Investors are flocking to total return equity futures in an effort to mitigate the impact of the uncleared margin rules,which are proving even more costly in a higher rates environment.

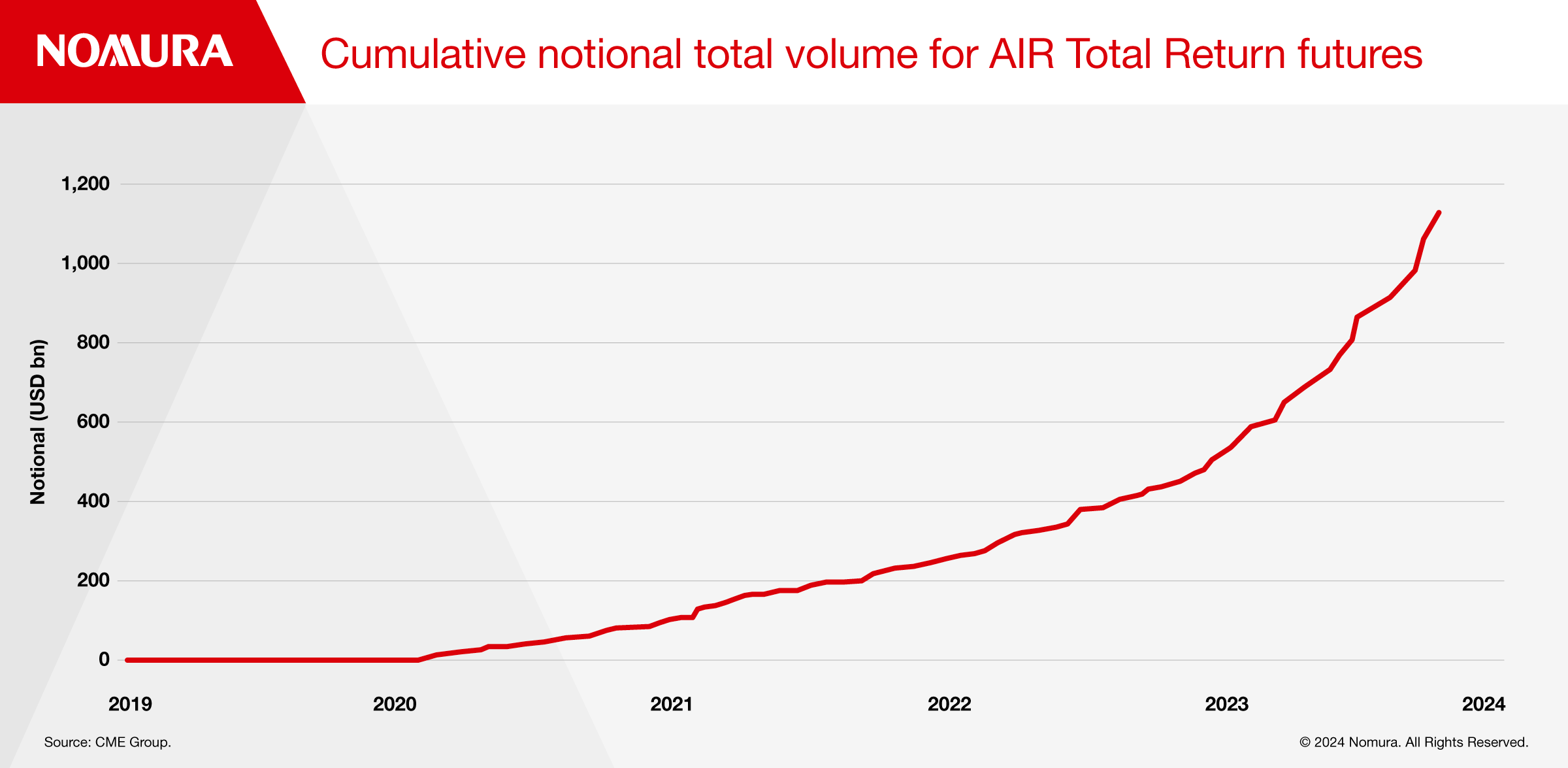

CME’s stable of Adjusted Interest Rate (AIR) Total Return futures – which combine index performance plus dividends and financing costs - reached an open interest high of 710,358 contracts, equivalent to $224 billion notional in November while average daily volume stands at 11,600 contracts for 2024, up 152% versus last year.

Since September 2022, regulatory initial margin requirements have applied to firms that have an average aggregate notional amount of derivatives trades exceeding €8 billion, or the equivalent in local currency.

This shift in over-the-counter (OTC) derivatives being listed on an Exchange has created an opportunity for Delta One desks as investors increasingly seek out more cost-efficient alternatives, says Josh Lukeman, Head of US Macro Delta One Trading at Nomura Securities International, Inc.

The uncleared margin rules were put in place by regulators following the 2008 financial crisis to require firms that trade OTC swaps facing one another to post more margin for financial stability reasons.

The rules require counterparties who engage in OTC derivatives transactions that aren’t cleared at a clearinghouse, to post an upfront deposit called initial margin. The amount of initial margin differs according to a product schedule with equity swaps being subject to the highest rates at 14% - 19% of notional value depending on whether the Standard or Alternative approach is used for initial margin calculations.

AIR futures still come with Exchange margin requirements, but they are set at a less onerous level of about 5% on average, depending on the banks’ netting position.

Take a hedge fund posting 5% margin versus 19% on a $100 million notional trade, it might only need to borrow $5 million to post margin at the Exchange at the current interest rate level of about 5% as opposed to borrowing $19 million on an uncleared swap. That translates into an interest saving of $700,000 annually, the difference between paying $950,000 interest on the uncleared swap and $250,000 on the listed future.

“A few years ago when rates were still low it didn’t matter as much, but as we went into this inflationary regime and saw rates dramatically rise, it makes a very big difference to profitability on the trade,” says Lukeman.

Using listed futures also helps banks reduce expenses on risk weighted assets as the lower amount of initial margin being set aside would typically attract a lower charge.

Regulatory Initial Margin requirements started being phased in from 2016 and in the latest phase (6), more than 775 counterparties with an excess of 5,400 relationships may become subject to the regulatory requirements, according tothe International Swaps and Derivatives Association.

Lukeman says the main users of the product are banks and hedge funds alongside asset managers, pension funds and insurers.

“Investment firms are looking at this product now as liquidity has almost doubled over the past 18 months so this gives participants an efficient tool to trade the total return product in a way that they couldn’t target as easily before.”

The S&P 500 was the first product but now AIR futures include the NASDAQ and Russell 2000 indexes in the U.S.

Most of the volume is done via the interdealer broker market but banks can also face their counterparts directly on screen although the size and depth still isn’t very mature.

Lukeman says that as banks head into year-end, they may face balance sheet constraints which could lead to a further utilization of AIR futures to help mitigate the exposure over the year end turn.

“The rally in the stock market post the US election has exacerbated bank’s balance sheet pressures headed into the year-end. This has resulted in elevated costs of funding, including higher implied costs to fund futures as portrayed by the spike in basis.”

Over the medium term, Lukeman sees the AIR futures product gaining further traction as the driver of regulation continues to reshape derivatives markets.

“All these facets coming together have fueled the Index Delta One space as more investors use listed products, creating a bigger ecosystem for hedging and managing risk,” he says.

To learn more about this topic please contact Josh Lukeman