Economics | 2 min read | June 2020

Economics | 2 min read | June 2020

Needless to say, a global pandemic like Covid-19 has had a significant effect on the world economy, and arises concerns about whether a second wave can be avoided. In cases such as the Spanish Flu of 1918, the second wave of infections can prove to be larger and deadlier than the first.

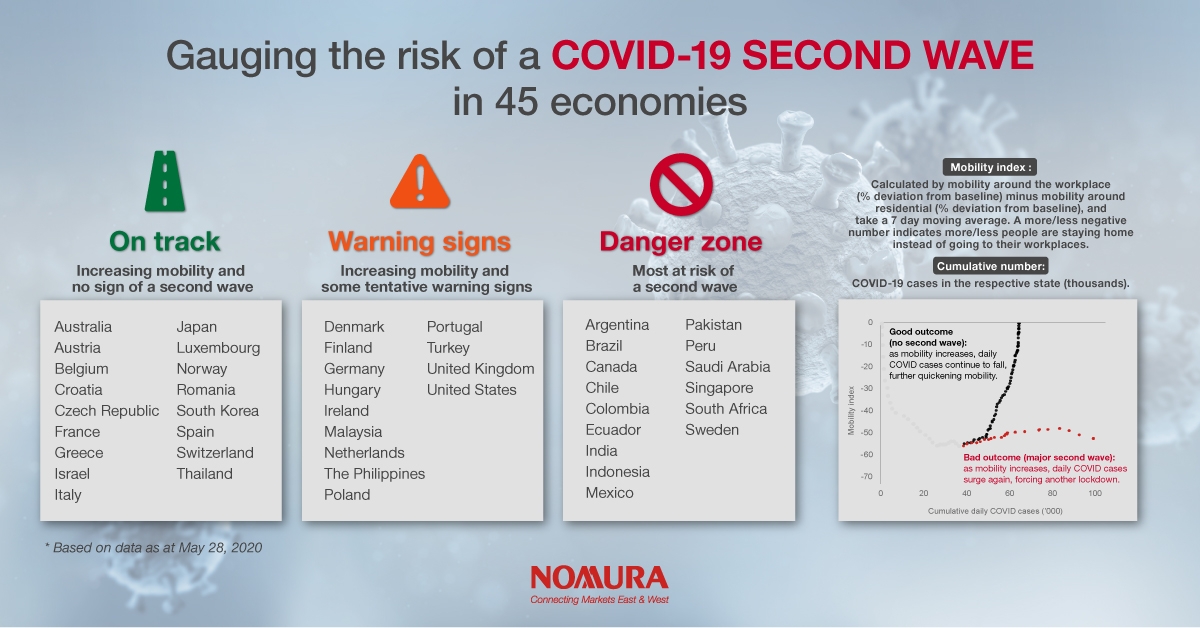

Based on high-frequency data, we developed an easy-to-use visual tool to help assess the risk of a Covid-19 second wave as economies reopen, applying it to 10 US states and 45 major economies around the world. The tool is based on the latest available daily data on Google mobility and confirmed Covid-19 cases. While the latter is updated every day, mobility index lags by about one week.

Through the schematic of the tool, there are two potential scenarios that could unfold. In the first (good) scenario, a country or US state experiences a quick recovery in people mobility. Lockdown measures become relaxed, and businesses resume operations with minimal increases in the number of new daily cases, resulting in an ease in public fear and further increase in people mobility. As the number of new cases declines, a positive feed-back loops kicks in.

On the other hand, the second (bad) scenario is characterized by a much ‘flatter’ curve. The reopening of the economy is associated with an acceleration in the number of new daily infections, growing public fear and ceasing people mobility; in extreme cases, lockdowns would be reimposed.

Our visual tool has yielded a mixed bag of results: 17 countries are on track with respect to reopening economies with no sign of second wave; 13 countries are showing some tentative warning signs and 15 countries in danger zone of being most at risk of a second wave, the latter group largely comprising of emerging market countries.

With regards to the US, Montana and Alaska are two states which are potential model cases where mobility has improved drastically along with minimal increases in new daily cases. Meanwhile, Mississippi, Tennessee and Georgia are showing tentative warning signs of a potential second wave. Mobility has increased, but the curves are flatter, indicating that the number of Covid-19 daily cases continues to increase. If this continues, they could move into the danger zone.

For further details on the methodology of this visual tool, read our full report here.

Head of Global Macro Research

Fixed Income Research

Macroeconomic Research Analyst, Asia ex-Japan

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.