-

In 2024, renewables are at grid parity in many countries

-

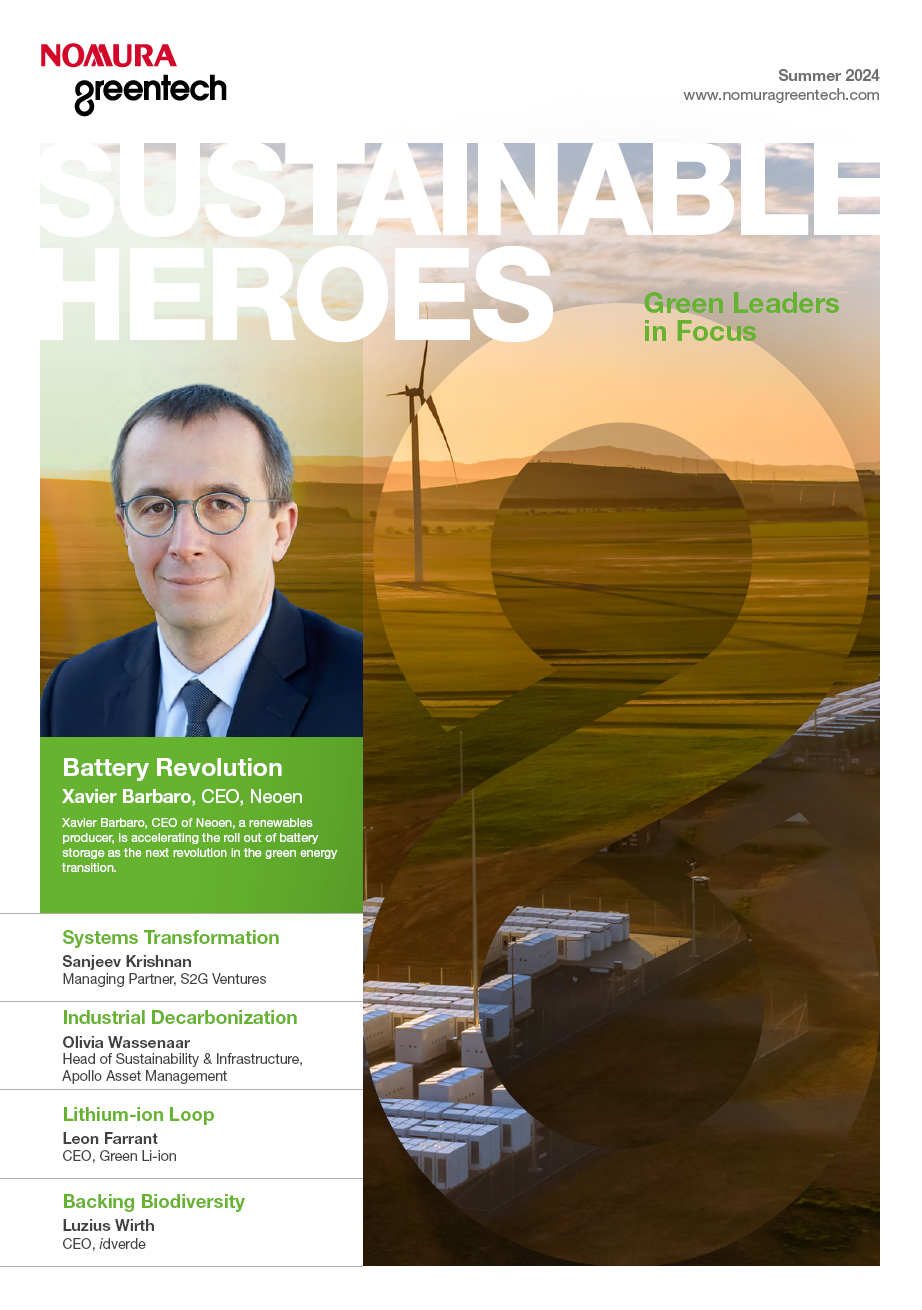

Batteries are the next big challenge, or rather the next great revolution

-

Neoen's ambition is to get to 20GW of blended storage and power generation from solar and wind by 2030, with two thirds coming from renewables and a third from storage

What first triggered your interest in sustainability and why did you establish Neoen?

In 2006, I was working for the Louis Dreyfus Company in the agricultural commodities branch, which is the main activity of the group, and I wanted to do something more entrepreneurial.

I had a taste for the energy industry as it was at the centre of major liberalisation. The predominantly large companies that owned the grids, the power generation assets and that had the clients, felt the power of competition as suddenly the industry opened up to independent players.

Transition could only happen quickly and efficiently if it was undertaken by reliable, responsible entrepreneurs with a long-term outlook. That’s how Neoen came about. First, within Direct Energie, and then, in 2008, as its sister company, with the support of shareholders Robert Louis-Dreyfus and Jacques Veyrat.

The name Neoen itself has a Latin root ‘neo’ for new and ‘en’ for energy. It can be read both ways, it goes back and forth, which represents the ability to renew.

It was a gutsy move. I have lost count of the number of times I heard people saying the market was saturated and that we were wasting our time and our shareholders’ money. We weren’t arrogant, but we ignored the naysayers. And 15 years later, here we are among the market leaders.

Given the rapid rollout of renewables over the past two decades, are you reassured that we can defeat climate change?

We’re delighted to see the worldwide surge in demand for solar, wind power and storage. Renewables are playing a crucial role in the energy transition, because they address all three aspects of the current crisis: climate, economy and strategy.

But the road is long and the challenge great. It would be a serious mistake just to sustain the current pace. We should put in even more effort, even faster. In 2024, renewables are at grid parity in many countries. Funds are available, new techniques have been tried and tested, innovation is ongoing and, in some regions, we can already see the results.

Neoen is active in solar, wind, and storage. What are your biggest challenges?

We are present in fifteen countries, each with its own challenges. In some places, permits are difficult to obtain, either because the rules are unclear or change constantly, or because of the time it takes (in France for example). We are talking about big infrastructure so there is often a bottleneck.

Sometimes, there is a shortage of land, so we have to be inventive — Agri solar is a great way to share land.

In other countries, it can be difficult to connect to the grid as it was not designed to cope with such requirements. Grid congestion can also delay the process. Fortunately, batteries can solve that problem, but market regulations do not always account for new technological solutions such as batteries. That means it’s up to us to prove their worth!

In more advanced markets, we are seeing negative prices at midday, when there is a surplus of solar power. So, we need to bring more sophisticated responses to further enhance the relevance of solar energy.

You have a goal to reach 10 GW of solar by 2025. How will you get there and what’s your fastest growing region?

In fact, we can say we’re already there. We have over 8 GW in operation or under construction (the equivalent of nine nuclear reactors), and we have already secured projects that will take us to the 10 GW mark in the next 18 months. We can be proud that Neoen is among the largest independent renewables producers in the world.

We plan on playing to our strengths: first Australia, our fastest growing region, where we are number one in renewables. But our growth is balanced, it will also stem from development in several geographies: Europe will make a strong contribution, especially in our home market of France, as well as the Nordics, and Italy, where we have just broken ground on our first projects. Germany is also very exciting, for storage. In the Americas we see particularly high growth potential for Neoen in Canada.

Solar power has come down in price driven by low-cost manufacturing in China creating excess supply. To what extent is this supply glut a problem for the overall development of the market?

The price of solar power has reduced thanks to a superb learning curve and new technologies which have enabled us to lower construction and maintenance costs, while improving production efficiency. On a recent trip to China, I met some of our suppliers and saw some huge, new, highly automated factories. China has attained the sort of manufacturing excellence that enables low-cost, yet very high-quality production.

Chinese industry was designed to supply the world with photovoltaic panels and competition within China has created excess supply. When the US market banned Chinese panels, the glut increased.

But I see it as an opportunity and a catalyst. Cheaper panels mean cheaper electrons, and therefore more and more demand for solar power. Our industry has already been subject to ups and downs due to supply/demand imbalance so it’s in our interest that manufacturers adopt regular production that corresponds to demand.

You are constructing the largest battery in the Nordics. With renewables so prevalent, is storage the next big challenge for clean power?

First of all, storage means the energy mix can incorporate more renewables, because it performs a vital role in grid management. In some cases, batteries can be installed instead of new transmission lines, thereby lowering the time and capex needed to reduce congestion.

Batteries also help solve the problem of intermittency. They store excess renewable energy and reinject it later, at peak times for example, which prevents negative price situations. The Nordics, the US and other countries suffer from the so-called ‘duck curve’ which means a lot of solar generation at midday and of course a lack of power generation in the evening when everyone needs power. Storage smooths the curve.

Lastly, combined with a portfolio of operating renewable assets and energy management expertise, storage provides corporate clients and grid operators with cutting-edge solutions. As an example, in Australia, we developed and operate the world’s first big battery, and our first 4-hour long duration battery is currently being built.

What does wind power need to reach the output and adoption rates of solar?

Wind power is challenging. Wind farms are more complicated to set up than solar because turbines are very visible and attract opposition from residents and local communities. Technically, they are also more difficult than solar, which is straightforward to roll out. Moreover, wind power plants have undergone price hikes (in investment, operations and maintenance expenses) due to a lack of competition among suppliers.

Still, we believe in wind as a key plank of our strategy and it should be a key component of the power mix of any country. Thanks to the new generation of turbines, we can develop projects in regions that are less windy, and at the same time, are less populated as they are far inland, or in forests.

We cannot bet everything on solar. A balanced and diversified energy mix is very important. Governments should focus their attention on permits; I think the rules are too stringent for wind.

In France, it is easier to obtain a permit for a nuclear plant than for windfarms. Of course, execution isn’t so easy for nuclear; it takes one year to build a windfarm versus 20 years to build a nuclear power station.

Do you think the EU Green Deal Industrial Plan has the potential to drive the next leg up in renewables? How does it compare to the US IRA?

We always welcome this sort of initiative, but let’s face it: the EU Green Deal Industrial Plan doesn’t pack the same punch as the IRA. We are not expecting it to drive change. Nevertheless, all the ingredients are already in place to accelerate the implementation of renewables: climate change, proven competitive pricing, increasing demand for electricity, the need for national energy sovereignty in the form of domestic power generation – which is most easily achievable through renewables that can be built quickly - and greater electricity demand from data centers in the context of AI. This is our moment!

The focus should be on building additional connections between countries rather than trying to support an industry that has largely succeeded by itself.

Contributor

Xavier Barbaro

CEO of Neoen

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.