Social Impact Investing Looks Set to Rise in ASEAN

ASEAN countries have made significant advances in reducing poverty and improving human development but improvements in gender equality and social mobility have been slow.

- Development financial institutions still account for the vast majority of social impact investment in the region.

- ASEAN social bonds could be important in encouraging additional private investment.

- To date, there have only been a handful of ASEAN social bonds, including two from Impact Investment Exchange, which raised funds to empower women. However, the COVID-19 crisis could increase investor interest in social bonds.

The 10 countries of the Association of Southeast Asian Nations (ASEAN), like others around the world, are focused on achieving the United Nations (UN) 2030 Sustainable Development Goals. Within the region, various social issues are being addressed under the ASEAN Social and Cultural Community Blueprint 2025.

Considerable progress has been made in the region in reducing poverty and advancing human development. According to the World Bank, 74% of Indonesians lived on less than $3.20 per day during the period 2000-2002; by 2015-2017 this figure had fallen to 30%; in Vietnam the percentage on $3.20 a day fell from 71% to 8% during the same period.

However, there have been fewer advances on other social issues such as gender equality and social mobility. According to the World Economic Forum, the Philippines is the only ASEAN country among the world's 153 countries to rank in the top 20 in terms of gender gap index, for instance.

Channeling funds to social issues

In order to address social issues, considerable investment is required. However, all governments, especially in the wake of COVID-19, face fiscal constraints. External capital is therefore required. Impact investment, which seeks to deliver a social and environmental impact in addition to monetary return, is becoming more important in this regard.

According to a survey conducted by the Global Impact Investing Network, about 30% of impact investors in the world invest in ASEAN,[ii] while cumulative impact investments in the region between 2007 and 2017 were $12.2 billion.[iii] By sector, financial services accounted for 44% of investment during this period, with projects to promote financial inclusion, mainly through microfinance institutions, a priority.

Within ASEAN, development financial institutions (DFIs) remain critical, accounting for more than 90% of cumulative investment between 2007 and 2017. Impact investment by private investors has grown but is still dwarfed by DFIs. This is expected to change given growing entrepreneurship in the ASEAN region and increased investment by young people who use technology to create socio-economic impacts. DFI and private investment differ in character: more than 80% of FDI investment is loans, while 50% of private investment is equity. Equity investments are primarily through impact funds, many of which are managed by Singapore asset managers.

The role of social bonds

Although private investment is on the rise, it remains small. Therefore, organizations addressing social issues have increasingly used bond markets to access a wider range of investors. The introduction of the ASEAN Social Bond Standards in October 2018 has been pivotal to the development of the market. The objectives of the ASEAN Social Bond Standards (developed in accordance with the International Capital Markets Association’s Social Bond Principles) are to improve the transparency, consistency, and uniformity of ASEAN social bonds.

ASEAN social bond issuers must be based in the region. Proceeds must be used for a regional project focused on basic infrastructure such as clean drinking water, sanitation, or transportation; essential services such as health, education, or financial services; affordable housing; job creation; food security; and socioeconomic development. Issuers are encouraged to seek external ratings and are required to report to investors on use of funds annually. Important ASEAN social bonds include:

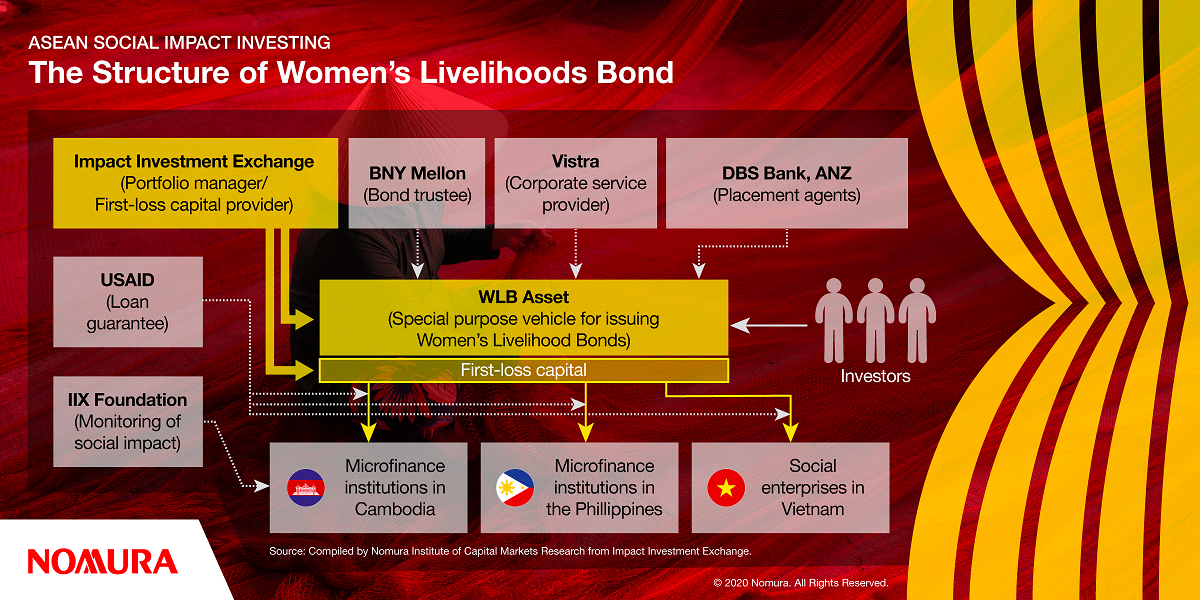

- Impact Investment Exchange, a Singapore-based social company, sold a $8 million four-year issue (Women's Livelihoods Bond) in July 2017 with the support of the Rockefeller Foundation. The US Agency for International Development, in partnership with Australia’s Department of Foreign Affairs and Trade, guaranteed 50% of the loan portfolio’s principal. The proceeds have been used by microfinance institutions in Cambodia and the Philippines and social enterprises in Vietnam to provide business funds to approximately 385,000 women. The bond was the first gender-related social bond listed on a stock exchange globally. In January 2020, Impact Investment Exchange sold a second four-year bond, Women's Livelihoods Bond 2, raising $12 million.

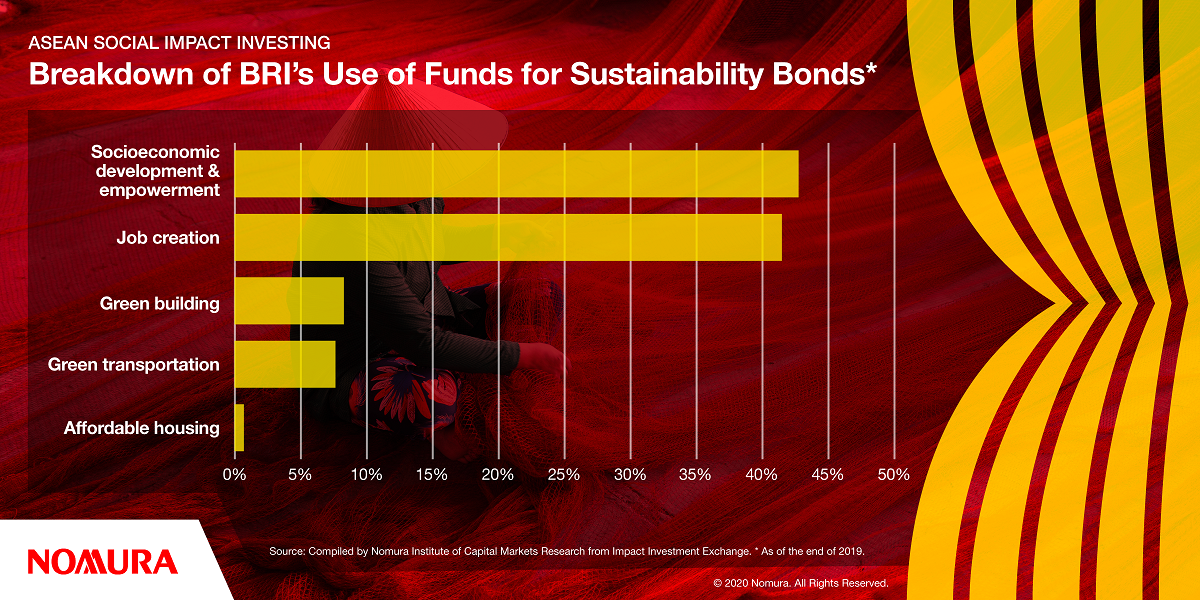

- Bank Rayatt Indonesia (BRI), Indonesia's largest bank, issued the country’s first sustainability bond in March 2019 raising $500 million with a five-year issue that was more than eight times oversubscribed. Proceeds have been used for affordable housing, job creation, socio-economic development and empowerment, and environmental improvements such as green construction and clean transportation.

How will the market develop?

There is currently insufficient investor demand for ASEAN Social Bonds. Barriers to growth include a lack of understanding of social and environmental issues, lack of historical data on investment returns, and inadequate information and transparency relating to issuers.[iv] Nevertheless, investor interest is growing. As of the end of July 2020, there were 48 ASEAN signatories to the UN Principles for Responsible Investment, with Singapore accounting for 31 of these. Of the total 48, 33 are asset management companies while seven are asset owners.

The COVID-19 crisis could be an important spur to further development of the market. In June, the Bank of the Philippines sold a PHP21.5 billion ($443 million) COVID Action Response Bond, which was increased significantly in size after a seven times oversubscription. Meanwhile, Impact Investment Exchange has announced its intention to issue a third social bond by the end of 2020, focused on helping women affected by the pandemic. The crisis has also encouraged investors to recognize the importance of sustainable investment to achieve stable returns over the medium to long term.

Read more insights from Nomura Institute of Capital Markets Research (NICMR) here.

-

[i]

World Economic Forum, Global Gender Gap Report 2020, 16 December 2019.

-

[ii]

Global Impact Investing Network, 2020 Annual Impact Investor Survey, 11 June 2020.

-

[iii]

Global Impact Investing Network, The Landscape for Impact Investing in Southeast Asia, 2 August 2018.

-

[iv]

CFA Institute, ESG Integration in Asia Pacific: Markets, Practices, and Data, 30 May 2019.

Download a PDF of the full whitepaper

Contributor

Yohei Kitano

Senior Analyst, Financial and Capital Markets in Asia NICMR

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.