Economics | 2 min read August 2018

Central Banks | 3 min read | September 2018

Central Banks | 3 min read | September 2018

History does not repeat itself, but it rhymes

Despite the lessons learned from past crises, currency crises still occur from time to time and spread contagiously when they happen. After receiving substantial capital inflows, some EM economies are under pressure this year, as investors re-assess the risks from developed markets monetary policy normalisation, trade protectionism, China’s economic slowdown and country-specific factors.

As investors gauge the contagion risks from the Argentina and Turkey selloff, one question needs to be answered: which other countries are heading towards an exchange rate crisis?

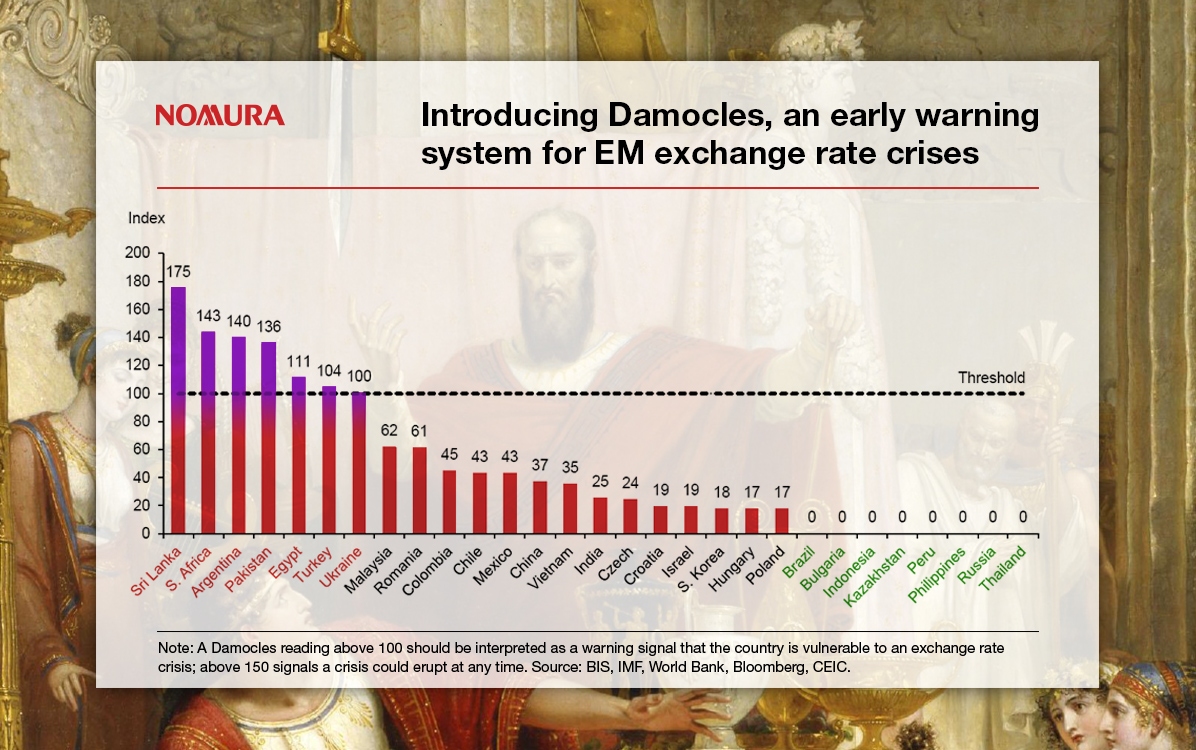

To address this question comprehensively, our Global Markets Research team introduced “Damocles”, an early warning system that assesses an economy’s vulnerability to a currency crisis. The Damocles index is composed of eight indicators that we have found to be the best predictors of exchange rate crises in our 30-country sample. It includes five single indicators: import cover, short-term external debt/exports, FX reserves/short-term external debt, broad money/FX reserves and real short-term interest rates, and three joint indicators: non-FDI gross inflows (1-year and 3-year), fiscal and current accounts, and current account and real effective exchange rate deviation.

Interpreting Damocles

The Damocles index is constructed such that a score above 100 suggests a country is vulnerable to an exchange rate crisis in the next 12 months. The advantage of Damocles lies in its objective nature in letting the data speak, but it would be foolish to make any exaggerated claims. Damocles used in a broader assessment of the global economic, political and local landscape, can help better assess EM risk.

In Nomura’s 30-country sample, Sri Lanka, South Africa, Argentina, Pakistan, Egypt, Turkey and Ukraine each have a Damocles score above 100, which indicates they are at risk of an exchange rate crisis in the next 12 months. Of these seven countries, on our definition, Argentina and Turkey are experiencing currency crises, while Argentina, Egypt, Sri Lanka and Ukraine have turned to the IMF for assistance, leaving Pakistan and South Africa as the standouts.

On the other hand, Brazil, Bulgaria, Indonesia, Kazakhstan, Peru, Philippines, Russia and Thailand have Damocles scores of zero. Thus, a key message from our report is not to lump all EMs together in a single homogeneous group; this is where Damocles’ advantage of letting the data speak presents itself.

Interestingly, a simple average of the Damocles score for the three EM regions – Asia ex-Japan, LatAm and EEMEA – shows that the risk of broad-based currency crises for all three regions is much lower today than it was in 1997-98. However, the regional averages mask individual vulnerabilities as a large number of countries currently have very low Damocles scores. The vulnerability count has risen in recent years to a level similar to that in 2008-09.

Tested and proven: The accuracy of Damocles

In back-testing, Damocles correctly signaled up to 12 months in advance, 67% of the past 54 EM exchange rate crises in Nomura’s sample, including the Asian financial crisis (1997-98), Russian financial crisis (1998) and the 2018 EM currency crises in Argentina and Turkey. However, our analysis confirms that Damocles needs to be supplemented by a judicious reading of political and other non-economic factors to assess a country’s ultimate vulnerability.

Please read the report here for more insights on how best to interpret the Damocles results for the 30 individual countries highlighted in the infographic.

Head of Global Macro Research

Macroeconomic Research Analyst, Asia ex-Japan

Chief Economist, India and Asia ex-Japan

Economics Analyst, Asia

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.

Economics | 2 min read August 2018

Economics | 3 min read June 2018