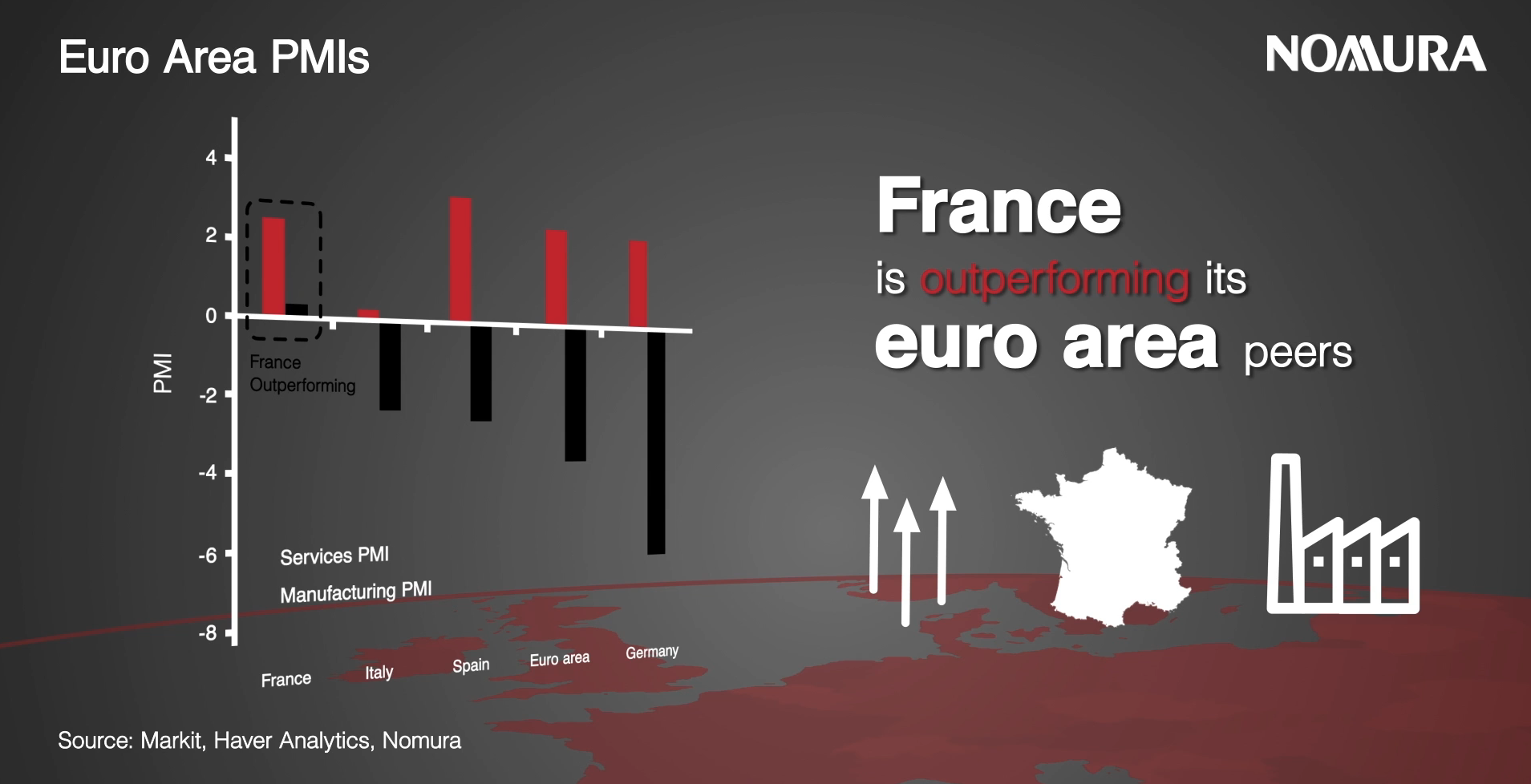

How has France achieved this?

There are three main factors that have contributed to France’s continued growth over the past two years.

First, France’s annual industrial production growth has been positive so far this year increasing 0.7% - this compares with negative performances in the three other largest European economies of Germany, Italy, and the UK. This strong performance can at least partly be attributed to lower exposure to the vagaries of global trade, particularly Chinese trade, than some other European economies.

Second, France has benefited from both loose monetary policy and has lower household debt than Germany, Italy or Spain, and a “refocus” of President Macron’s fiscal policy in response to the Gilets Jaunes protests earlier in the year. As the European Commission has noted:

“Fiscal measures should provide further support to purchasing power over 2019, especially for vulnerable households with a high marginal propensity to consume”

The third and final driver has been President Macron’s labour market reforms. Despite being historically high, the French unemployment rate has fallen (albeit slowly) to 8.5%. And while total employment is not growing particularly strongly, full-time jobs – which the President’s reforms have targeted by reforming taxes, benefits, unfair dismissal costs, and temporary contracts – are growing at a rate of some 1.5% y-o-y, much faster than is the case in Germany (0.4%) or Italy (flat). This has come at the cost of part-time employment, which is falling at an annual rate of 5% (in Germany, Italy, and Spain part-time jobs are growing at an annual rate of between 2% and 3%). There is still much work to be done. However, with further reforms planned for the remainder of Mr. Macron’s presidency, it is fair to be optimistic. But this is reliant on whether he has the political capital to introduce them – which is questionable.

Can the French economy continue to grow?

Looking ahead there are positives and negatives to France’s recent economic prosperity. On the downside, global macroeconomic uncertainty may end up denting a key support to the French economy, that of fixed capital investment, which has been growing at an annual pace of 3-3.5% so far this year. And while a hard Brexit would prove harmful to France, it could be worse for other countries such as Germany and, to a lesser extent, Spain where exports to the UK make up a larger portion of GDP.

In saying that there does seem to be more positives than negatives to support the continuing French economic growth:

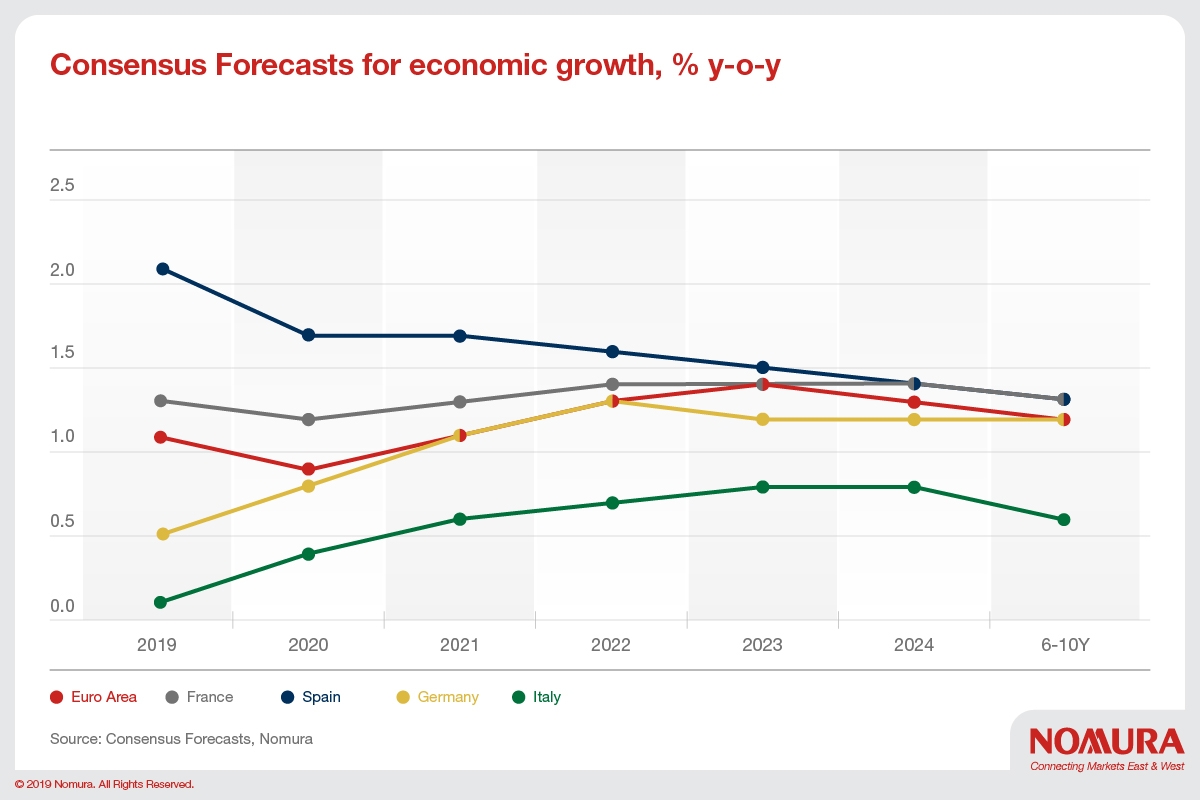

In short, these factors may justify a consensus forecast profile for French GDP looking generally more optimistic than for other major European economies.

For more information read our full report on ‘Why is France Outperforming?’

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.