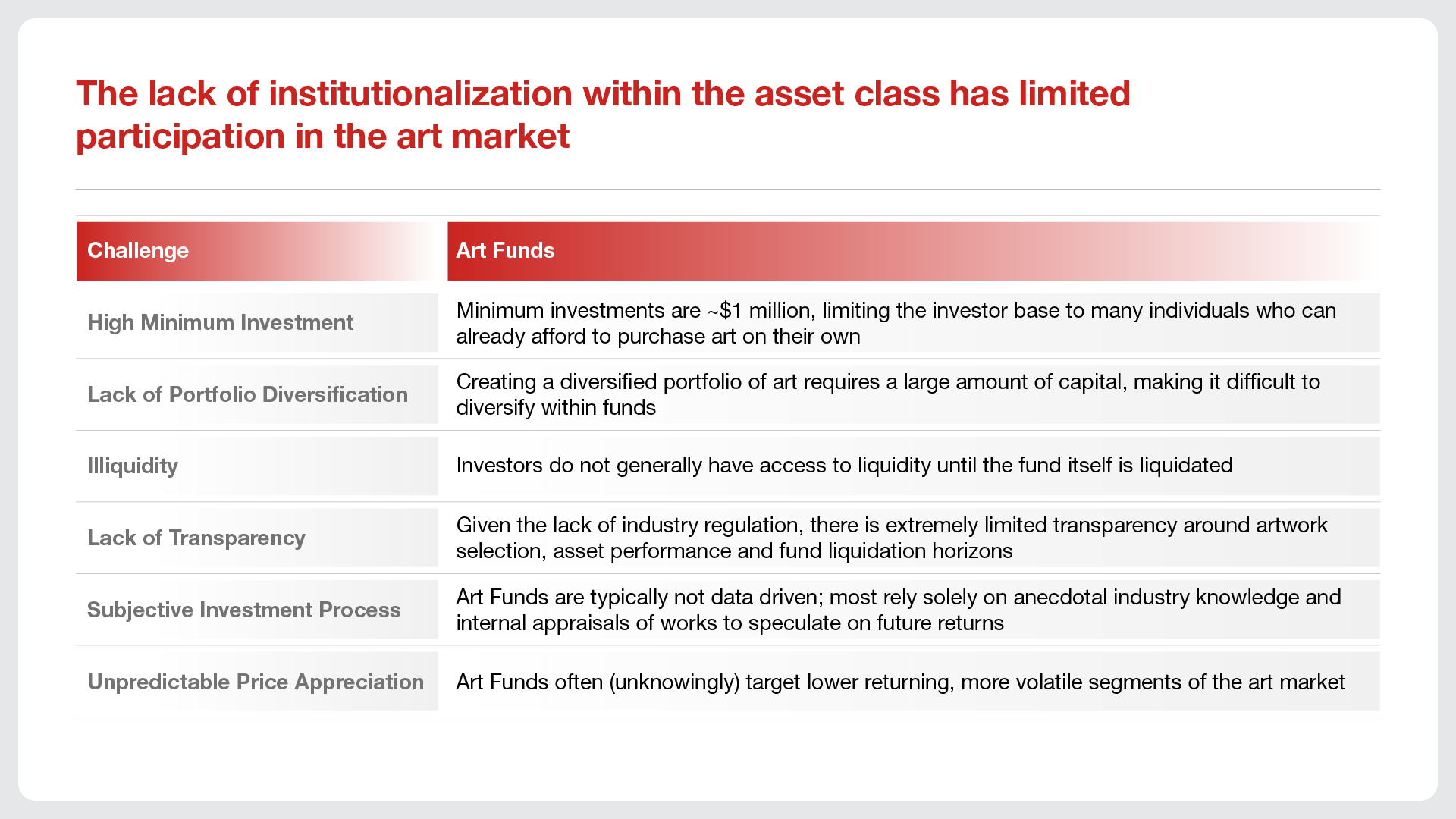

Art has a long history as a transactable asset, with marketplaces and auction houses like Sotheby’s having existed for more than 275 years. Art has always demonstrated long-standing cultural significance and aesthetic qualities, which allows it to be universally appreciated and desired around the world. It is also broadly understood that art could be beneficial to the owner financially, particularly for buyers at the high-end of the market. Yet this idea of art value appreciation was largely supported anecdotally by the ultra-wealthy. The lack of research, in addition to inaccessibility, prevented the majority of investors from becoming involved in the market. However, with improvements in technology and increased interest from investors in alternatives, the financial profile of art is becoming increasingly understood, and also more widely available via securitization of the asset class.

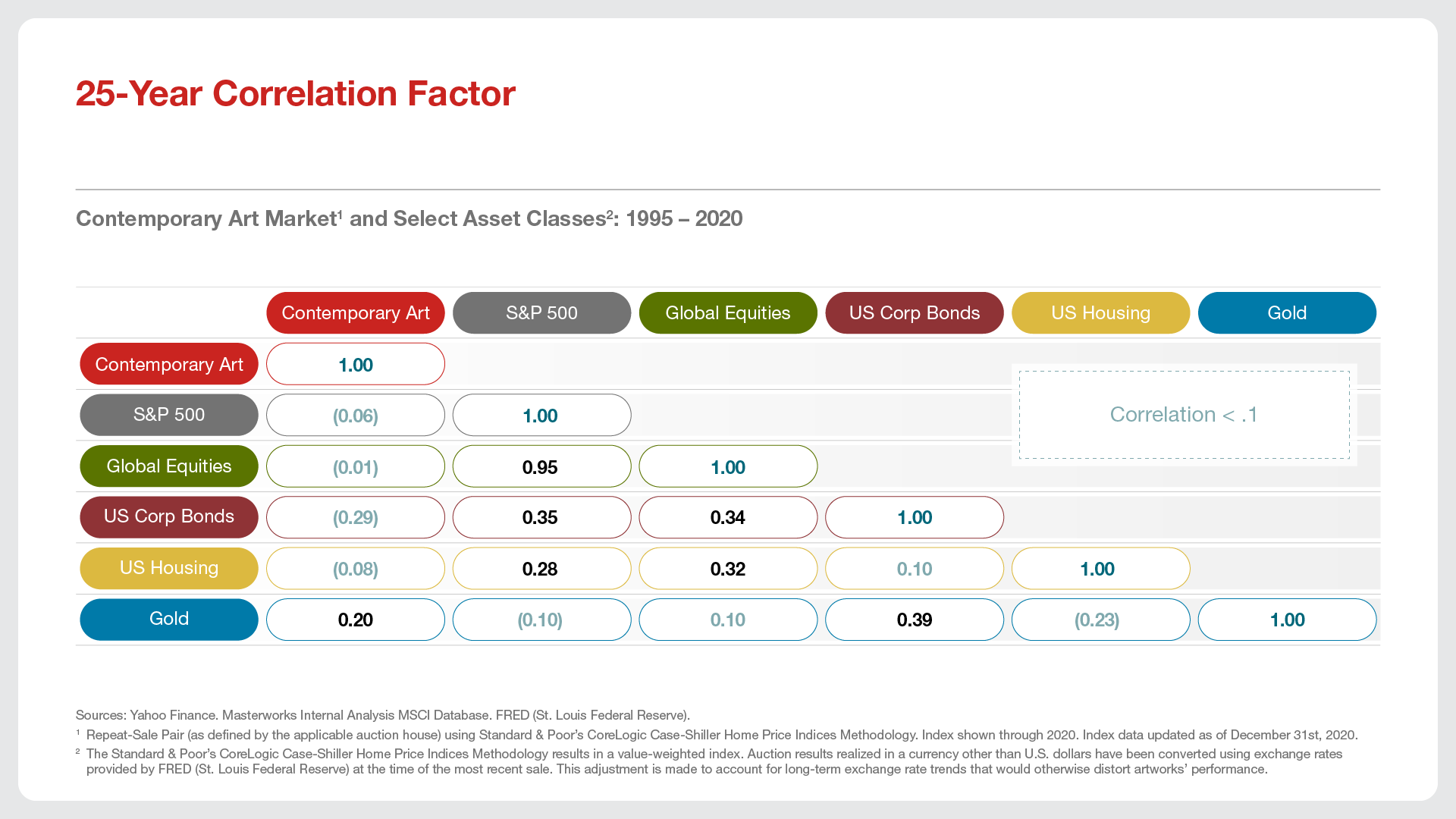

In conclusion, given the securitization and digitization of the Art and Collectibles marketplace, we are seeing more and more interest from younger buyers and collectors. Coupled with the impending handover of wealth from one generation to the next (the largest in history) it is fair to expect to see a continued rise in valuations as more young investors begin to participate and look to earn uncorrelated market returns from these investments. This is surely an area to keep an eye on in the future as investors could benefit from knowledge and access to such ecosystems.

Sources: Deloitte, ArtTactic: Deloitte Art and Finance Report 2019. Preqin. McKinsey & Company: Private Markets Come of Age: McKinsey Global Private Markets Review 2019. Internal Masterworks Analysis. Yahoo Finance. MSCI Database. FRED (St. Louis Federal Reserve).

Footnotes

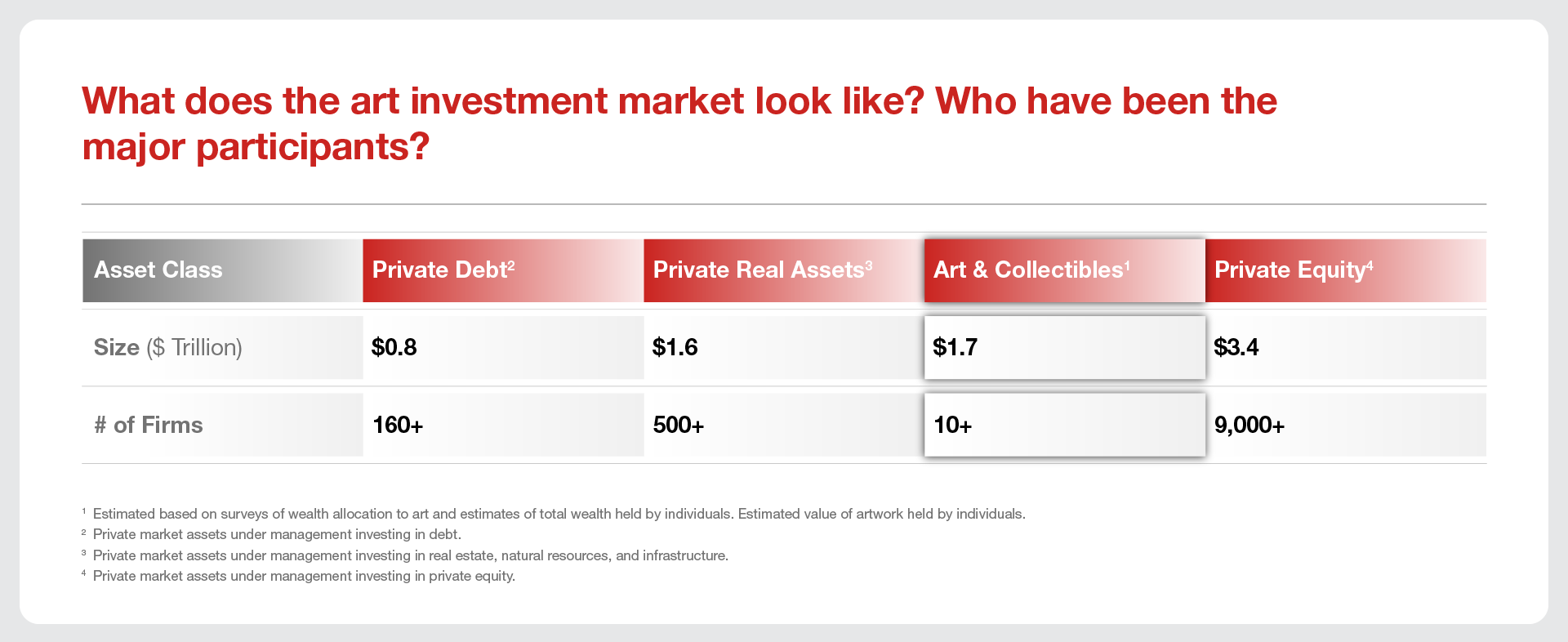

- Estimated based on surveys of wealth allocation to art and estimates of total wealth held by individuals. Estimated value of artwork held by individuals.

- Private market assets under management investing in debt

- Private market assets under management investing in real estate, natural resources, and infrastructure

- Private market assets under management investing in private equity

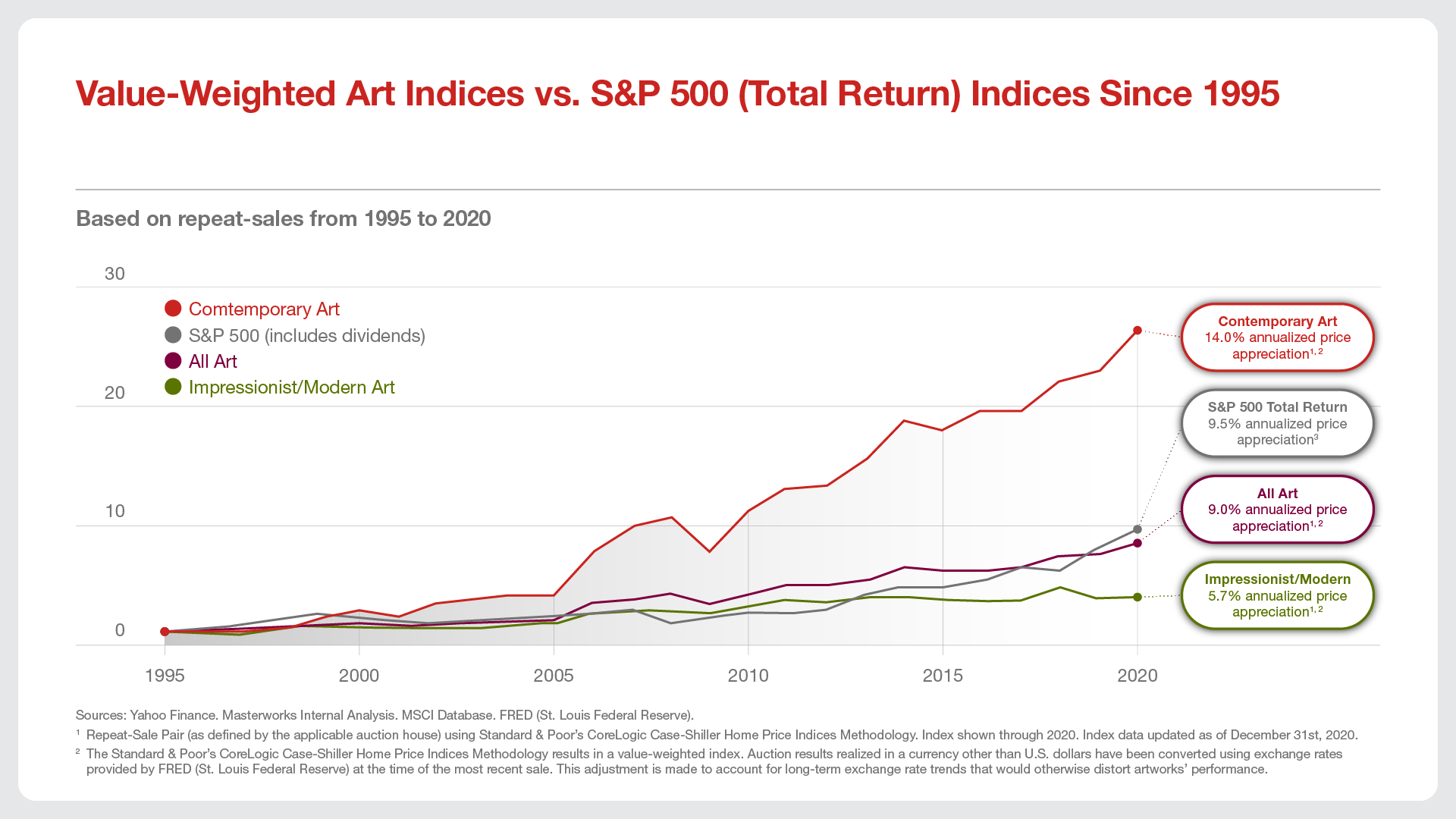

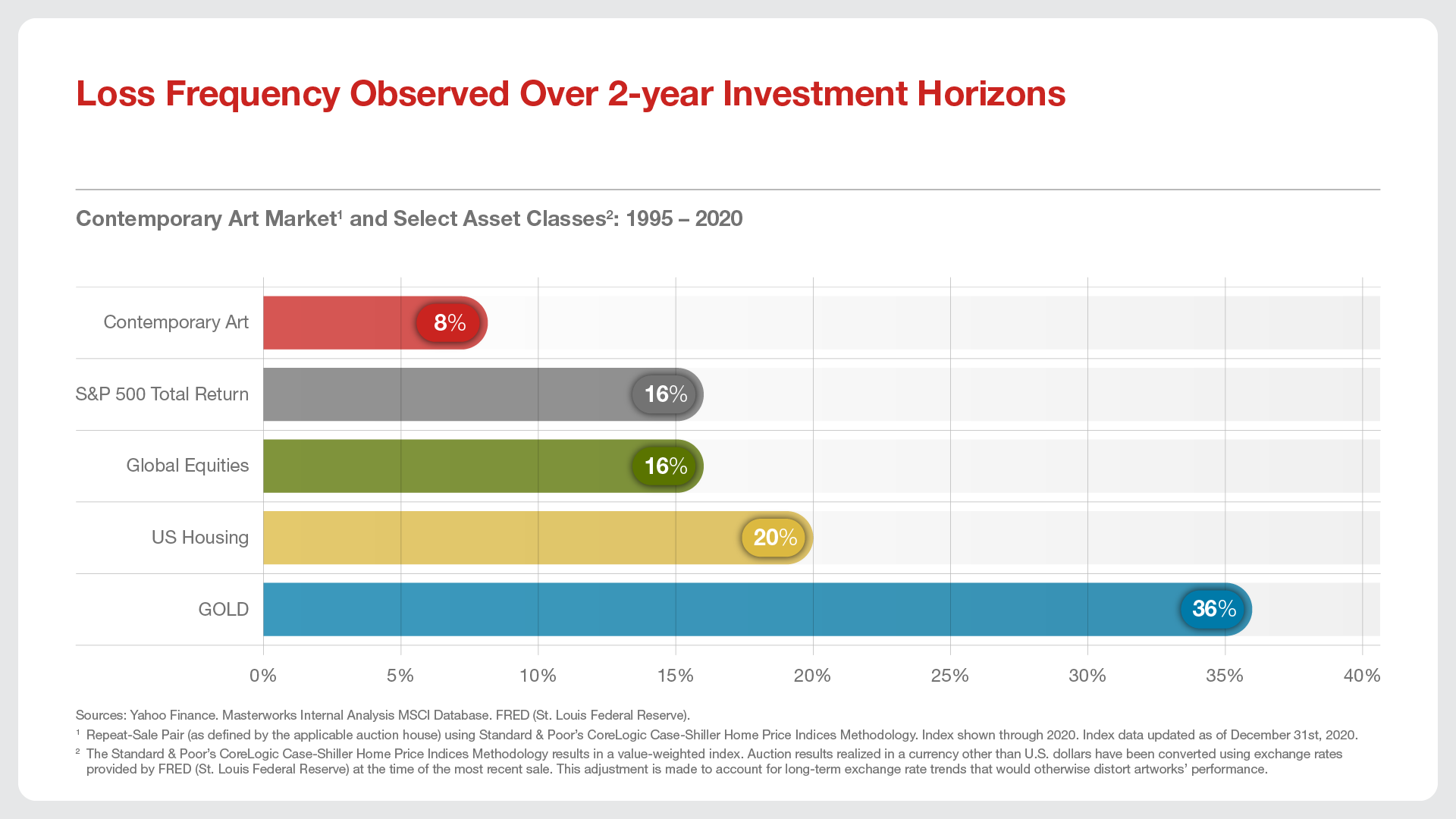

- Repeat-Sale Pair (as defined by the applicable auction house) using Standard & Poor’s CoreLogic Case-Shiller Home Price Indices Methodology. Index shown through 2020. Index data updated as of December 31st, 2020.

- The Standard & Poor’s CoreLogic Case-Shiller Home Price Indices Methodology results in a value-weighted index. Auction results realized in a currency other than U.S. dollars have been converted using exchange rates provided by FRED (St. Louis Federal Reserve) at the time of the most recent sale. This adjustment is made to account for long-term exchange rate trends that would otherwise distort artworks’ performance.

- S&P 500 Total Return Index as of December 31st, 2020.

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.