Central Banks | 2 min read January 2020

Economics | 2 min video | January 2020

Euro Area Outlook 2020

What's in store for the Euro Area as we move into 2020?

Economics | 2 min video | January 2020

What's in store for the Euro Area as we move into 2020?

"Our view is that euro area growth will recover going into 2020, this recovery will mainly driven by an improvement in global demand, but at the same time a supportive domestic economy."

As with the UK signs of green shoots have already shown in the euro area surveys as we have seen them bottoming up and possibly reaching an inflection point and improving.

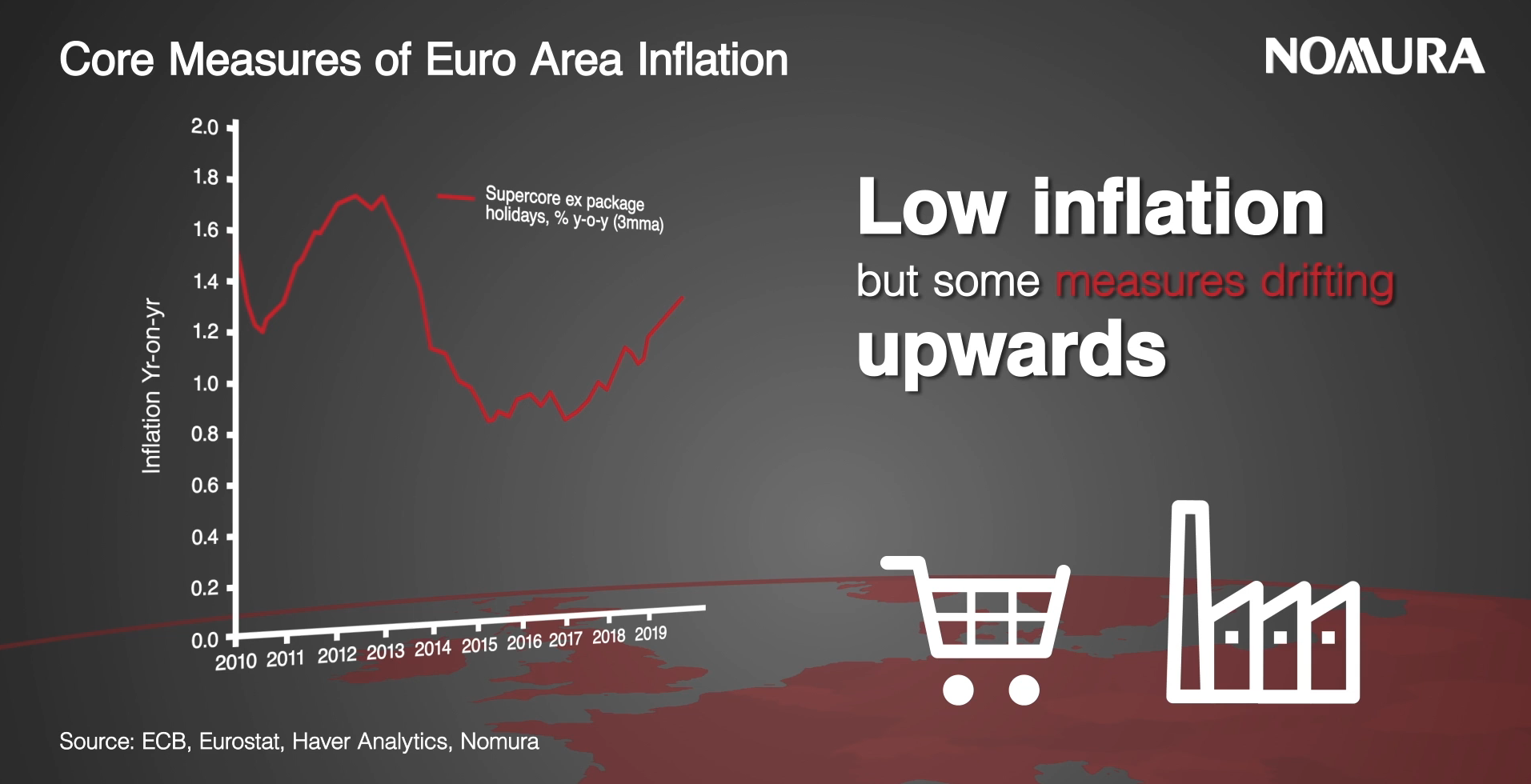

Inflation in the euro area is currently subdued, however signs of recovery are shown by measure like seasonally adjusted inflation and supercore.

We expect the ECB to remain on hold for the remainder of the year as a result of improving data and inflation moving higher. This view is supported by the fact that several members of the ECB governing council have recently expressed their concern around the side effects of negative rates.

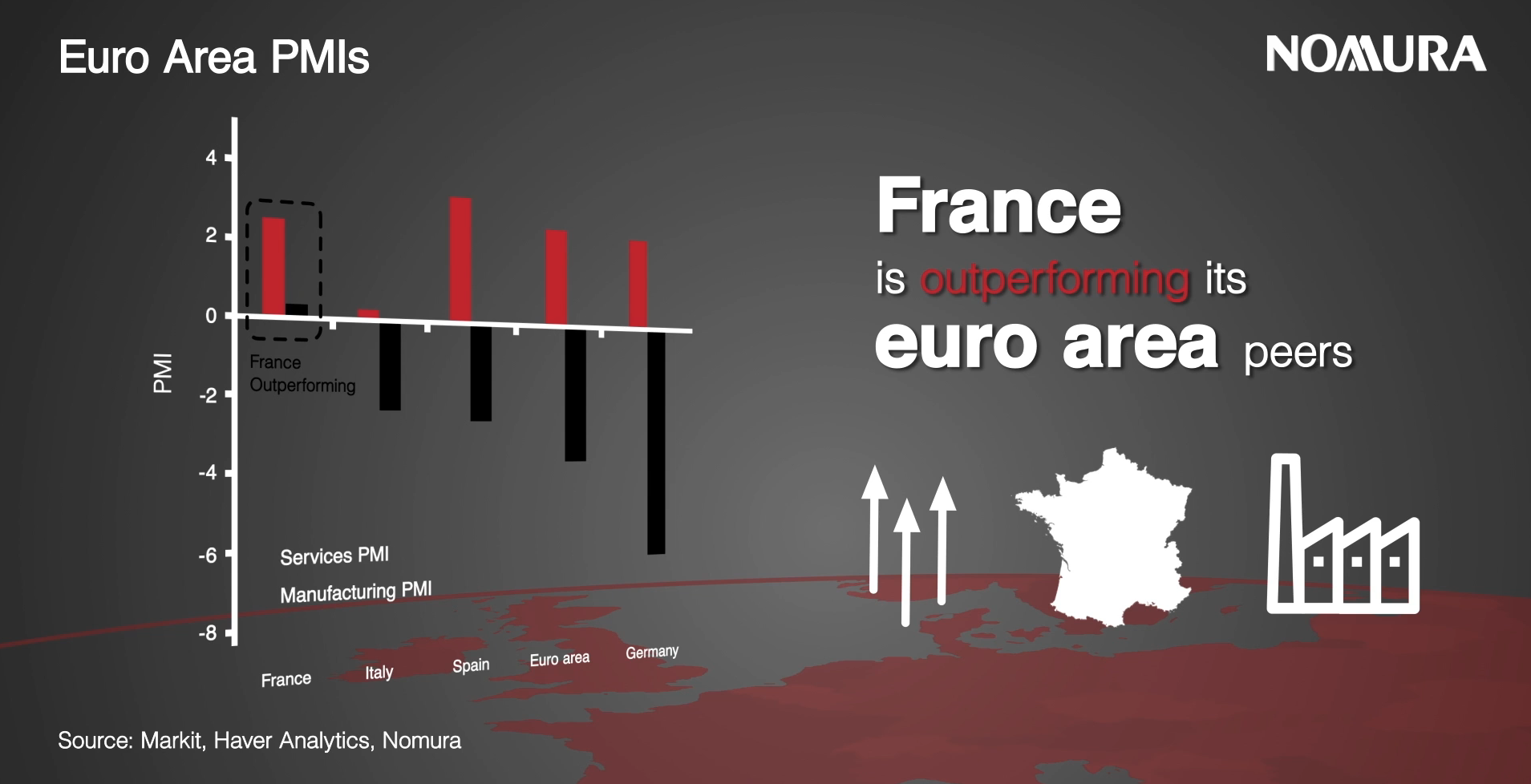

Looking more in detail at the euro area big four, we think that France will be the main out-performer of 2020. In Germany a manufacturing recession still continues, and while we still think there will be a recovery it will be slow. In Italy we don't expect elections going into 2020, with a fairly stable political outlook. Finally in Spain we think that their catch -up is potentially coming to an end.

For a more in-depth analysis of our 2020 forecast, read our full outlook here.

European Economist

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.

Central Banks | 2 min read January 2020

Central Banks | 1 min read January 2020

Central Banks | 2 min video January 2020