Economics | 31 min podcast November 2020

Volatility | 3 min read | November 2020

How the UK Economy is fast becoming the runt of the G10 litter?

Will the UK be able to vaccinate itself against a weakening economy?

Volatility | 3 min read | November 2020

Will the UK be able to vaccinate itself against a weakening economy?

The UK remains the G10 economy most heavily affected by the pandemic. At its trough, UK GDP was down just over 25% in April relative to January, and while output has bounced, it remains well below where it was before the virus – around -8.5% relative to the start of the year according to September’s GDP print figures.

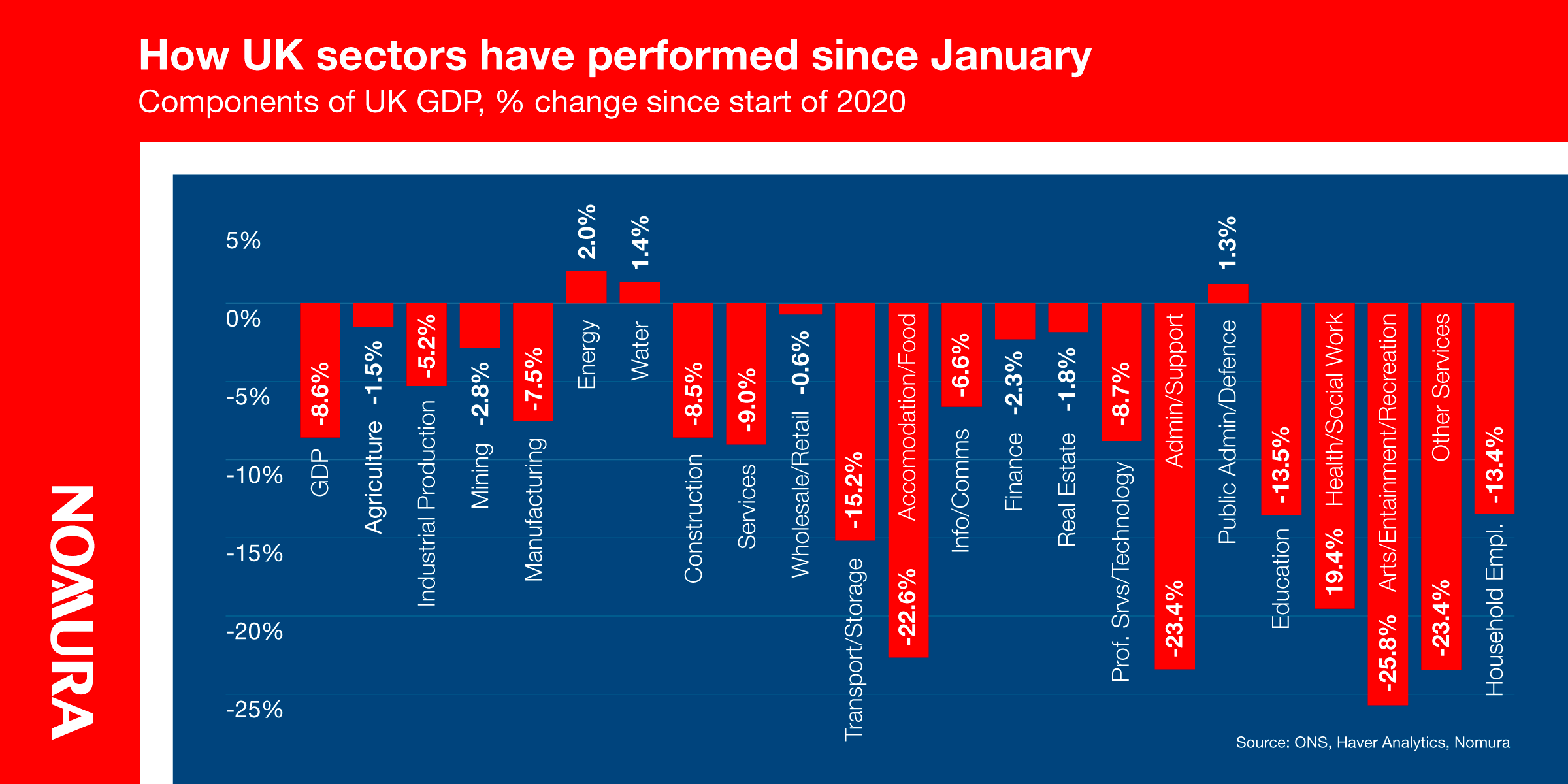

We have detailed below how the UK sectors have performed since January, with accommodation and food output at -22.6%, while industries such as the arts, entertainment and recreation down even further at -25.8%.

Ultimately we expect GDP to contract again during Q4 as virus case numbers have risen and fuller lockdowns were implemented from the start of November, though we think the fall in GDP will be far more modest than was the case earlier in the year for various reasons:

We forecast around a contraction in GDP between September and December, then a levelling off in early 2021 before rising again into the spring.

‘Comparison is the thief of Joy’ – Theodore Roosevelt. This is the painful truth for the UK when comparing GDP both historically, and against its peers, as neither bode well. The UK and Spain are among the worst GDP performers when comparing the third quarter of this year, with the last quarter of 2019, with falls of -9.7% and -9.1% respectively. In contrast countries like the US and France are in a far less perilous state with declines of only -3.5% and -4.1%.

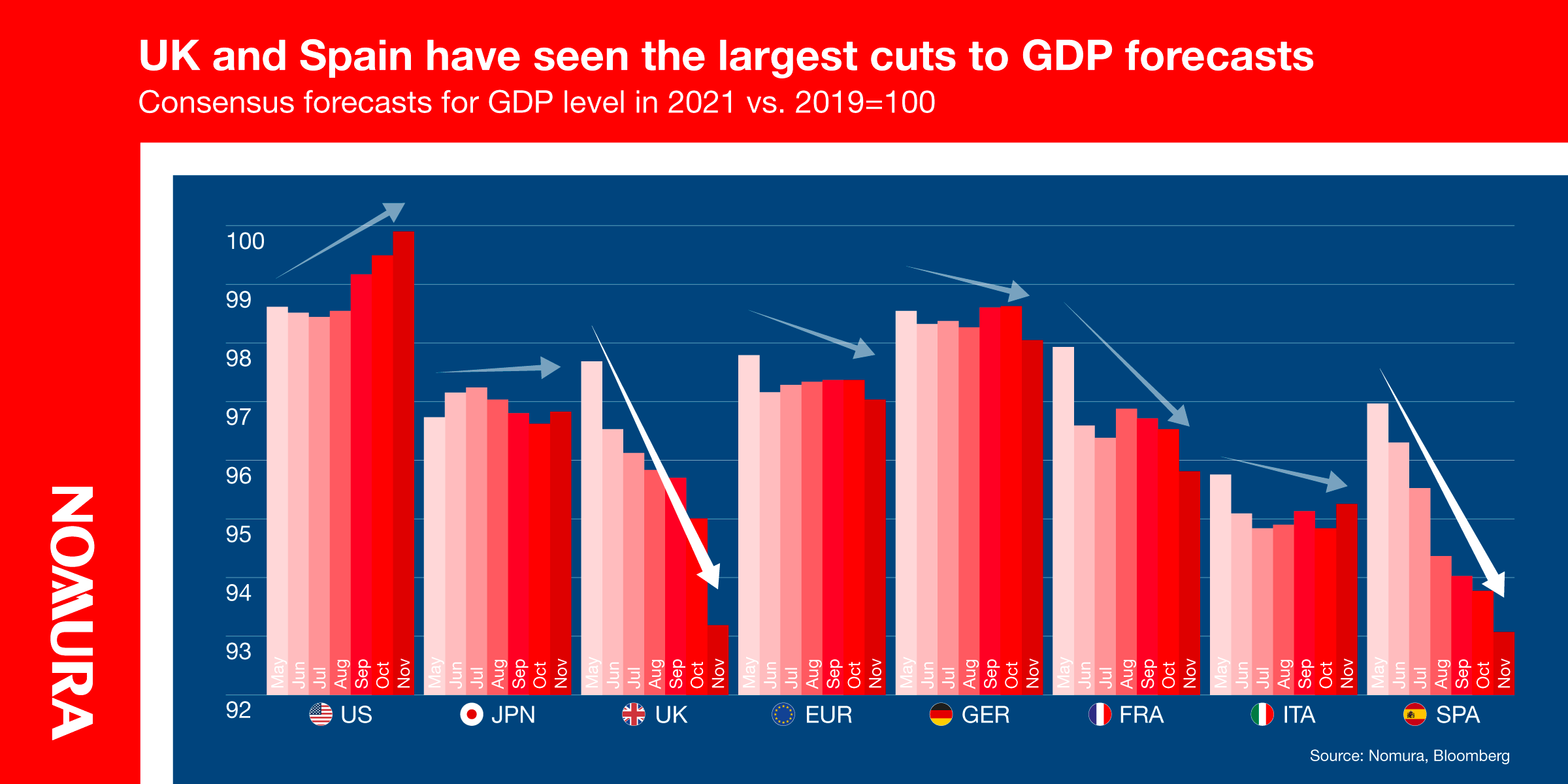

We have been closely tracking Consensus Forecasts for GDP in the UK and across developed markets more generally for some time, and these revisions in 2020 GDP expectations typically lead to simultaneous adjustments being made to 2021 forecasts. It’s a case of ‘the harder they fall, the more they bounce’, it’s important to capture the net effect of any such changes.

As a result, the graph below shows how Consensus Forecasts for the level of 2021 GDP relative to that of 2019 have been evolving over the past few months. What it shows is that economists have revised down their forecasts for UK and Spain’s activity more heavily than many other countries.

This plunge is possibly due to their heavy reliance on the service and tourism sectors, and the strenuous impact Covid-19 has had on them.

As ECB President Lagarde said, “the recovery may not be linear, but rather unsteady, stop-start and contingent on the pace of vaccine roll-out. In the interim, output in the services sector may struggle to fully recover”.

The silver lining is that the UK is one of the countries with potentially the most to gain once the recently announced vaccines are rolled out and the “back to normal” process takes place. The key questions will be how much economic scarring is left and how far will the government continue to support business in the recovery phase.

The extension of the UK’s furlough scheme until March points to a high probability that the UK will, like many other economies, enjoy a swift upswing in growth after lockdowns end.

Even with the recent announcement of the UK’s fiscal plans it’s tough to say how the UK’s growth will compare with other economies. But as the UK has had the most to lose so too in the “back to normal" recovery trade it could have the most to gain.

For more information see our reports on ‘Rebound in UK GDP among the weakest’ and ‘GBP: Brexit beckons but also looking at 2021’

Chief UK & Euro Area Economist

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.

Jump to all insights on Volatility

Economics | 31 min podcast November 2020

Economics | 3 min read November 2020