Growth divergences across Asia

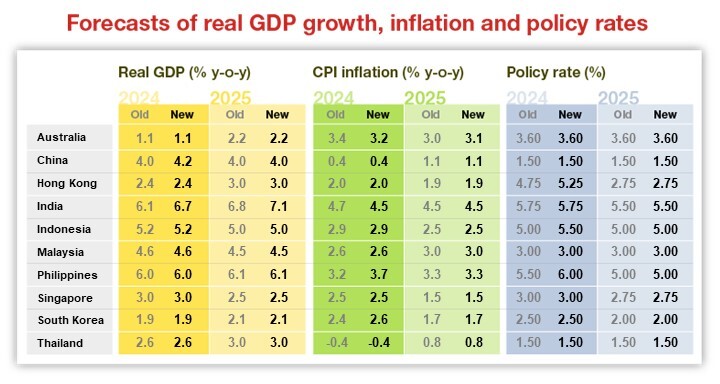

Over the last year, growth expectations have diverged across Asia. According to Consensus Economics, Thailand, Hong Kong and China have had their GDP growth outlooks revised down the most, while India has had one of the largest upgrades. The equity market performances in these economies have similarly diverged, confirming the importance of growth expectations in driving forward returns.

Nomura’s framework for identifying leaders and laggards combines Asia’s cyclical and structural outlooks. The most important factor underpinning our positive cyclical view is the turn in the goods cycle, which we see as transitioning from a recovery to an expansionary phase. This is mainly led by semiconductors, due to rising demand for artificial intelligence and the end of the inventory correction phase. As such, the benefits should percolate largely to the open, tech-oriented economies in the region. From a structural perspective, some Asian economies are also experiencing shifts in investment and productivity, which may affect potential growth in parts of the region.

Presenting the leaders and the laggards

Leaders of the pack

- India. The boom in India appears more structural. GDP growth has repeatedly come in above expectations over the last year and remains resilient. Public capex may slow around the elections, though higher infrastructure spending and relocation of supply chains are medium-term growth tailwinds. A policy focus on growth may result in a pick-up in private capex.

- Singapore. Our 2024 GDP growth forecast of 3.0% is well above the consensus estimate of 2.3%. The tech rebound will lift manufacturing output and eventually feed into services. The labor market also remains resilient.

- Philippines. Cumulatively over 2024-2025, we expect GDP growth to beat consensus by 0.6 percentage points. Both private consumption and investment have remained resilient to past rate hikes. Public investment growth is also likely to rise ahead of the 2025 mid-term elections.

Growth laggards

- China. Despite positive growth surprises in Q1, we see 4% as the new normal in China, below the consensus forecast of 4.5-5.0%. Property developers’ contract sales continue to drop, geopolitical challenges remain as the US presidential election nears, and Beijing’s efforts to curb debt accumulation in heavily indebted regions risk another fiscal cliff – a critical imbalance in the government’s revenues versus obligations.

- Thailand. The economy faces both cyclical and structural headwinds. Our 2024-25 growth forecasts are below consensus, given the budget delay, drought, restrictive monetary policy and a delayed implementation and limited multiplier effects from the Digital Wallet policy, which is the government’s proposed cash handout program announced late last year. More fundamentally, an ageing population, high household debt and loss of export competitiveness in electronics and autos are bigger concerns.

Watch out for monetary policy surprises

Given the divergence in growth and inflation outlooks

in the region, we also see scope for policy divergence

within Asia.

Dovish surprise

- Thailand’s growth concerns are materializing amid expectations that inflation will fall short of the central bank’s target. Moreover, Thailand has one of the highest real policy rates in the region. We expect the central bank to cut rates ahead of the Fed, and cumulatively reduce the policy rate by 50 basis points this year.

- China’s growth and inflation undershoot calls for more policy easing: we expect two rounds of rate cuts in Q2 and Q4, with 15 basis points each to both the open market operations and medium-term lending facility rates.

Hawkish surprise

- Our base case for Malaysia is unchanged rates, but risks are skewed towards a hike. We expect inflation to gradually rise due to the government’s subsidy rationalization and revenue-raising measures. Real policy rates also remain low compared to historical averages.

- The growth-core inflation outlook for Singapore suggests risks are skewed in a hawkish direction. Nomura’s FX strategists expect the country’s central bank to leave its FX policy unchanged and throughout 2024, though they assign a 20% probability to policy tightening.

Less dovish than expected

- India’s slower growth in 2024 is partly because of last year’s high base, but headline inflation above 4% suggests less easing than we currently expect in our baseline scenario.

- Higher growth and above-target inflation by year-end suggest that while easing is the likely next step, we can anticipate fewer or later rate cuts in Korea, Indonesia and the Philippines.

For more on our growth projections, read our full report.