Emerging Markets | 3 min read November 2018

Emerging Markets | 2 min read | February 2019

Emerging Markets | 2 min read | February 2019

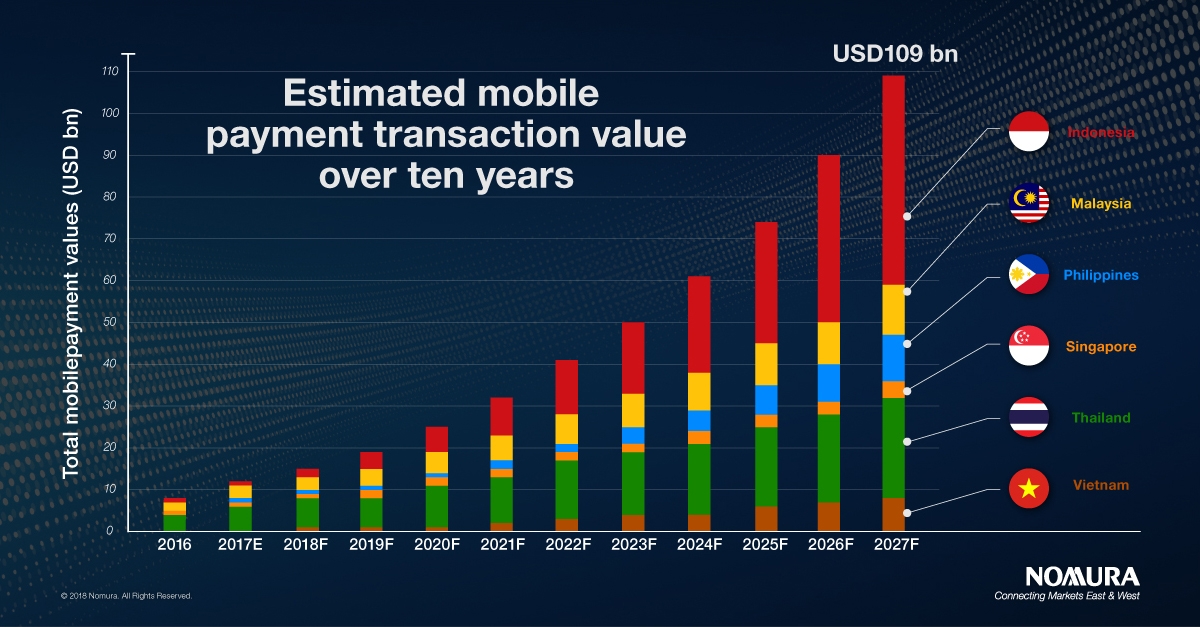

After countries like China and India, where resident rely on mobile wallets in their day-to-day lives, ASEAN is slowly catching up. Cash remains the dominant transaction mechanism in most of Southeast Asia, with 70% of consumer payments still conducted through a physical exchange. However, with smartphone and mobile purchasing penetration in ASEAN already at 46% and 25%, respectively, payment transactions via mobile phone(s) are likely to increase. Additionally, gross transaction value of mobile payment is expected to rise to USD109bn over FY17-27F, implying a 25% increase over ten years.

Although we expect the adoption of mobile wallets/payments to accelerate in ASEAN, the difference in adoption rates between the ASEAN and China remains stark. However, we believe this is likely to change in the next ten years. It is estimated that current mobile payment penetration in ASEAN is only about 7%, and this is expected to increase to about 27%, or 167mn users, by 2027F. Similarly, as incomes grow, the average mobile payment value per capita could increase from USD282 to USD649 over this timeframe.

Why now?

Part of the reason for ASEAN’s delay in adopting mobile wallets to date is the lack of acceptance, low banked and credit card penetration, and high regulatory barriers in most markets. However, there are multiple reasons why the operating environment is improving:

Regional leaders best positioned

We use a five-factor model to rank 38 different wallets in the region. Our proprietary analysis of 38 mobile wallets in the region is based on an assessment of five factors that we think are critical for success in the industry

Using this matrix, GoPay (Go-Jek), True Money (True/CP Group) and GrabPay (Grab) are best positioned in the region. Commonalities among these companies include a regional presence, strong investor backing and a large number of already developed use cases.

For more insight on ASEAN’s development of e-wallets, click here.

Internet and media sectors, China

Head of Internet Research, China

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.

Emerging Markets | 3 min read November 2018

Technology | 4 min read January 2019

Economics | 3 min video December 2018