Central Banks | 1 min video December 2018

Economics | 3 min video | December 2018

Economics | 3 min video | December 2018

Need to add blockIntro

A credit crunch in H1 2019

We expect China’s economic conditions to worsen significantly in the spring of 2019 due to the payback from the front-loading of exports, major property market correction in lower-tier cities, and more defaults and a widening of credit spreads. In addition to China, we forecast three other factors that will increasingly drag in H1 on broader Asia growth: 1) a deepening downturn in the global tech cycle; 2) renewed flare-ups in Sino-US trade/investment frictions; and 3) further tightening of Asia’s financial conditions.

The significant build-up of private debt is Asia’s Achilles’ heel to a sharp growth deceleration in H1 2019 amid simultaneous property market corrections in China, Hong Kong and Korea, and the switch to global quantitative tightening, a recipe for a credit crunch that could be exacerbated by evaporating market liquidity. We expect the current account surplus countries of Greater China, Korea, Singapore, Thailand and Malaysia to be at the center of this third and final wave.

Asia’s time to shine in H2 2019 and 2020

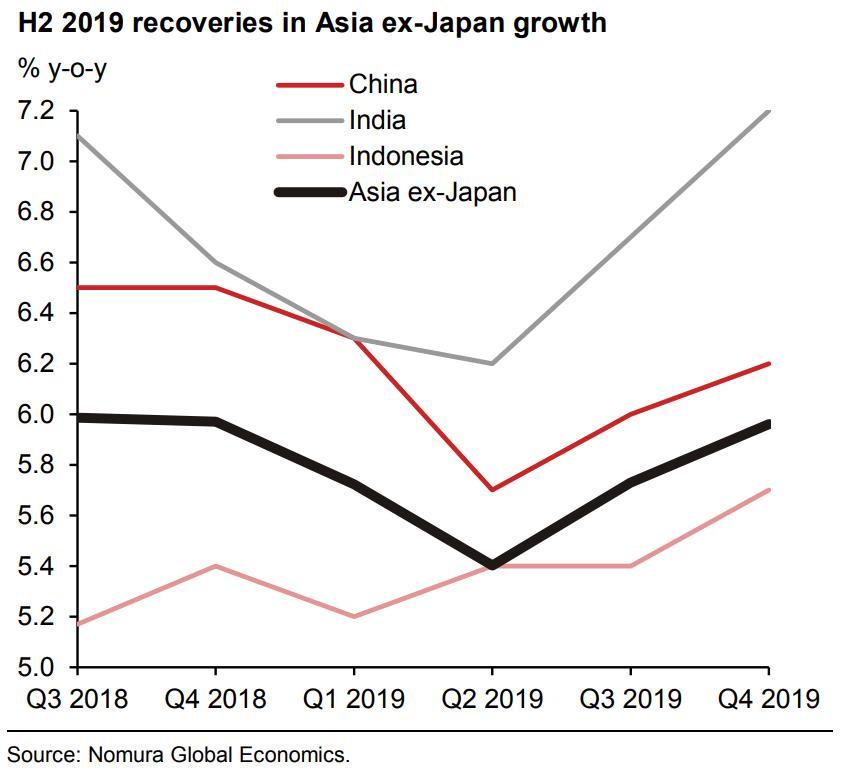

Invariably, economies recover and we expect Asia to do so in H2 2019. One driver will be the double-barreled support from when the Fed pauses and game-changing China’s policy stimulus in Q2. Low oil prices and an upturn in the global tech cycle will also be a strong tailwind for Asia’s terms of trade in Q3.

In H2 and into 2020, we expect a widening of the GDP growth differential, in favor of Asia ex-Japan (AeJ) over slowing advanced economies. Additionally, we see H2 being the defining moment when AeJ starts to be widely appreciated as the undisputed locomotive of the world economy.

Asia strategy into 2019

We believe the performance of Asia FX/local markets over the coming year can be categorized into three episodes. In the first episode, which runs into the start of Q1 2019, we expect a continuance of our base case of slower but stable global growth and low oil prices. Episode two occurs from around February to April and should lead to some differentiation, where Indonesia and India local/FX markets outperform while Northeast Asia and Singapore are challenged by a drop in global growth momentum and concerns over US-China trade tensions in February (if trade talks progress too slowly). During episode three from May until year-end we expect some positive developments – such as a notable pick-up of fiscal stimulus in China – to support China (and markets closely linked to China). Following the expected period of capital outflows and reduced positioning in February-April, we see potential for a significant return of foreign capital inflows.

To read our full Asia Outlook for 2019, click here.

Click here to read our China Outlook for 2019.

Head of Global Macro Research

Senior Economist Korea, Taiwan and Hong Kong

Chief China Economist

Week Ahead Podcast Host and Chief ASEAN Economist

Chief Economist, India and Asia ex-Japan

Global Head of FX Strategy

Asia Rates Strategist

Asia Rates Strategist

Week Ahead Podcast Host & Australia Economist

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.

Central Banks | 1 min video December 2018

Economics | 4 min video December 2018

Economics | 2 min video December 2018