Focused thinking | 4 min video November 2019

Central Banks | 2 min video | November 2019

Central Banks | 2 min video | November 2019

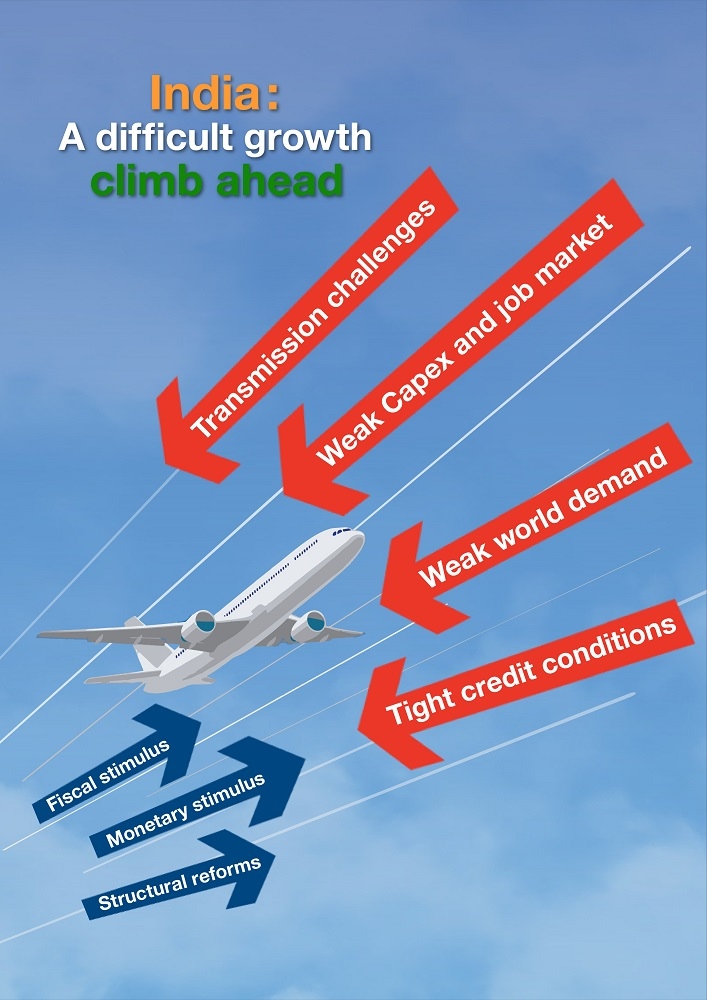

Contrary to our expectations of a recovery starting in Q3, high-frequency indicators have plunged and domestic credit conditions remain tight amid weak global demand. As a result, India’s economic recovery is expected to be delayed and the subsequent pickup is expected to be sub-par. There are four main reasons why.

The first is that India is facing a triple balance sheet problem involving banks, corporates and now, shadow banks, which has tightened credit conditions. In the thick of resolving the twin balance sheet problem of banks and corporates, the economy is now additionally burdened with a “triple balance sheet problem”, involving shadow banks. Over a year after the crisis first erupted, differentiation among shadow banks persists due to elevated credit risks, while bank lending has remained subdued.

The second reason contributing to delayed economic recovery is that policy accommodation is a growth tailwind, but is working against two headwinds, namely clogged credit channel of policy transmission which counters the policy easing delivered by the Reserve Bank of India.

Thirdly, investments, particularly private, remain quite weak. At the heart of the issue is the ensuing deleveraging corporates and banks. Without investment, a durable and broad-based jobs-driven consumption recovery has been missing, and lower investment has also held back trend (potential) growth, and is also impinging on job creation.

Finally, an additional headwind for India is weaker global demand. Although India is a relatively closed economy and not part of the China-centered supply chain, India’s growth rate cycles are closely intertwined with global growth rate cycles due to both trade and confidence channels.

For a more detailed outlook on India’s growth recovery, read the full report here.

Chief Economist, India and Asia ex-Japan

Asia Economist

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.

Focused thinking | 4 min video November 2019

Central Banks | 2 min video October 2019

Economics | 2 min read September 2019