As the energy system becomes more decarbonized, decentralized and digitalized, AI will play a crucial role in delivering efficiencies and optimizing energy usage, according to a senior executive of an energy storage company speaking at Nomura Greentech’s Sustainable Leaders Summit.

The storage executive whose company optimizes batteries and stored energy from commercial clients said at the event held under the Chatham House Rule that every discretionary dollar in Silicon Valley is flowing into generative AI and the energy sector is no exception.

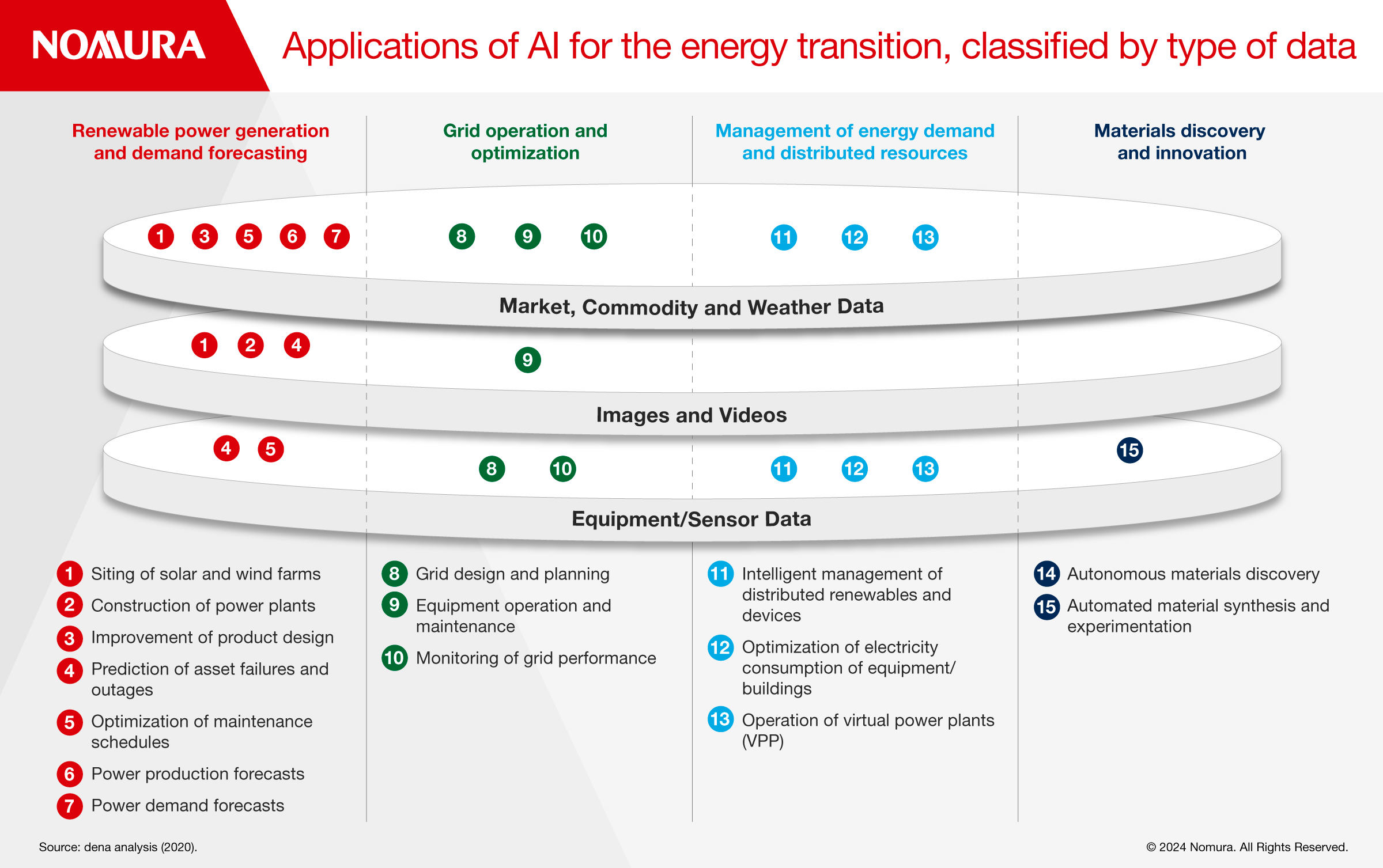

AI has tremendous potential to support and accelerate a reliable and low-cost energy transition, with potential applications ranging from integrating variable renewable energy resources into the power grid, to supporting an autonomous electricity distribution system.

He explained that his company is arming one of the big energy trading companies with AI tools to make its traders more efficient, but he emphasized that human insights are still very valuable. He gave the example of Super Bowl Sunday where his AI enabled forecasting tool knows exactly how the weather is going to impact power prices over the next 24 hours and updates every five minutes.

Crucially though, an AI trader working alone would not have added details of the extra load for the super bowl leading to an inaccurate forecast.

He also gave an example of the interconnectedness of the energy system from hotel software controlling lights through to a nuclear power plant being programmed through software. A green technology investor said that nirvana in the energy world would be to connect these agents and unleash the potential of “optimizing everything everywhere”.

On the flipside, a heavily optimized system requires an additional layer of security because interconnectedness opens the system itself up to bad actors.

The CFO of an energy software company said that his discussions on this topic have highlighted pressure to optimize everything and go faster.

He said that the primary constraint on the grid is at the federal level due to differing regulation between utility territories, but he sees AI as a solution as it can target an overburdened load circuit and dispatch down some of the thermostats in that particular circuit. Reducing demand on specific circuits is already occurring at some utilities on the West Coast, he said.

The delegates agreed that not everyone wants their thermostat to be controlled by someone else, raising questions about ceding too much power to a utility company, a piece of software or to an AI that controls electricity usage for often very critical household items.

The executives discussed the extent to which software innovation around energy systems is just table stakes versus creating real profit pools.

The head of an energy-as-a-service company said that his firm is focused on demand from institutional customers in the healthcare and higher education sectors. He gave an example of how AI could help his firm, which is increasingly managing projects at scale across multiple hospitals which sometimes means 25 or 30 campuses across several states. He has to send an engineer to each campus to observe the prevailing conditions such as the attributes and usage volume of an air handling unit in a mechanical room and record the data.

The engineer must then return to his or her desk, devise a solution, figure out the energy savings associated with that solution and manually calculate the cost of implementing it. As there are thousands of these areas in the unit, it’s not just one solution and it becomes very iterative and manual.

“When you’re in a business that’s scaling fast like ours, that’s a huge barrier,” he said. “We can’t find qualified energy engineers quickly enough. If an AI just automatically populates the entire solution, that is where we want to go so for us it’s far more than table stakes.”

The storage executive said that in some sectors, using AI such as Microsoft Copilot orientation to team up with humans is the right starting strategy. The traders have a high degree of skepticism, but they want something to make them more productive.

“It’s not that these tools are going to replace you, it’s that you can do more, you can be faster, you don’t have to do the yeoman’s work of administrative tasks, leave that to the AI - copilot orientation is really important for acceptance.”

The storage executive said that by some estimates we will lose 180 million jobs globally over the next 20 years while creating 200 million because of how AI and the energy transition are happening coincidentally.

He said that to the example of the engineers checking energy usage across multiple hospitals, it would be difficult to replace all those people immediately, but AI would make them more accurate and faster, leading to margin expansion by pricing your energy-as-a-service product better.

“That’s the interim opportunity, it’s probably a five or ten year period which is a nice time to make a lot of money, but eventually you are going to replace these people,” he said. “They are not going to be sitting there once you figure out that this is really working.”