The term "wild-geese-flying pattern" of economic growth is a literal translation of the Japanese term "ganko keitai", which was coined by economist Kaname Akamatsu to describe the pattern of economic development he empirically observed in Japan. Post-war Japan was the lead goose, which started out by producing low-value products such as garments. Then, as its costs rose, it relocated production in the 1960s to the next flock of geese, the newly industrialising economies (NIEs) of Hong Kong, South Korea, Singapore and Taiwan.

As the NIEs caught up with Japan in the early 1990s, they helped set fly the next flock of geese: the Asean-4 (Malaysia, Thailand, the Philippines and Indonesia) and China. The Asean-4 economies did not fully take off, but China soared.

If seen through Akamatsu's lens, the shift in supply chains from China might be viewed as nothing but a natural progression of economic development, although US-China tensions and the pandemic have clearly accelerated the trend.

Using top-down data, such as foreign direct investment (FDI) flows and export shares, alongside a bottom-up survey of around 130 companies, we observe some interesting patterns.

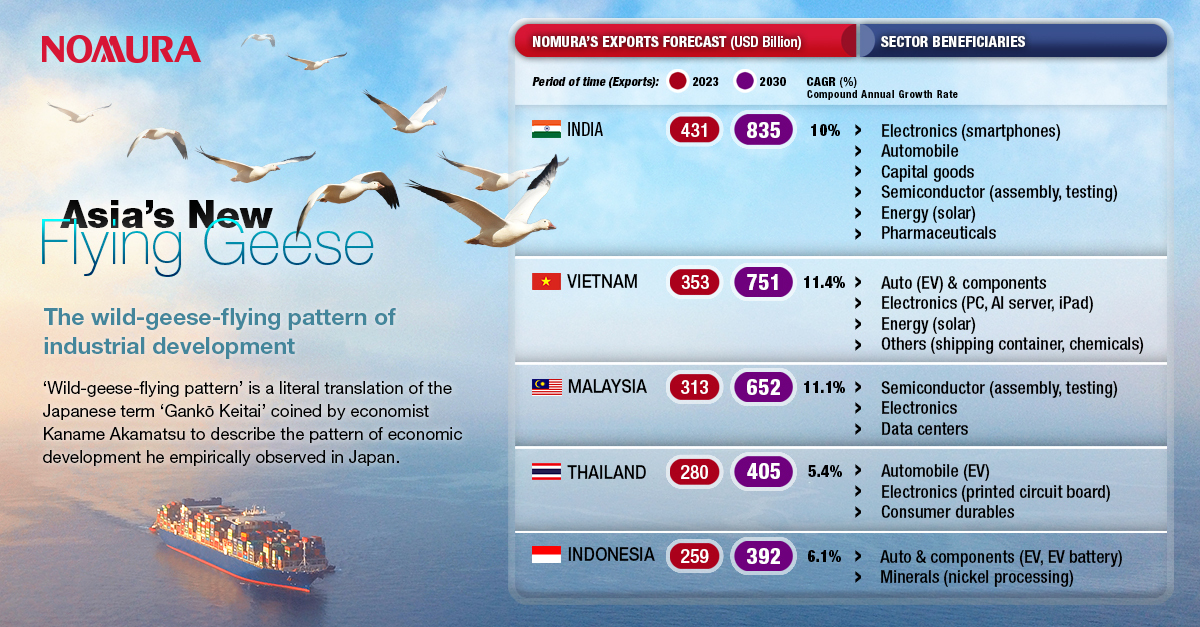

Asia is the main beneficiary of the China-plus-one strategy, led by India, Vietnam and Malaysia, while Mexico is benefiting outside of Asia.

India has received the most interest from firms, partly owing to its large domestic consumer market, with a pipeline of projects across smartphones, automobiles, capital goods and semiconductor assembly and testing.

Vietnam remains a frontrunner in Asean, with most of the investment originating from Chinese companies, in electric vehicles (EVs), personal computers and solar panels.

Malaysia is the biggest beneficiary of semiconductor assembly and testing capacity being set up in Asia, and of electronics and data centres.

Benefits for the rest of Asean appear more mixed. Thailand is experiencing some benefit in EVs, printed circuit boards and consumer durables, but it faces a structural deterioration in competitiveness in other exports. Indonesia's prospects are mainly tied to the development of the EV battery supply chain, while the Philippines has lagged.

Then versus now

We conducted a similar survey five years ago, and the results were slightly different.

First, back in 2019, most production relocation was concentrated in electronics and apparel. Now, it appears to be more broad-based across automobiles, electronics, apparel, capital goods, consumer durables and the semiconductor sector.

Second, the initial supply chain shifts were led by US companies and by reshoring efforts from Taiwanese and Japanese firms. Now, we find that Chinese companies are the lead investors, likely looking to bypass trade tariffs amid geopolitical tensions.

Third, investments by Chinese firms are mostly concentrated in Asean economies, while a majority of the investments into India are from US companies, likely reflecting their geopolitical alignment.

Finally, Mexico is Asia's biggest competitor, as it has attracted large investments from firms looking to cater to US demand. That said, the investment source into Mexico is fairly diversified, suggesting that Chinese companies are using Asean, rather than Mexico, as a route to sidestep tariffs.

China's role within the global value chains is also changing. As a key investor, China is now a lead goose. It is also well-embedded in the reconfigured supply chains, although less as a final assembler and more as a supplier of intermediate goods.

China also presents a unique case study of a country with presence in both low-tech (toys) and high-tech (such as EVs and semiconductors) sectors, and thus is a competitor to developing and advanced nations alike.

Our results also show that weaning off China is likely to be difficult.

Its ability to produce large quantities at the right quality and low prices is a combination no other country has been able to replicate. Therefore, supply-chain shifts will be gradual.

Our new flying geese are taking off against a more hostile global backdrop. There is more protectionism and firms are now looking for diversification, rather than putting all their eggs into one basket.

As the new geese integrate into the global value chains, they will benefit from rising exports and investments over the next few years. However, the process of becoming integrated is still in its infancy; countries also have to move up the value chain over time.

Government policies to develop human capital and promote innovation will determine which economies transition from low-tech to high-tech manufacturing in the coming decades.

For Asia's new flying geese, this is only the beginning.