Economics | 4 min read December 2020

Emerging Markets | 2 min read | January 2021

Emerging Markets | 2 min read | January 2021

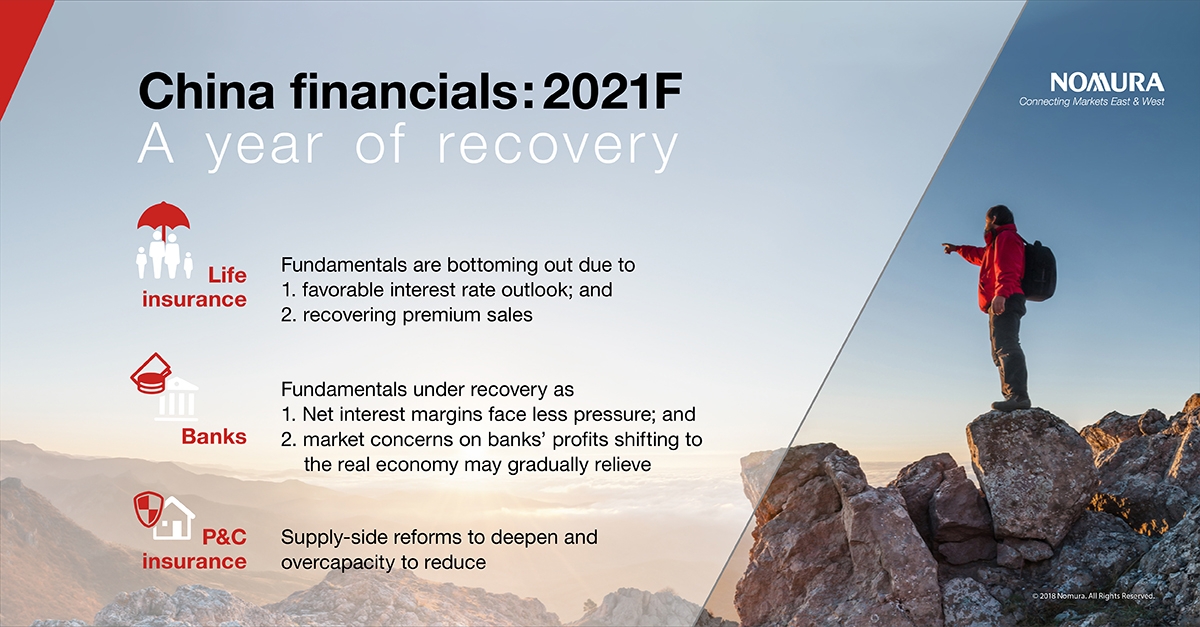

We believe China financial stocks deserve a re-rating to ride the ongoing economic recovery going into FY21F. Under potential strong economic recovery with less stimulus and policy easing, we prefer life insurers and banks, as they appear poised to enjoy the tailwinds of rising market interest rates.

Life insurers’ fundamentals are bottoming out, driven by a favorable interest rate outlook and recovering premium sales. Market concerns on negative spread risks should fade away accompanied by rising interest rates on the back of strong economic recovery, thus providing a solid reason to expect an improving operating environment for Chinese life insurers in 2021F, in our view. We also expect a strong rebound in open year sales in 2021F, given a low base effect and the recent shift in business focus away from the FY20 target. However, the pace of first year premium growth recovery, particularly for protection and long-term saving products sold by offline agents, still depends on the progress of Covid-19 control and the vaccine.

We expect banks’ fundamentals to be under recovery in 2021, because net interest margins will face less pressure than we earlier expected and the decline in 2021F will narrow, driven by an improved new loan structure and recovered returns on interest-earning assets due to stabilized market interest rates. Another reason for this recovery is market concern on banks’ profits shifting to the real economy may gradually relieve, as the special regulatory guidance for Covid-19 will phase out gradually on the back of the strong economic recovery. Additionally, we expect loan growth to slow due to less stimulus and policy-easing going forward, for our covered banks.

Net profit is expected to rebound from 2021F. However, we understand that, considering the exits of stimulus policies, NPL ratios and asset default risks may continue to rise and will add uncertainties to banks’ financial results, with banks consequently lagging behind the economic recovery.

On the other hand, life insurers’ fundamentals are bottoming out, driven by rising market interest rates and recovering premium sales. We anticipate the operating environment for Chinese life insurers will continue to improve in 2021F.

Slowing outstanding aggregate financing growth on the back of the exits of stimulus policies. As per our economics team’s view, 2021F appears set to be a year of policy normalization, unless China is hit by a serious second wave of Covid-19. The withdrawal of policy stimulus is expected to be gradual and moderate, with only a modest slowdown in credit growth.

For more insight on China’s overall financials outlook for 2021, read our full report.

Head of Hong Kong and China Insurance and Non-Bank Financials Research

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.

Jump to all insights on Emerging Markets

Economics | 4 min read December 2020

Central Banks | 6 min read December 2020

Central Banks | 17 min video December 2020