The BOJ wrapped up its latest Monetary Policy Meeting (MPM) on 28 April. The four highlights of the meeting were the statement on monetary policy, the Outlook Report, the issuance of forward guidance, and the announcement of a “broad-perspective review of monetary policy”.

Monetary policy was unsurprisingly left unchanged; the statement adds mention of “accompanied by wage increases” to the discussion of price stability

The BOJ made no changes to its YCC policy, its asset purchase programs, or any of the other principal parameters of its monetary policies at this MPM. Out of the 47 economists surveyed by Bloomberg between 13 April and 18 April, 41 had expected the BOJ to leave its policies untouched. The decision to stick with the currency policy course should thus come as no surprise.

The BOJ has been managing its monetary policy with an eye towards attaining its price stability target, and on that topic it added a mention of inflation “accompanied by wage increases” in its latest statement on monetary policy. This presumably amounts to an acknowledgement that sustainable inflation requires not just an upward push on prices from the supply side but also a pull from personal consumption and other forces on the demand side.

No path to sustainable and stable 2% inflation presented in Outlook Report

After the meeting, the BOJ also issued its latest Outlook for Economic Activity and Prices (Outlook Report). This latest Outlook Report extends the BOJ’s forecast horizon by one year, such that it now includes forecasts for real GDP growth and core CPI inflation (all items less fresh food) through FY25.

Change in forward guidance on policy interest rate comes as surprise but does not represent hawkish pivot

The BOJ has been regularly issuing forward guidance on its Quantitative and Qualitative Monetary Easing with Yield Curve Control (QQE with YCC), the monetary base, and its policy interest rates. At the latest MPM, it made an unexpected change to its forward guidance for policy interest rates.

The BOJ’s forward guidance for policy interest rates had up until now read “For the time being, while closely monitoring the impact of COVID-19, the Bank will support financing, mainly of firms, and maintain stability in financial markets, and will not hesitate to take additional easing measures if necessary; it also expects short- and long-term policy interest rates to remain at their present or lower levels”.

In the latest statement on monetary policy, this has been shortened to “The Bank will continue to maintain stability of financing, mainly of firms, and financial markets, and will not hesitate to take additional easing measures if necessary”.

We had been expecting the reference to COVID-19 to be removed, but we had not expected the comment that “it also expects short- and long-term policy interest rates to remain at their present or lower levels” to also be removed.

Despite our surprise, we think it would be wrong to read this change as indicating a hawkish pivot. We suspect that the change represents a move by the BOJ to grant itself more policy flexibility and freedom by doing away with overly specific statements. In addition, the structure of its latest forward guidance appears to allow for the simultaneous withdrawal of both YCC and negative interest rate policy(NIRP) at some point in the future.

“Broad-perspective review of monetary policy” not simply third review in series of reviews, but rather first full policy retrospective under current Bank of Japan Act

The BOJ has been trying to tackle the price stability problem for 25 years now, and this has been the backdrop to its extensive monetary easing measures. Because these measures have had such far-reaching impacts, the BOJ announced that it has decided to conduct a “broad-perspective review of monetary policy”, and that it intends to spend a year or even a year and a half on the project.

The BOJ has conducted reviews of its monetary policy on two other occasions, but each of those reviews took only two to three months from the announcement of the review through to the disclosure of its findings. The policy review that the BOJ is planning now—given how long it is supposed to take—should probably not be thought of as simply the third in a series of policy reviews. If anything, the review it is planning looks more like the 10-year or 20-year policy reviews of economic trends and policy management that have been conducted by the US Federal Reserve System (FRS) and the European Central Bank (ECB) in the past.

We do not see this policy retrospective as a precondition for changes to (or withdrawal from) YCC or the withdrawal from NIRP. We think the door is open to YCC and NIRP being abandoned even before the results of the review are announced, depending on economic growth and prices.

Nomura’s monetary policy scenarios: our main scenario is mostly unchanged, but we now revise our risk scenario

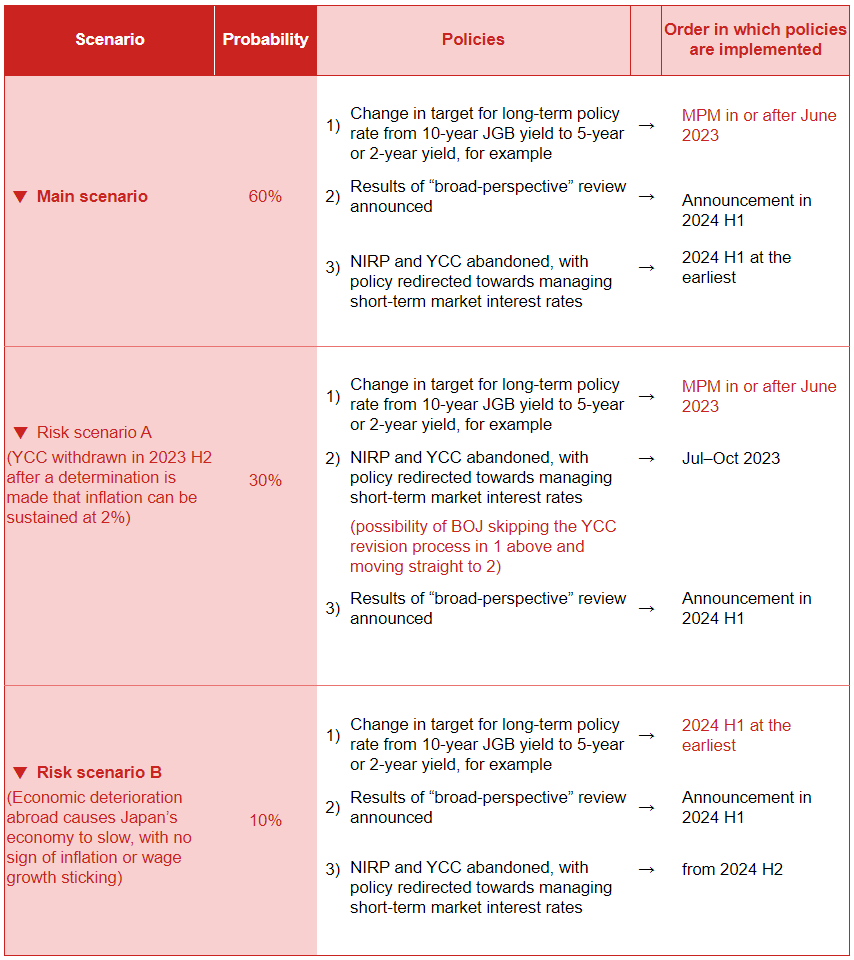

In Figure 1, we lay out our forecast scenarios for BOJ monetary policy based on the outcome of the latest MPM.

Our main scenario (60% probability, by our estimate) is essentially as it was before. In this scenario, we assume the BOJ will announce tweaks to its YCC policy as early as at the June 2023 MPM. What we expect is that the BOJ will shorten the YCC policy’s targeted maturity, switching from the 10yr JGB yield to either the 5yr yield or the 2yr yield. The intent, in our view, would be to address the unwelcome side effects of the current YCC policy while working to stabilize 2yr or 5yr interest rates, which have a more powerful impact on the economy than 10yr rates do. Also in this main scenario, we picture NIRP and YCC being withdrawn in H1 2024 at the earliest, on the assumption that the findings of the “broad-perspective” policy review will be revealed in H1 2024, and after the BOJ has had a chance to assess the wage hikes agreed upon in the 2024 round of spring wage negotiations.

In risk scenario A (30% probability), we picture the BOJ being quicker than we expect to make a judgment that Japan is on its way to sustainable and stable inflation of 2%. Should that happen, YCC and NIRP could be withdrawn before the results of the policy retrospective are known, perhaps at the MPM in July, September, or October 2023. (Updated versions of the Outlook Report are also due at the July and October meetings.) In this scenario, we see the possibility of the BOJ skipping the YCC revision process and moving directly to abandoning YCC and NIRP somewhere between July and October of this year.

In risk scenario B (10% probability), we envision the BOJ taking an increasingly cautious stance on the outlook for economic growth and inflation in the latter half of 2023 in response to economic deterioration overseas and other developments. This scenario assumes long-term interest rates in Japan remain low, and YCC’s side effects become suppressed. In this scenario, we would expect a YCC revision to be put off until 2024 H1 at the earliest. In this scenario, we see BOJ monetary policy as remaining unchanged for at least the remainder of 2023. In that event, we think the withdrawal from YCC and NIRP would have to wait until H2 2024 or perhaps even later.