Volatility | 18 min podcast September 2020

Economics | 4 min read | September 2020

Economics | 4 min read | September 2020

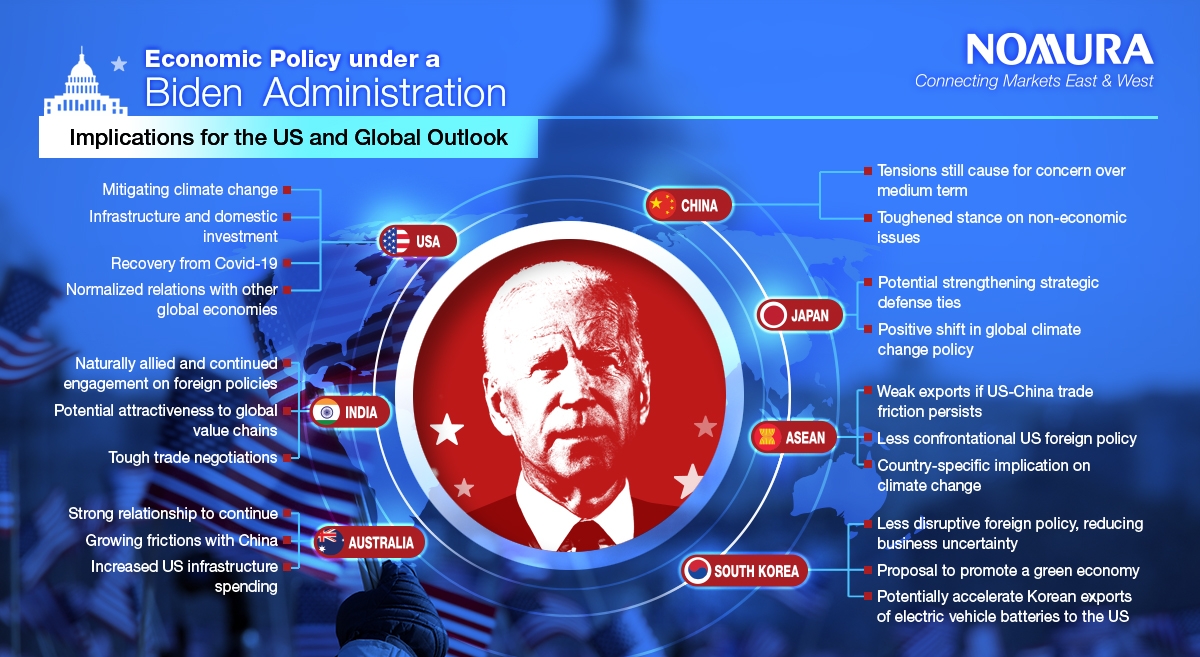

With the recent US elections, we are yet to know the full extent of the outcome under the new administration under President-elect, Joe Biden. This note looks at the economic policy under his presidency.

Biden’s proposals for economic policy seem to be designed to promote two distinct objectives: recovery from the Covid-19 economic contraction and transforming the economy to generate more desirable outcomes. As the pandemic continues to be a significant threat to both the global and domestic economy, the public health response should be an economic priority. Extending current fiscal support – including enhanced unemployment benefits, support to small businesses, state and local governments, schools, etc. – will require immediate attention in the earliest days of the administration.

A large infrastructure bill with an emphasis on climate change is likely to be the first major legislative economic initiative, after ensuring that basic fiscal support – such as unemployment insurance – is extended.

Other priorities that Biden is likely to pursue, in the infrastructure bill or through other means, include: a higher minimum wage, greater access to healthcare, paid sick leave and childcare, strengthening unions, increasing the tax burden on corporations and high income individuals, promoting competition, particularly for technology companies, and strengthening education and immigration programs.

In addition, US relations with the rest of the world are likely to improve and normalize to a significant degree, with being more mindful of allies and respectful of the processes of international relations. However, regardless of the election results, US-China friction is still cause for concern over the medium term, although Biden is may be more likely to resort to sanctions as opposed to tariffs when advancing his agenda.

With India, the US has historically been natural allies due to shared democratic values. Despite far and few trade frictions, there has been continued engagement on foreign policy. India is a member of the Quad alliance (along with US, Japan and Australia) and acts as an important counter-balance to China’s influence over the region. Under a Biden administration, we expect the relationship to prosper.

In ASEAN, it is not clear whether a Biden presidency would be positive to the region’s economic prospects. A less confrontational US foreign policy would definitely be a welcomed relief for ASEAN countries. However, if US-China tensions persist, and the higher tariffs imposed on Chinese imports are unlikely to be rolled back, then regional growth prospects may continue to be weighed on by weak exports and remaining protectionist policies.

With regards to Japan, we are not yet clear whether the US-Japan relationship on various fronts will return to “normal.” Biden and the Democrats made clear their plan to revert the retaliatory tariffs that the Trump administration imposed, but there has been no indication of whether they would return the US to a multilateral free trade regime under a Biden presidency. We could also see a major shift in global climate change policy which in effect will attract greater attention in Japan too with more focus on the green-themed government policy, corporate activities and innovation from H2 2020 through 2021.

Under Biden, South Korea would face a completely different situation to its current one. On the bright side, we would first expect less disruptive foreign policy, which should reduce business uncertainty. This, combined with Biden’s proposal to promote a green economy, should aid the recovery in global capital spending. We see this benefitting Korea’s economy in two ways. First, green initiatives should enable Korea’s companies to implement more aggressively new growth strategies that will accelerate the ongoing industrial restructurings in the domestic economy. Secondly, the US return to the Paris climate accord will likely expand markets for green economy.

On geopolitics, Australia has a strong multi-decade relationship with the US, spanning several governments on both sides. We would expect this strong working relationship to continue following a Biden win. We expect Australia-China tensions to continue, given a) our expectations that US-China tensions will continue, with somewhat different focus; b) Australia’s continuing close defense ties with the US; and c) the continuing economic rise of China, to name a few.

Moving west towards Europe, we are likely to see positive impact as a result of a likely larger US fiscal stimulus (which will have spillover effects for Europe), improved diplomatic relations and a lower risk of tariffs imposed on auto imports from the EU to the US. However, there are questions surrounding the ease with which a UK-US trade deal might be agreed under a Biden administration.

For a deep dive into each economy’s outlook under a Biden presidency, read our full report here.

Chief US Economist

Chief UK & Euro Area Economist

Chief China Economist

Chief Japan Economist

Week Ahead Podcast Host and Chief ASEAN Economist

Week Ahead Podcast Host & Australia Economist

Chief Economist, India and Asia ex-Japan

Global Head of FX Strategy

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.

Volatility | 18 min podcast September 2020

Economics | 32 min podcast September 2020

Economics | 28 min podcast June 2020