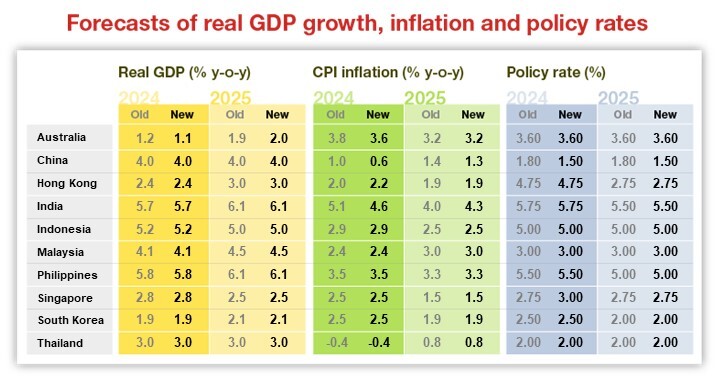

2024 will be the year of policy pivots in Asia, reflecting lower inflation, softer domestic demand and Fed rate cuts, according to Nomura analysis. In 2024-25, we forecast 150 basis points (bp) of rate cuts in Korea and the Philippines, 100bp in India and Indonesia, 50bp in Thailand, 30bp in China and no change in Malaysia. How do these forecasts stack up against the Taylor rule, a rules-based framework that objectively quantifies where policy rates should be?

Using a modified version of the Taylor rule adjusted for historical evidence, such as how central banks have shifted towards a growth-supportive policy stance since the global financial crisis, we plot the divergence between the rules-based estimate and actual policy rates. A greater variance shows increased chances of a future catch-up.

Results

With a few exceptions, our modified Taylor rule (MTR) estimates show that the rate hiking cycle is over in Asia. Policy easing is likely the next step. However, the degree of policy easing, or lack thereof, will differ across economies. Based on MTR, policy rates are currently restrictive in China and Thailand, accommodative in Malaysia, and appropriate in India, Indonesia, the Philippines and Korea. The results suggest there is potential for policy surprises.

Potential for larger-than-expected rate cuts

- China: We forecast two 15bp cuts to the open market operations (OMO) and medium-term lending facility (MLF) rates in March and June, respectively. However, the MTR suggests these cuts would still leave policy rates in restrictive territory given weak fundamentals, negative inflation and a sluggish property sector. Risks appear skewed towards even lower policy rates.

- Thailand: Relative to the current policy rate of 2.5%, the MTR suggests that policy rates are at least 1 percentage point above where they should be. Our base case assumes the central bank will deliver a 25bp rate cut in June and another in August, but risks are skewed towards earlier and deeper cuts.

Potential for less-than-expected rate cuts

- South Korea: The MTR suggests monetary policy easing could be less than what we forecast (100bp of cuts in 2024 and 50bp in 2025 for a 2% terminal rate) due to inflation easing but stabilizing around the 2% target and growth improving over 2024-25. Theoretically, according to MTR, policy rates should stabilize at 2.50%-2.75% by mid-2025.

A long pause (or potential hikes)

- Malaysia: The MTR suggests the overnight policy rate should rise from mid-2024 as fiscal measures are set to raise headline inflation towards 3%. However, we expect the central bank to prioritize growth and focus on core inflation, where limited spillovers should mean unchanged policy rates through end-2025.

Policy easing in-line with Nomura forecasts

- India: The MTR projects an easing cycle that begins in Q3, in line with our forecasts, and predicts a terminal policy rate in this cycle of 5.50%-5.75% by mid-2025. We expect liquidity easing to precede actual rate cuts and see a potential change in the policy stance to neutral in April.

- Indonesia: We expect policy easing from June with 100bp of cuts to 5% by the end of 2024. The MTR also predicts a policy pivot in Q2 with 100-125bp of potential rate cuts.

- Philippines: The central bank has been aggressive in its hiking cycle, resulting in headline inflation returning to its 2%-4% target faster than expected in December 2023. However, we do not expect an immediate pivot. The MTR suggests policy easing should begin in Q3, with 150bp of cumulative cuts to 5.00% by early 2025.

Conclusion

Policy easing in Asia is not immediate, but it is likely within the forecast horizon. In the coming months, we expect early signals such as dissenting votes and changes to policy guidance. Our MTR analysis also confirms that Asian central banks will ease policy rates by less than the Fed in this cycle. For the Fed, we expect rate cuts totaling 100bp in 2024 and 200bp in 2025. Finally, we are monitoring policy divergences with the risk of deeper or delayed cuts in some Asian economies.

For more on our growth projections, read our full report.