Economics | 4 min read March 09, 2022

Nomura’s Infrastructure and Power Business (IPB) was mandated to arrange a $350 million financing deal to support Amp Energy develop solar infrastructure across the globe, in the latest sign that investors are backing renewable energy projects as countries strive to meet net zero greenhouse gas emissions targets.

The $350 million cross-border debt facility, which could increase to $700 million, will finance the construction of solar and battery storage assets in the US, Japan and Australia, equivalent to supplying power to more than 100,000 homes annually.

The deal had a number of unique features including an innovative revolving delayed draw facility to meet Amp’s financing goals. The transaction was also structured keeping in mind each geography’s regional nuances.

“Amp Energy’s assets have significant environmental attributes and they support the de-carbonization of power infrastructure,” said Vinod Mukani head of the IPB group. “Due to the international nature of the transaction, we had to resolve multicurrency issues to secure the cross border capital.”

How the Deal Unfolded

Nomura was retained by Amp Energy as the Sole Lead Arranger on an innovative cross border capital solution.

The combination of Nomura’s structuring expertise and institutional reach allowed it to work with various leading investors to provide liquidity to Amp.

The deal highlights the rapidly growing solar sector as countries come under increasing pressure to de-carbonize legacy power infrastructure to meet net zero emissions goals by 2050. A report last year from UN climate science body, the IPCC, revealed that a 1.5C temperature rise will be reached by 2040 in all emissions scenarios. And if emissions aren't slashed in the next few years, this will happen even sooner.

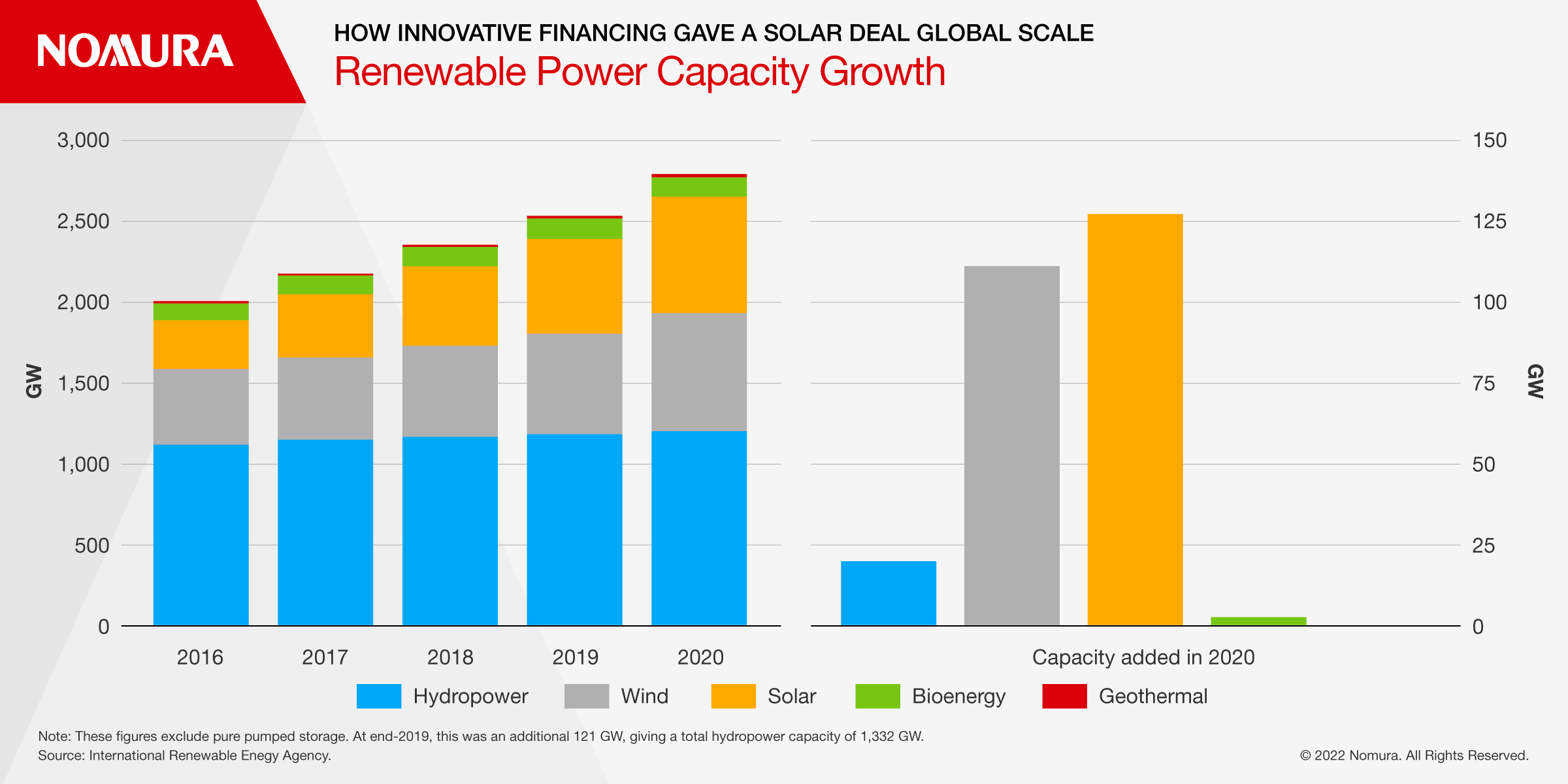

Solar energy capacity increased 22% to 127 gigawatts in 2020 compared to the previous year, according to the most recent data from the International Renewable Energy Agency.

Promoting Renewables

The cross-border nature of the deal required a tailored approach to structuring as countries incentivise green energies using different policy tools and are at different stages of de-carbonization. Nomura’s deep experience in global renewable markets, allowed it create a solution that addressed each of these facets.

Australia, for example, is undergoing a change in its power generation capacity from legacy coal fired assets to renewables. This made it critical to understand the ongoing regulatory, policy, and legislative changes while taking into account the economic impacts and meeting the needs of the Australian energy markets.

Japan supports renewables with so-called feed-in tariffs, which typically provide producers with secure long term contracts or above market prices for delivery to the grid. Japan’s Ministry of Economy, Trade and Industry offers producers 10 or 20 year power purchase agreements.

The US subsidizes renewables through the tax system. For a solar project, 30% of the eligible basis is made available in the form of investment tax credits while in the case of wind, it’s in the form of production tax credits.

“This is a pivotal time for the renewable space as an overall megatrend,” said Mukani. “Solar is at the heart of de-carbonization in the ongoing climate crisis and it’s maturing to become the cheapest form of energy production.”

ALL OF THESE ARE COMPONENT CANDIDATES! CHECK REUSE

Head of Infrastructure & Power Business, Nomura Securities International, Inc.

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.

Economics | 4 min read March 09, 2022