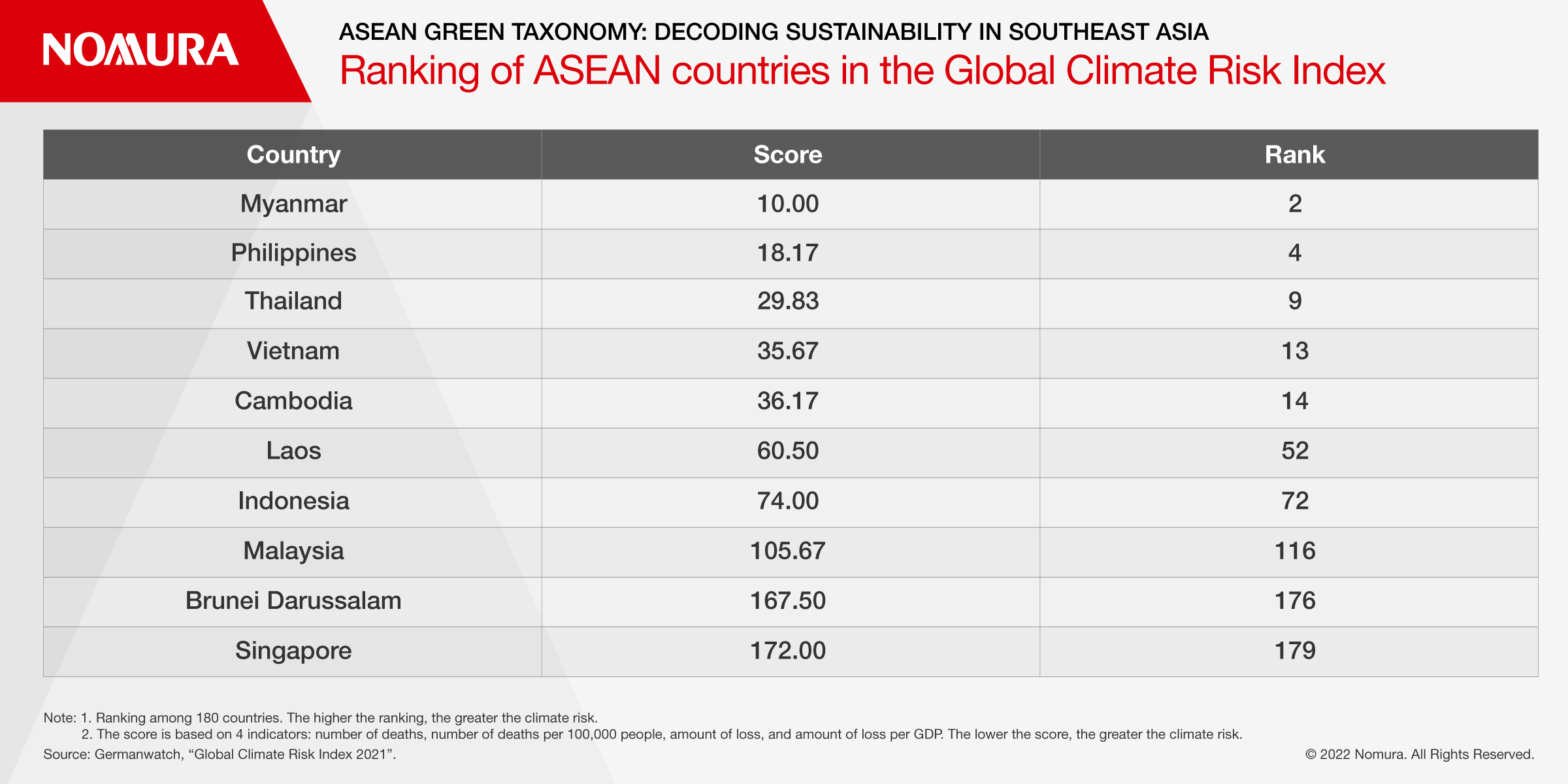

As Southeast Asia grapples with a myriad of major environmental issues, including typhoons and floods, the need for and willingness to support green finance initiatives is growing. Worries that natural disasters such as coastal erosion due to rising sea levels and the impact of drought on agriculture could worsen as climate change progresses have made the adoption of sustainable finance in the high-risk region imperative.

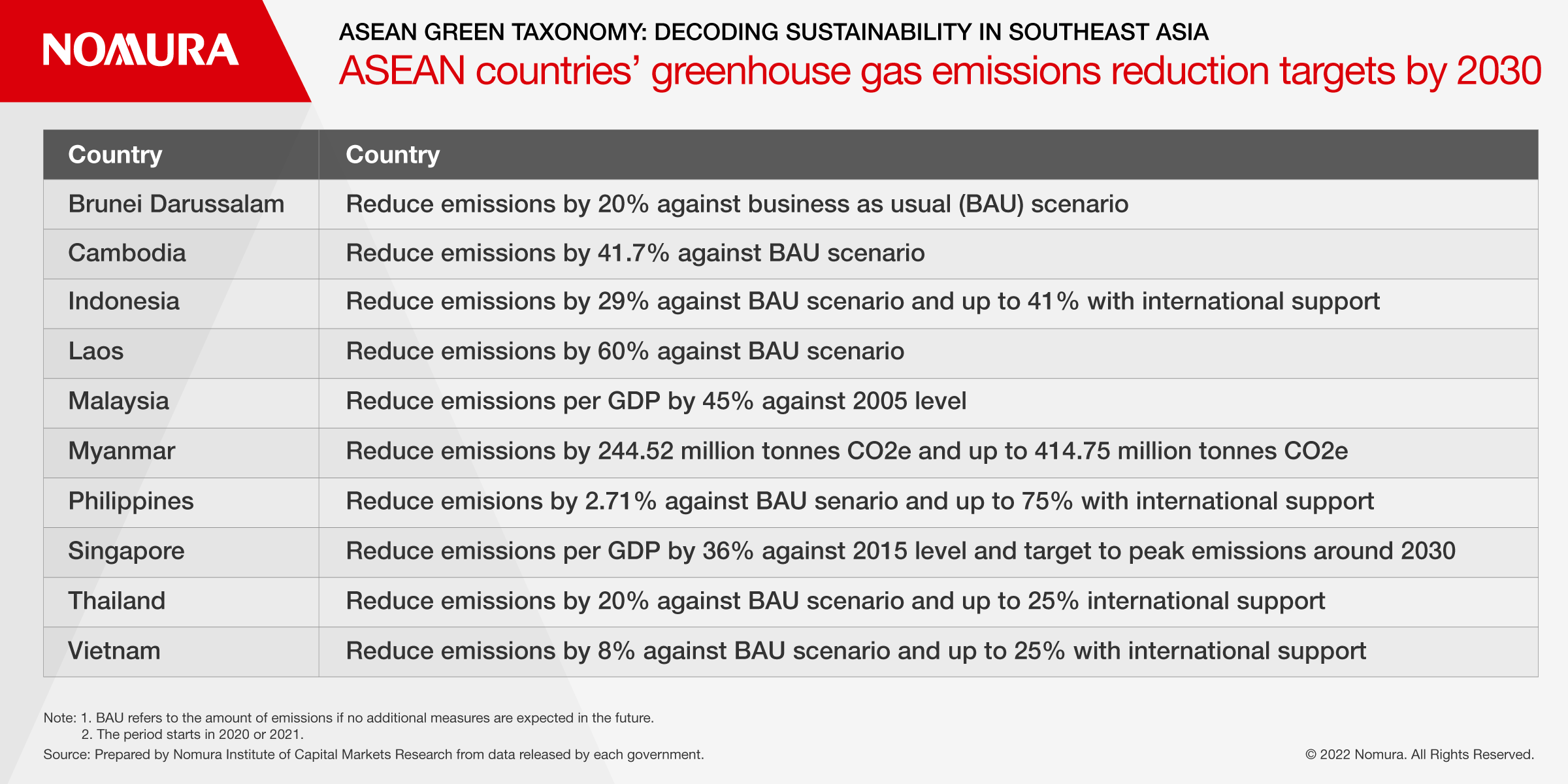

To be sure, Association of Southeast Asian Nations (ASEAN) member states have in recent years made strides towards promoting the development of green finance. ASEAN countries are increasingly committed to working towards the reduction of greenhouse gas emissions. On that score, all member states have already signed the Paris Agreement.

As part of the ASEAN Community Vision 2025, several countries in the region are expanding their use of renewable energy. For instance, installed capacity for renewable energy in ASEAN increased 2.6 fold from 33 gigawatts (GW) in 2000 to 86.8 GW in 2020, according to the International Renewable Energy Agency.

Still, ASEAN countries’ heavy reliance on fossil fuels such as oil and coal to meet growing energy demand has meant that greenhouse gas emissions have been increasing. According to the International Energy Agency, carbon dioxide (CO2) emissions from fuel burning in the region increased from 690 million CO2 tons in 2000 to 1.49 billion CO2 tons in 2018, driven by increasing energy demand amid high economic growth, population growth and urbanization.

Even as Southeast Asian nations come to grips with the increasing criticality of taking climate action quickly, there is room for even more resolve. ASEAN countries will need to invest a total of $2 trillion in green businesses over the next 10 years to achieve the net-zero greenhouse gas emissions target, according to a report by Bain and Company, written in collaboration with Microsoft and Singaporean sovereign wealth fund Temasek.

As the need to boost these endeavors becomes increasingly critical, member states are doing more to propel the implementation of sustainable finance.

The ASEAN Capital Markets Forum (ACMF) has undertaken various steps to promote capital market financing, including the introduction of the ASEAN Green Bond Standards in 2017 and the ASEAN Sustainability Bond Standards in 2018.

The ACMF also released a Roadmap for Sustainable Capital Markets in ASEAN in May 2020, which focused on strengthening infrastructure, expanding and improving access to financial products, raising awareness and capacity building, and improving connectivity. In terms of strengthening infrastructure, reducing concerns about so-called greenwashing – the practice of companies giving a flattering picture of their climate policies and business practices – was a crucial recommendation.

Effecting Change with the ASEAN Taxonomy for Sustainable Finance

As efforts to promote green finance initiatives in Southeast Asia have gathered pace, new standards and classification systems have emerged in tandem with recent developments. For example, the first version of the ASEAN Taxonomy for Sustainable Finance (ASEAN Taxonomy) was published in November 2021. This classification system, which was developed in accordance with internationally recognized taxonomies like the EU’s, is ASEAN’s own standard for sustainable economic activities in an extremely diverse region.

The first version focuses on the environment and will serve as a comprehensive guide to complement national sustainability efforts to benefit all ASEAN members by providing a credible structure.

The ASEAN Taxonomy lists four environmental objectives: (1) mitigation of climate change risks; (2) adaptation to climate change; (3) protection of healthy ecosystems and biodiversity; and (4) promotion of resource resilience and a transition to a circular economy. It also states that economic activities contributing to one environmental objective should not cause harm to other objectives and that steps should be taken to improve energy transition.

There were several reasons behind the issuance of the taxonomy. First, the lack of a common language for communication and collaboration on economic activities and classification of financial instruments. Second, the absence of transparency in information and data on initiatives for sustainable capital markets. Third, complexities and loopholes when comparing sustainability reporting standards imposed by stock exchanges on listed companies in different countries. And finally, challenges in identifying and implementing a systematic evaluation method to assess whether economic activities and enterprises are promoting initiatives to reduce carbon emissions.

ASEAN’s economic diversity demands a tailor-made approach to measuring economic activity and its impact on the environment. The ASEAN Taxonomy employs two approaches for this – the Foundation Framework, which classifies all sectors using qualitative screening criteria, and the Plus Standard, which classifies specific sectors of high importance using specific criteria.

To sum up, the introduction of the ASEAN taxonomy is expected to effect three main changes in the sustainable finance space.

First, it has the potential to facilitate energy transition in a high-growth region that currently relies heavily on fossil-based systems of energy production and consumption. The ASEAN taxonomy will likely play a role in defining technologies that will enable Southeast Asian countries to effectively achieve net zero greenhouse gas emissions.

Second, the ASEAN taxonomy will likely complement and help further develop the ASEAN Green Bond Standards and the ASEAN Sustainability Bond Standards.

Finally, the ASEAN Taxonomy is expected to ensure consistency among policy authorities, financial market stakeholders and global investors in the region by standardizing definitions of green or sustainable assets and activities.

In summary, this means that as investors plan their portfolios for another year, participants in Southeast Asian markets will be keenly watching how the ASEAN Taxonomy promotes green finance and contributes to the sustainable development of capital markets in the region in the mid-to-long-term.