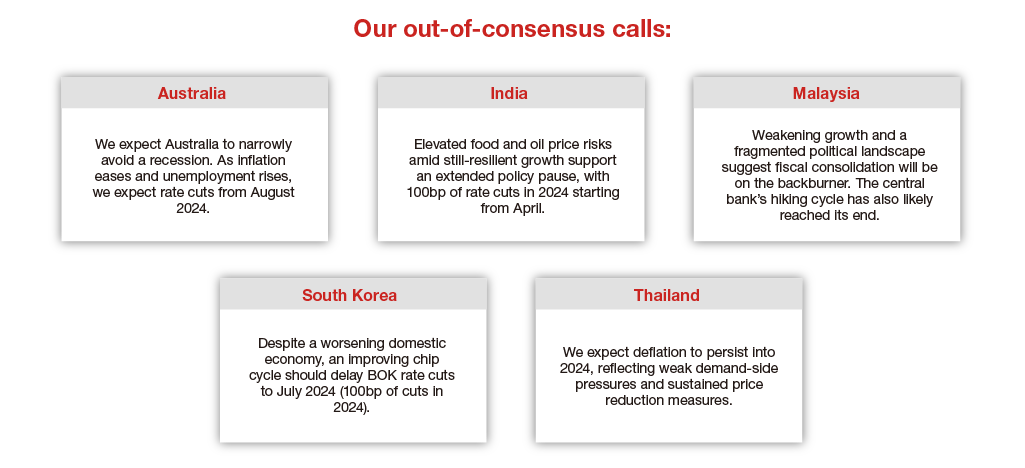

Most Asian economies focus on the year-on-year inflation rate, but a better gauge of the underlying momentum is the 3-month on 3-month seasonally adjusted annualized rate. The measure strips seasonality factors out of inflation. In Asia, it has risen for four consecutive months, led by India, the Philippines and South Korea. The uptick is primarily due to higher food and energy prices.

We expect this metric to continue to climb due to stabilizing commodity prices, depreciation in local currencies and impending adjustments in tax, subsidies and utility prices across a few economies. Looking at this measure, as well as pipeline price pressures, our economists see an increasing possibility of inflation divergence across Asian economies.

Underlying inflation scorecard for Asia

To gauge underlying inflation, economists at Nomura assessed Asia’s economies on a scorecard that looked at, for each economy, the deviations of underlying inflation from its long-term average and the central bank target (or historical average of headline inflation in the absence of a central bank target), as well as the deviation of core inflation momentum (3-month on 3-month saar) from the central bank target. The economies are then divided into three categories: hot, warm and cold.

Hot: Higher underlying inflation, elevated wage growth

- Singapore has the highest underlying inflation in the region. Though the domestic labor market has started to cool, wage growth remains elevated and the economy remains vulnerable to imported food and oil price shocks. The second stage of the GST hike from 8% to 9% will become effective on January 1, 2024, nudging up headline and core inflation further.

- Philippines’ underlying inflation has risen materially over the last three months. It remains vulnerable to higher food prices due to El Niño and food protectionism. Inflation expectations and wages have both begun drifting higher too.

- South Korea’s inflation pressures remain elevated, with rising upside risks to the 2024 inflation outlook. The country stands out in Asia with sticky core inflation momentum higher than the central bank’s 2% target. Disruptions to the agricultural supply chain and higher energy prices are likely to keep headline inflation above 3% over the next six months.

Warm: Around target underlying inflation, contained second round effects

- Malaysia’s underlying inflation remains close to its historical average and wage inflation is slowing. The key upside risks to inflation in 2024 emanate from the supply side: food price inflation due to El Niño, the proposed service tax hike to 8% from 6% and a rationalization of fuel subsidies. However, the timing of these adjustments is unclear. On net, inflation is unlikely to fall from here, but we also do not expect a substantial rise.

- India ranks in the middle of the inflation pack, though it remains vulnerable to supply-side shocks and the broader increase in food prices due to El Niño. Core inflation has moderated towards 4% and inflation expectations are easing.

- Hong Kong’s underlying inflation has risen over the past year. But at ~1.5%, it remains below the historical average. We expect price pressures to remain subdued as it follows the higher-for-longer US monetary policy to support its pegged currency. Property markets could remain under pressure.

Cold: Lower underlying inflation, contained second round effects

- Thailand’s CPI inflation rate dipped into negative territory in October. Its underlying inflation rate is at a low 0.4% and we expect deflation to persist over the next year, as government policies should keep domestic energy prices low. We see potential growth headwinds from a weak manufacturing sector, budget delay, drought and an underwhelming digital wallet scheme.

- Indonesia has the lowest underlying inflation score within Asia. Headline and core inflation are unlikely to fall further, but a substantial rise is also unlikely, due to weak demand-side pressures. Higher food prices and currency depreciation pose upside risks to inflation.

- China has experienced subdued price pressures, though the lack of granular CPI data makes measuring underlying inflation a challenge. CPI flipped back into deflationary territory in October, mainly due to lower food prices. Also, negative services inflation weighed on core inflation, indicating fragile demand conditions. We expect headline deflationary conditions to persist until January and core CPI to remain below 1% year-over-year through 2024.

So far this year, economies in Asia have experienced synchronized disinflation, or a slower rate of inflation. But we expect more divergence ahead, as the risks of inflation generalization differ across economies.

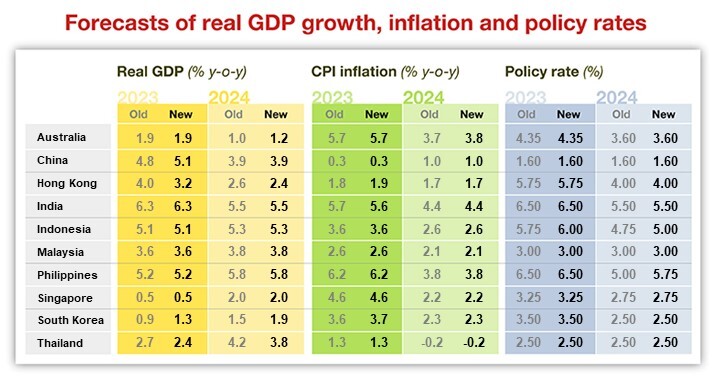

For more on our growth projections, read our full report.