobile operators, with overhauls of pricing structures that are likely to boost mobile average revenue per user. In the electric power sector, rate hikes primarily implemented in April 2023 have eliminated losses stemming from the inability to pass through fuel costs exceeding the price ceiling under the fuel cost adjustment scheme, and steps have also been taken to boost gross margins.

REGULAR PRICE HIKES

Fourth, we have seen regular price hikes in response to rising costs and higher procurement prices. In the housing & real estate sector, condo developers with strong bargaining power versus construction companies have been generating high margins by reining in construction order costs and hiking selling prices.

In the autos & auto parts sector, recent contracts have increasingly contained clauses allowing for sharp rises in the cost of inputs such as plastics or electronic parts to be passed on, which tended not to be the case previously.

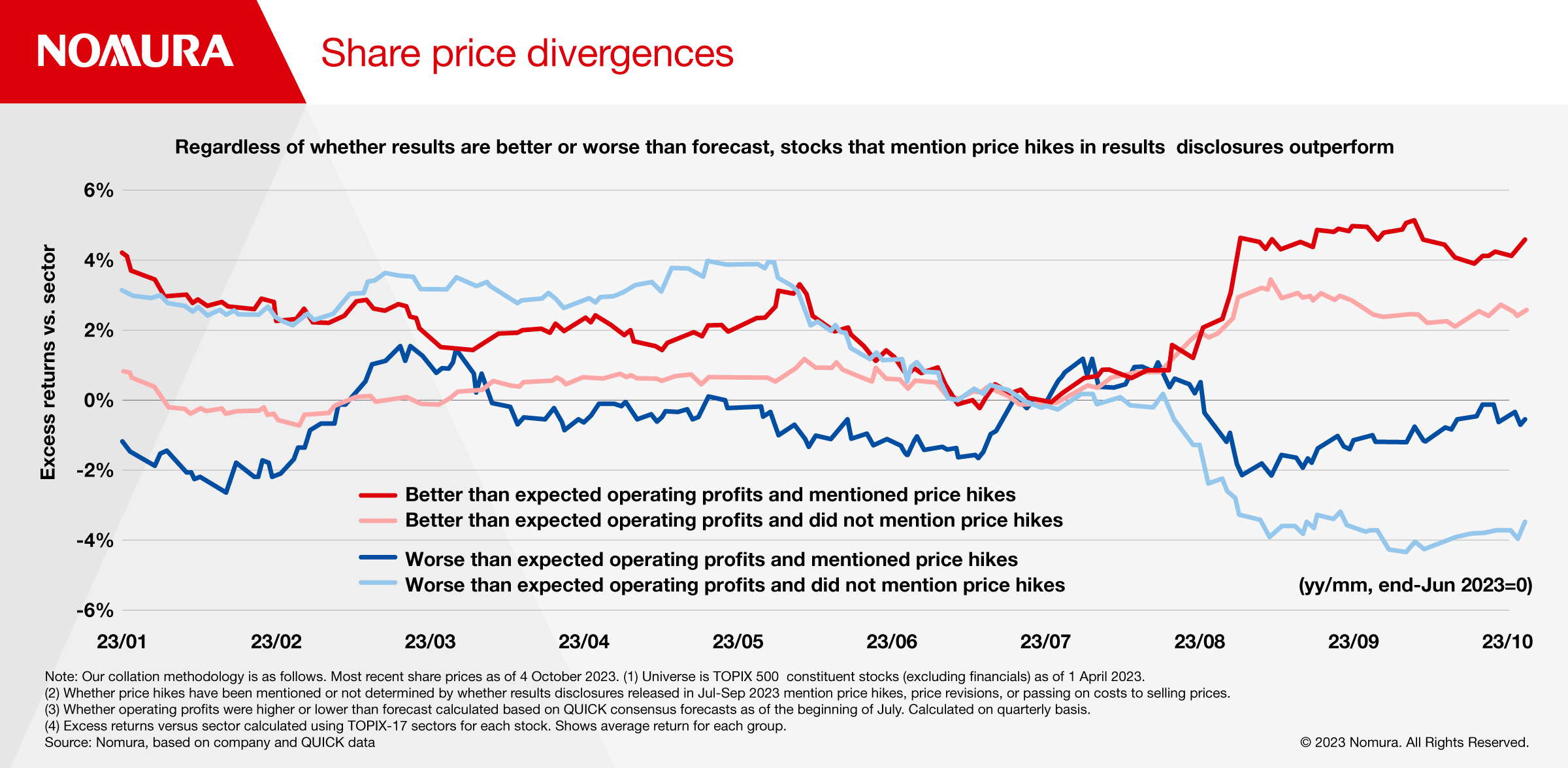

COMPANIES’ PRICE HIKES LINKED TO EARNINGS AND SHARE PRICE

When we look at the performance of stocks whose results statements released in the most recent quarter (Jul–Sep 2023) mentioned price hikes, we see that performance was better for this group of companies regardless of whether operating profits were higher or lower than expected.