This article was produced in collaboration with

Introduction

Responsible investors are keenly aware of the impacts of environmental change, and ESG knowledge is helping them mitigate risks, benefit from opportunities, and express their values, as companies respond. Nevertheless, there remain crucial knowledge gaps in the global ESG framework, particularly in the social pillar.

In our previous article we discussed the challenges that companies and ESG ratings providers face in producing performance assessments. In South Korea we found a lack of data standardisation, and burdensome and contradictory requirements, which confuse and discourage companies from providing data for the public domain. One outcome is variability in companies’ approaches to information disclosure, which feeds divergence in agencies’ ESG assessments.

Investor preferences are also driving this divergence, with some demanding environmental emphasis, and others social or governance factors. This variety carries some advantages for knowledge-seeking investors. One area that is lacking in most ESG reporting, however, is deeper analysis of the contexts within which companies are operating, which raises risks when investors face unfamiliar territories, particularly over the longer term.

In this, our fourth article, we examine East Asian and South Korean contexts to demonstrate the need for a layered approach in ESG reporting that includes long-term non-financial factors.

Why East Asia?

East Asian economies continue to advance along a distinct growth pathway. Indeed, the East Asian development experience has long been considered a distinct conceptual pathway for understanding socio-economic trends across the region, with Akamatsu’s Flying Geese metaphor well-known among experts.

Not to over-emphasize, East Asian countries share common features in their development, which help to shape their short and long-term futures. This presents investors with a need to understand the opportunities and risks inherent in this particular developmental pattern and its ‘path dependencies’, or determined outcomes.

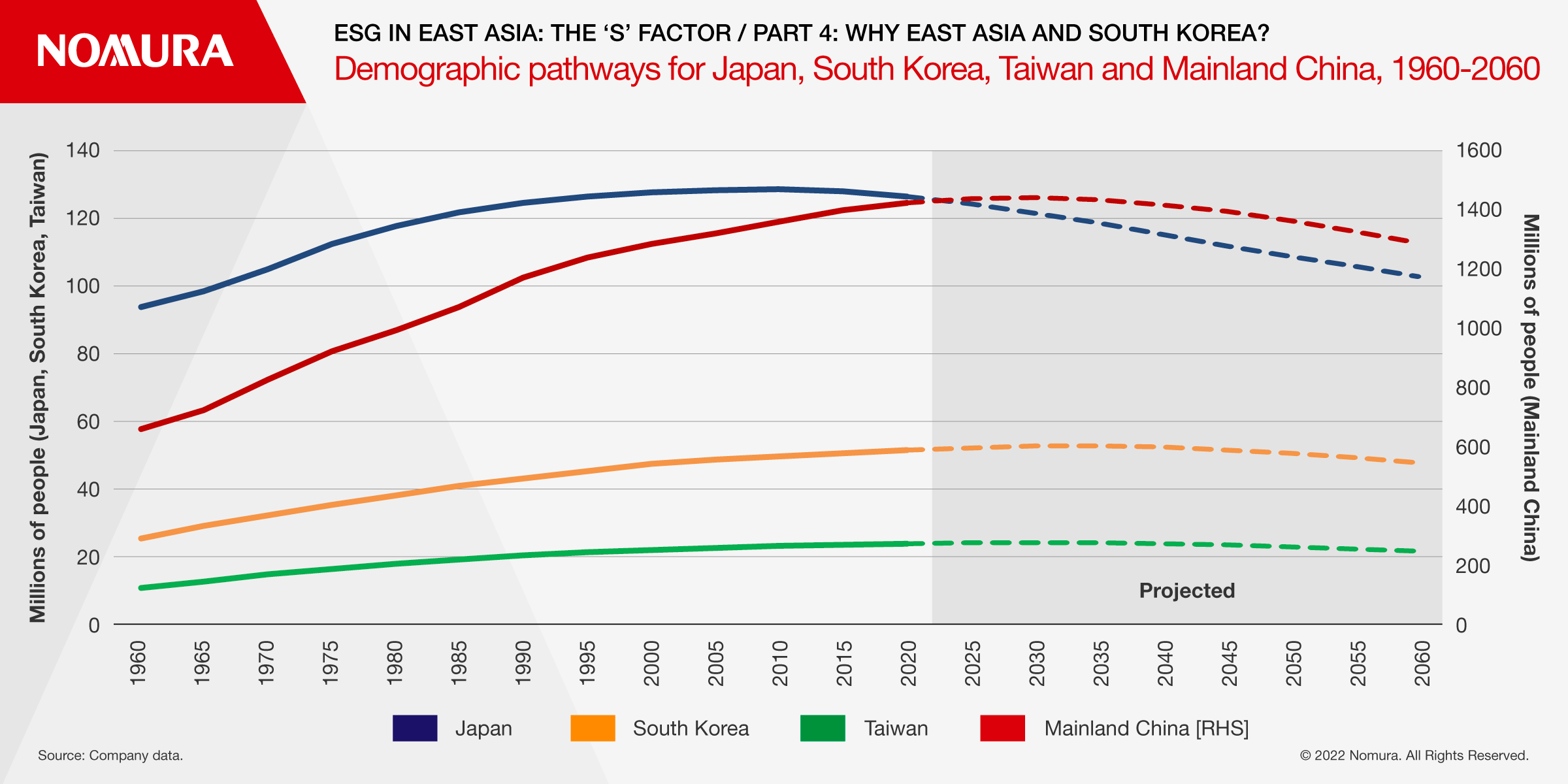

The clearest illustration of how this phenomenon works is the East Asian demographic transition curve, showing a rapid growth phase in the late 20th and early 21st centuries, a levelling in the 2000s-2030s, and depopulation thereafter (Figure 1). The underlying cause is decreasing fertility rates, as families have fewer or no children. This has important consequences for each country, and each company, as they adjust to an evolving future reality.

How can ESG performance measurement help us to identify companies that are engaging with these processes?

South Korea

South Korea is now the world’s tenth largest economy, and emerged from Japan’s shadow from the late-1980s as the leading member of the original NIEs (Newly Industrializing Economies), sharing many characteristics with Japan and the NIEs as an East Asian growth economy. However, Korea is also rather unknown, relative to its size and importance, presenting opportunities for more knowledgeable investors.

Demographic ageing and shrinkage is one of many underlying, and predictable, long-term trends that companies should adjust themselves to reaping opportunities from being ahead of their competitors. South Korea has the lowest long-term fertility rates in the world, at just 0.81 children per woman in 2021, leading to a fall in the working age population and a decline in labor supply.

What should investors be looking for when considering a long-term commitment to South Korea in their portfolios? How can ESG performance analysis help to reveal investment opportunities?

Here we briefly introduce three ESG standards that we think will inform company performance over the long-term as South Korea’s demographic situation deepens, and we suggest some questions that investors might like to ask themselves as they research their options. In the next three articles in our series will develop these subjects in greater detail.

Diversity & Inclusion

Just as Japan is experiencing now, in the future we expect rising levels of diversity and inclusion in employment in leading South Korean companies, as the working age population reduces in number and workers increase their selling power. Currently, many South Korean companies are lagging in their approach and, moreover, understand this issue solely through the lens of gender composition.

We view boosting diversity and inclusion as a financial positive for companies, to mitigate underlying demographic change, and as a method for unlocking the leadership

and innovation

potentials of non-standard employees in a rapidly changing world.

Investors may want to ask, therefore, how deeply are South Korean companies including previously marginalized groups into their core workforces and leadership?

Human Capital Development

Increasing educational attainment is both a cause and an outcome of lower fertility, as parents invest more resources in fewer children. This delays labor force entry, but produces higher levels of productivity and innovation. Well educated employees need continued challenge and opportunities to grow, and they have the potential to work longer later in life. Companies will need to attract and fix those workers through the provision of high-quality training and development opportunities, and challenges that meet workers’ talents and knowledge. 21st

century jobs are increasingly requiring non-routine and digital skills, which in turn require highly educated and motivated employees.

How are South Korean companies investing in their employees’ personal and professional development across the whole employment lifespan? How are companies rewarding and promoting the most productive and innovative workers?

Employee Voice & Representation

Employment relations have long been a live political issue in South Korea. In ESG terms it is sometimes placed within the governance pillar. Here we include it in the social pillar, because the degree to which someone’s voice is consulted and considered is an important aspect of long-term employee satisfaction and motivation to remain in a company’s employ and contribute ideas. It therefore contributes to a company’s long-term employment stability and dynamism.

Investors may want to ask whether and how companies recognize employee representation, and whether employees feel that their voice is being heard.

Conclusion

In our research we want to help investors understand more about employment standards, because we assert that it underpins company performance across the whole ESG spectrum. We argue here that investors need to know about long-term underlying socio-economic trends that will impacting company decision-making and performance into the future.

East Asian development patterns place distinct and discernible constraints on each economy’s performance trajectories, including its workforce. Responsible investors will be keen to understand how companies are evolving and adjusting their employment systems to the long-term impacts of these dramatic though sometimes rather hidden transformations.

In our next three articles we will look at specific examples of how companies are responding to these challenges.