Economics | 3 min read December 2020

Rates | 5 min read | June 2021

A Measured Approach to ESG Investing

An overlay technique of consensus-ratings to improve the ESG quality of portfolios

Rates | 5 min read | June 2021

An overlay technique of consensus-ratings to improve the ESG quality of portfolios

Why should sustainability investing for the common good be rewarded? ESG investment may benefit investors in the very long term, as an indirect effect of its benefit to society, but why should investors expect to benefit in the near term?

Do ESG sceptics have a point? A number of prominent academics, practitioners, and journalists have raised this question. While there has been much debate on the topic, demand for ESG investment products has continued to set record highs.

Crucially missing from the debate about the impact of ESG on investment performance is clarity about the degree of ESG under consideration. In fact, an explicit measurement of a portfolio’s ESG quality relative to some ESG-agnostic benchmark is seldom considered.

We approach the subject of ESG with a basic question: How should we rate the ESG quality of a portfolio? We introduce a method for rating the ESG quality of a portfolio based on consensus ESG ratings of companies, as well as a method of improving ESG quality of a portfolio.

We consider a portfolio’s ESG rating as a foundational metric that should be required for any meaningful discussion of the financial impact of ESG. We then introduce an ESG overlay approach that improves the ESG quality of the investment portfolio under consideration.

To overcome the inherent subjectivity of interpreting ESG categories we rely on consensus ratings which provides a “Wisdom of Crowds” (WoC) aggregate rating drawn from a large growing pool of ESG data sources to give us a rating for two purposes:

Passive index investing has been steadily gathering assets at the expense of active investing. Can we take a passive index strategy and amplify its ESG qualities by adding an ESG overlay to make it more attractive for ESG investing? And if so, does this help or hurt performance? A reweighting of the stocks in the S&P 500 that incorporates ESG metrics illustrates what can be achieved.

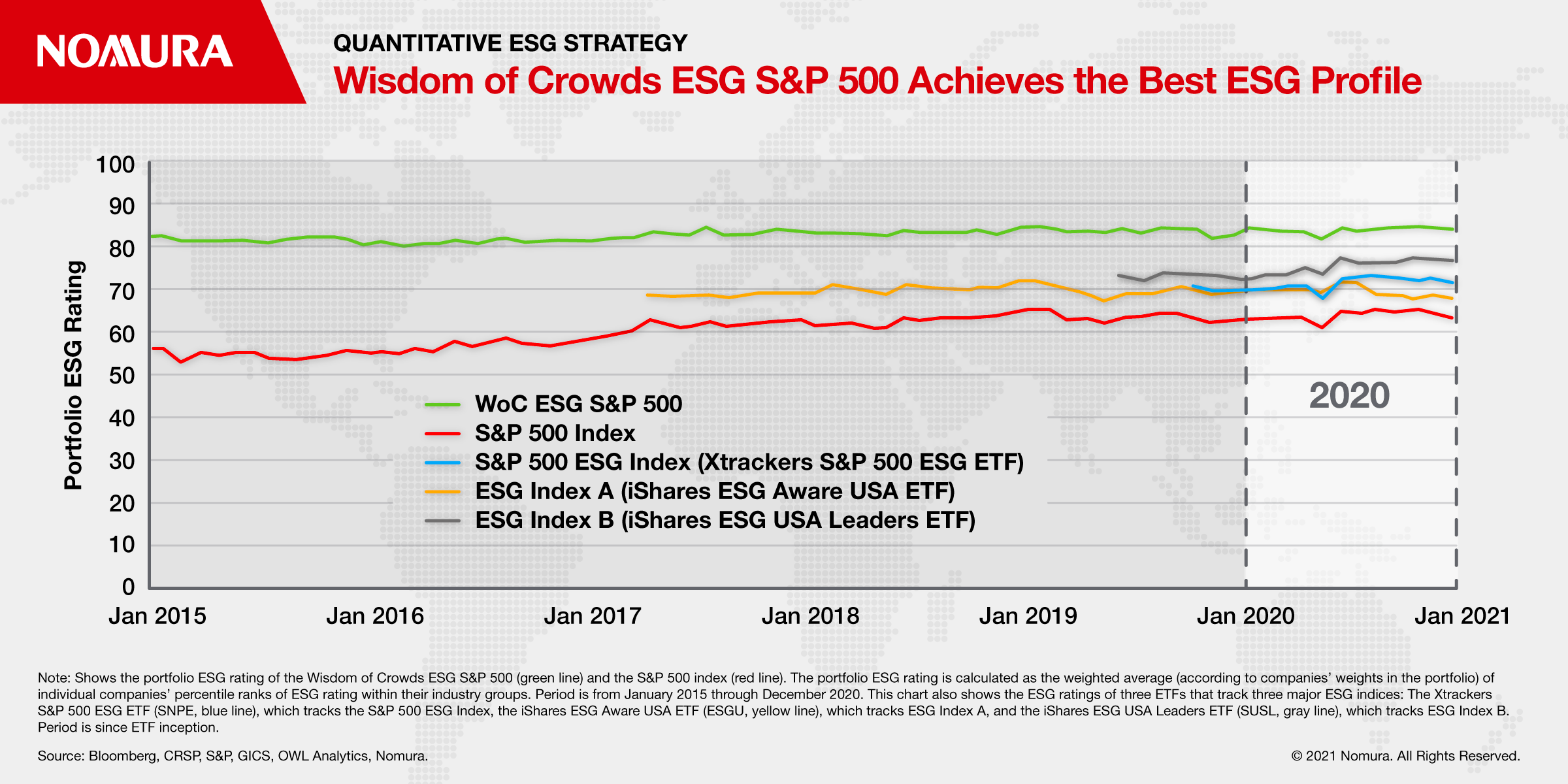

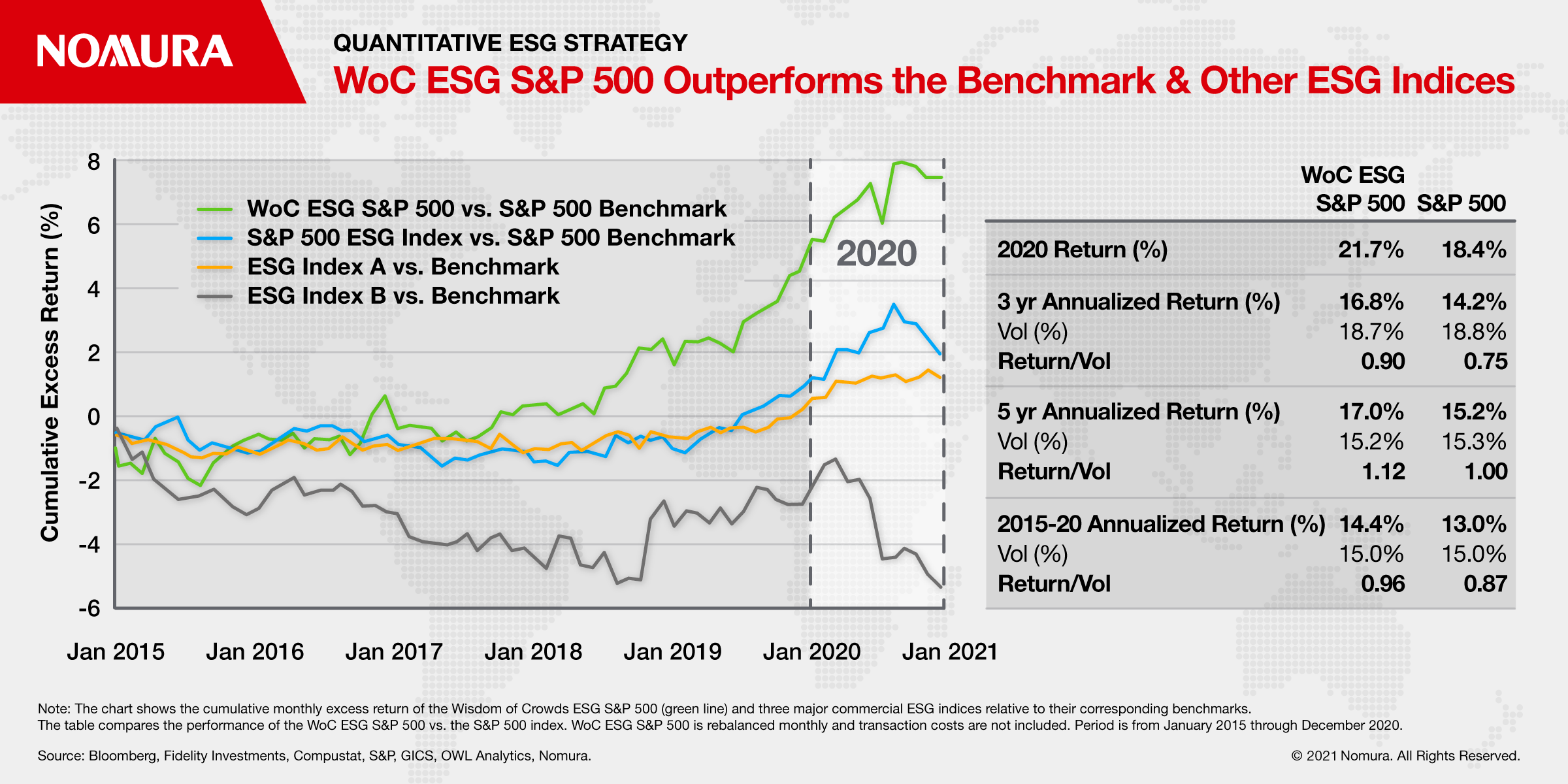

If we overweight the companies with higher consensus ESG ratings than their industry group peers and underweight those with lower consensus ESG ratings to construct a Wisdom of Crowds (WoC) ESG S&P 500 index, we can see from Figures 1 & 2 that we achieve an overall better ESG ratings profile than three other major ESG indices/ETFs, and outperform the benchmark and other ESG indices in terms of cumulative excess return.

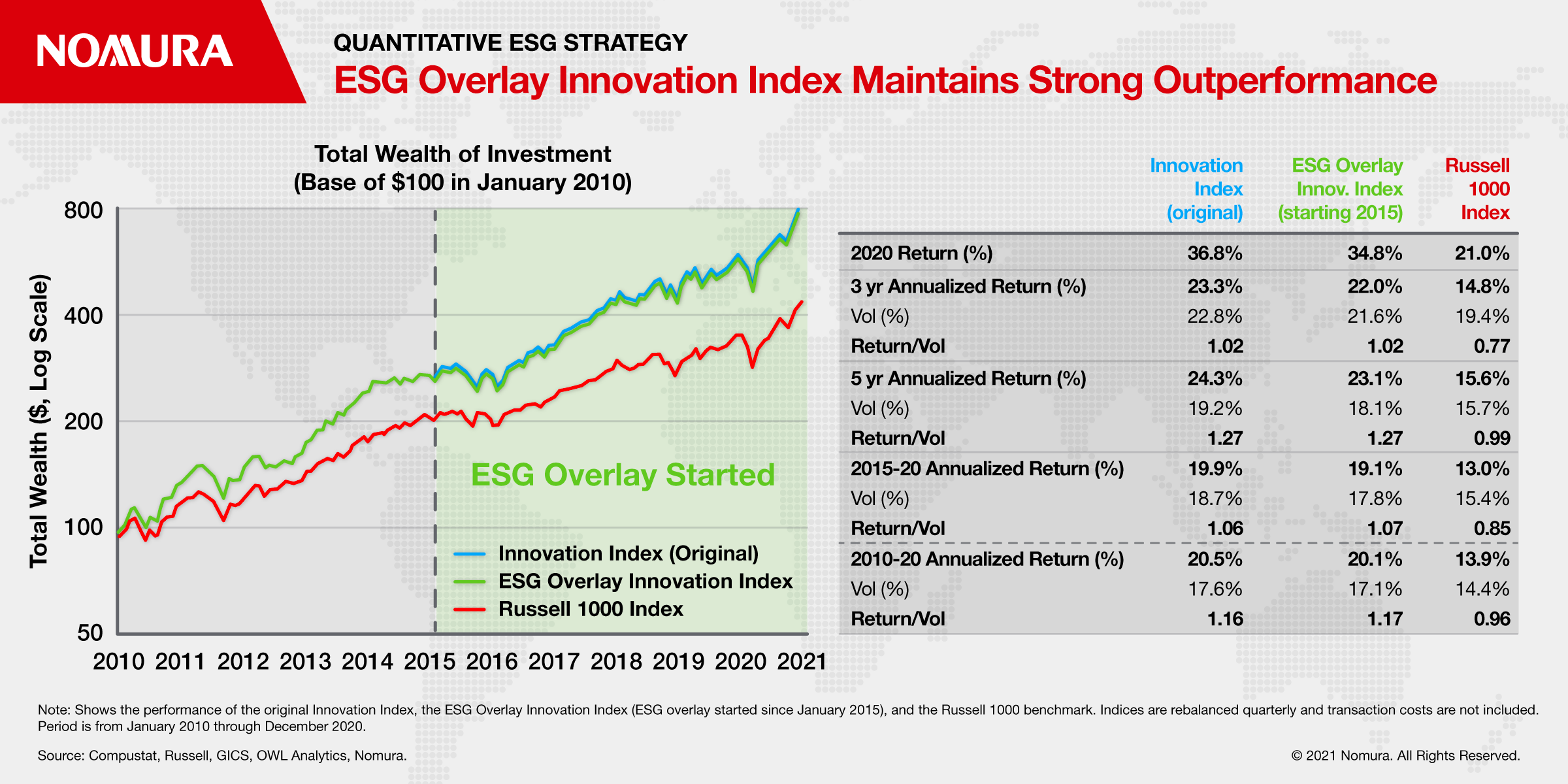

The ability to use ESG as an overlay should be particularly appealing to active managers. Even when applied to an active strategy such as Instinet’s Innovation index – an index based on a straightforward idea that innovation is more likely to happen where innovation is funded, and thus the strategy systematically weights Russell 1000 companies by their industry group relative innovation spending (measured by R&D/EV). What’s key here is that there is no focus on ESG in this strategy.

We can remedy the ESG-deficiency of this active strategy by applying an ESG overlay! As an example of ESG overlay on a passive index, in the previous section we used a blend of the market cap and the industry group relative ESG score of each stock as the weight to create the WoC ESG S&P 500 index. For this active strategy, we use a blend of the industry group relative R&D spending and the industry group relative consensus ESG score as the weight to create an ESG Overlay Innovation Index.

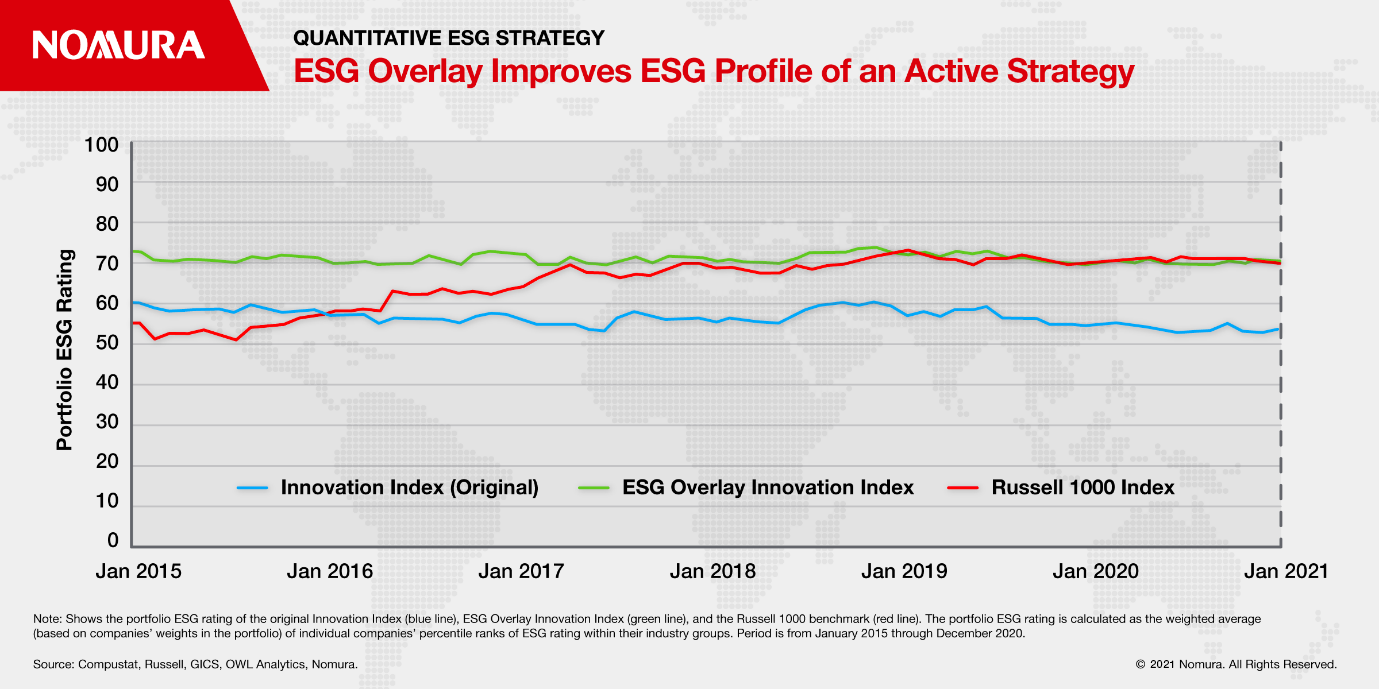

The chart below indicates that the ESG rating of the Russell 1000 (red line) has generally been superior to the ESG rating of the original version of the Innovation Index (blue line). But the ESG Overlay Innovation Index improves the ESG profile of this active strategy and its ESG rating has always at least matched the rating of the Russell 1000. And again with regards to performance the ESG Overlay Innovation Index closely tracks the performance of the original Innovation Index and maintains strong outperformance of the Russell 1000 benchmark since its simulated inception.

This commentary introduces two innovations: A technique for improving the ESG quality of an investment portfolio and a consensus-rating based method for measuring portfolio ESG quality.

Our technique for improving portfolio ESG quality employs an ESG overlay that re-weights portfolio members to achieve higher overall portfolio ESG quality. Our consensus ESG rating for portfolios allows us to quantify this improvement in ESG quality. Both constitute important tools for investors looking to meet increasing demand for ESG investment without sacrificing investment performance.

We believe measuring the ESG quality of portfolios is a foundational element of ESG investing and find it remarkable that ESG funds and ETFs do not have a transparent way to measure and report portfolio ESG quality. Without a portfolio level ESG rating, how can investors determine whether an ESG investment is worthy of the name? The label 'index huggger' has been applied to active portfolios that aren't really that active, hugging their benchmarks by measures such as active share. Figure 1 shows that we should apply similar scrutiny to investments branded as ESG-focused. Our analysis reveals that many so-called ESG ETFs in fact do little to distinguish themselves from their relevant benchmark indices in terms of portfolio ESG quality.

When we applied an ESG overlay to a passive index, the S&P 500, it substantially improved both the ESG rating of the portfolio and portfolio performance. When we applied an ESG overlay to an active investment (a systematic stock selection strategy, in this case), the ESG rating was substantially improved. The overlay did not materially affect performance of the active strategy, leaving untouched its significant outperformance of the benchmark.

Thus, for both passive and active investors, we show that there is no need to sacrifice the performance of current strategies to meet the present demand for ESG. Our ESG overlay can be used to boost the ESG ratings of investment portfolios without harming performance.

Head of Equities Quantitative Strategy

Quantitative Investment Strategist

Quantitative Investment Strategist

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.

Jump to all insights on Rates

Economics | 3 min read December 2020

Economics | 3 min read March 2021