Some countries appear more susceptible to housing boom-bust cycles, and monetary tightening has been much more aggressive in some economies than in others. We account for these factors plus several others in our analysis, which looks at 30 countries between 1985 and 2019. 41 out of the 101 monetary policy tightening cycles ended in hard landings and 60 in soft landings.

Our analysis suggests that developed market (DM) economies are more likely to have hard landings this time, in contrast to the usual pattern of higher investor risk premium built into emerging market (EM) economies, which tend to be more prone to financial crises and hard economic landings.

Moreover, it is highly likely that China will be a significant growth pole for EM this year – particularly for EM Asia – as its reopening, coupled with policy stimulus, may unleash pent-up demand.

We define a hard landing as real GDP growth falling in any one quarter during the three-year period after the peak of the policy tightening cycle by more than two standard deviations from its whole-period average growth. On this criterion, the US economy has a hard landing when real GDP falls by more than 3.3% year-over-year. Otherwise, it is classified as a soft landing.

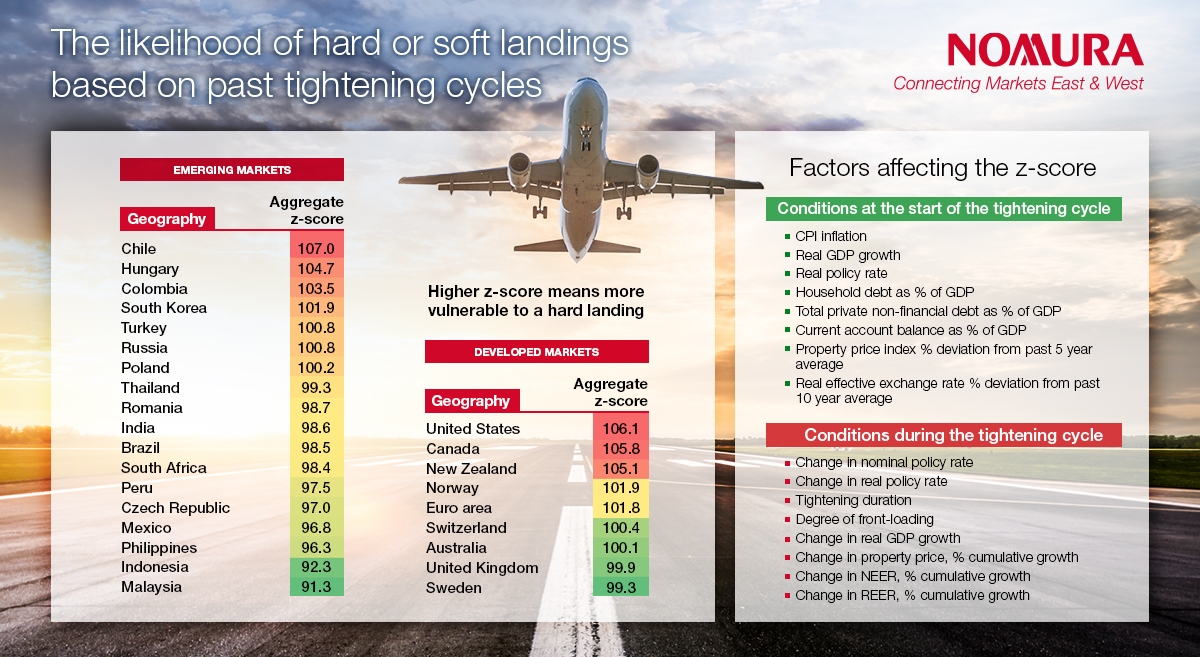

There are sixteen common features at the start and during past tightening cycles that tend to be associated with eventual hard landings. For example, countries with high inflation just before a tightening cycle begins are more likely to have a hard landing. Elevated household debt and property prices in DM at the start of tightening cycles are also common features of hard landings. For EM economies, the common features are large current account deficits and strong real effective exchange rates. Hard landings also tend to feature tightening cycles that are larger, longer and less front-loaded.

Ultra-loose monetary policies before and during the pandemic led to debt-fueled housing price booms in several countries that have only recently started to deflate, as central banks have raised interest rates sharply to tackle inflation. If history is any guide, financial imbalances often unwind quite abruptly, and can be associated with deleveraging and, in the worst case, a nasty balance sheet recession.

Taking the results of our analysis at face value, three DM economies – the US, Canada and New Zealand – and three EM economies – Chile, Hungary and Colombia – are the most vulnerable to a hard landing. Interestingly, Malaysia, Indonesia, the Philippines, Mexico, Czech Republic, Peru, South Africa, Brazil, India and Romania, all EM, are more likely to have soft landings.

Whether an economy has a hard or soft landing should be an important determining factor in how much central banks would later need to cut rates. We plotted our metric of hard economic landing risk against the latest market pricing of the expected (net) change in policy interest rates by the end of this year from current levels. Among DM economies, our results suggest that New Zealand and the euro area stand out as places where the market may be pricing in too many rate hikes. Of the EM economies, the market may be pricing in too many rate hikes in Colombia.

To learn more about the global hard economic landing risk, read our full report.