It has been seven months since the US imposed a new wave of tariffs, initially targeting China and later broadening to a wide set of Asian economies. The debate has since centered around a critical question: who ultimately bears the burden of these tariffs? Are Asian exporters absorbing the costs through compressed profit margins, or are they passing the burden on to US retailers and consumers?

Cross-country divergence

Nomura economists estimate tariff cost absorption as the ratio of the change in US import price or Asia’s export price (adjusted for FX pass-through) as a proportion of the change in Asia’s effective tariff rate during the same period. We found that global exporters are bearing roughly one quarter of the tariff burden, with the remainder being passed on to US importers and ultimately consumers. In aggregate, Pacific Rim countries have absorbed about 18.5% of the US tariff cost into their profit margins.

In Asia, there are three distinct tiers of tariff absorption. We see high absorption (>20%) in Asian newly industrialized countries (NICs) such as Singapore, which are characterized by advanced manufacturing and high-value exports, with greater capacity to absorb costs. There is low absorption (<10%) in China, Japan and South Korea, which suggests costs are largely being passed on to customers. It is worth noting that China's relatively low absorption rate implies limited margin flexibility for firms, after experiencing years of disinflation. On the other hand, ASEAN's zero tariff absorption rate indicates complete pass-through of tariff costs, due to a lack of margin flexibility in labor-intensive exports.

Sectoral divergence and competitive dynamics

Sectoral trends also reveal divergences. US import prices/Asia’s export prices have declined in sectors such as autos in Japan and Korea, semiconductor and electronics in NICs, and aluminum articles and fabricated metals in China. Meanwhile, prices have increased in sectors like textiles in ASEAN, pharmaceuticals in Singapore, and motor vehicle parts in Korea and Japan, among others.

Competition within sectors has intensified across countries. For instance, textile prices have fallen in China but risen in ASEAN, boosting China’s competitiveness in the sector. Korean chemical exporters have slashed prices far more aggressively than rivals, which could help them gain market share in the US albeit at the cost of diminished profitability. In electronics, Japan and China lowered prices while Korea raised them, creating sharp divergences, even within the same product categories. These patterns reflect not only sector-specific demand elasticity but also differing corporate strategies in balancing market share retention and margin preservation.

The double whammy: Tariffs and FX appreciation

The appreciation of Asian currencies against the US dollar reduces export revenues, while export price cuts to remain competitive further squeeze margins, creating a double whammy for Asian exporters. The impact on Japan, Korea, Singapore and Thailand has been substantial, while China’s margin hit appears smaller, driven mainly by price cuts rather than currency effects. The impact on ASEAN exporters appears largely neutral, as export price increases seem to have offset local currency appreciation.

Asian exporters left with a difficult choice

With reciprocal tariffs having risen from 10% in July to 15-20% in August, further margin compression is likely in the months ahead. Temporary measures such as cost cutting and running down inventories to delay a price increase in the US will not be sustainable in the long run. This is consistent with what we have observed in Q2 corporate earnings, where firms warned of further margin hits as cost-saving measures reach their limits.

Higher US tariffs have left Asian exporters with a difficult choice: either pass on the rising costs and put US market share at risk, or absorb the costs and take the hit in profitability. This has been aggravated by local currency appreciation and competitive price pressures. Economies with higher-value, brand-driven exports tend to hold prices steady for longer, sacrificing margins, whereas low-margin exporters make a quicker move to pass on costs, risking competitiveness.

If Asia’s profit margin squeeze worsens, we may see spillovers into the real economy. Exporters facing sustained margin pressure may cut back on capex, slow hiring or limit wage growth in export-dependent economies, which raises the risk of a negative feedback loop between trade shocks and domestic demand. This would require Asian policymakers to respond through targeted subsidies, tax relief or even currency intervention, if competitiveness erodes further.

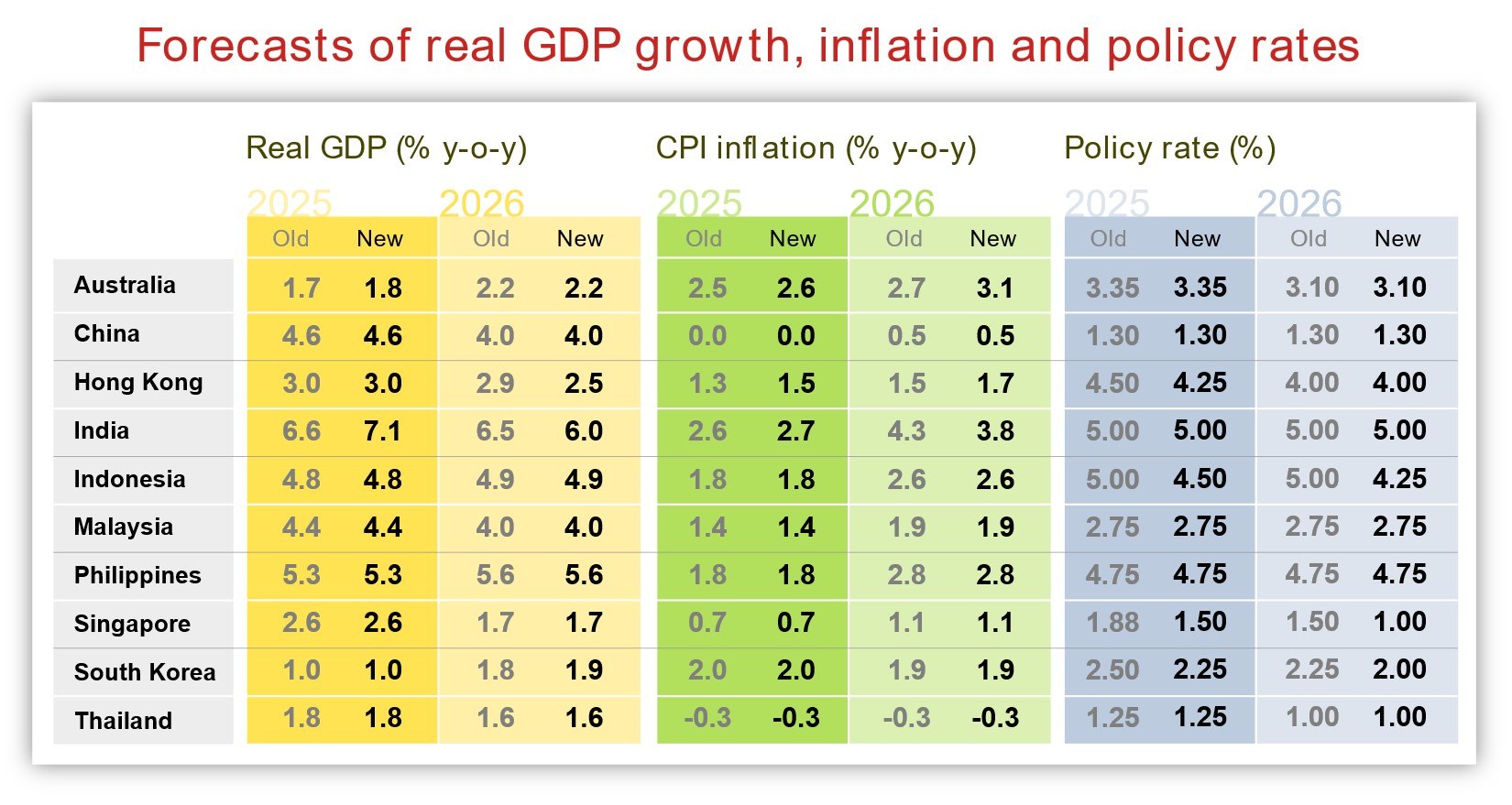

For more on our regional projections, read our full report.