How will asset managers survive in a data driven world?

Asset management’s next phase of disruption has arrived with big data creating the imperative for a radical re-imagination of technology in the investment processes.

Article | 6 min read | May 2019

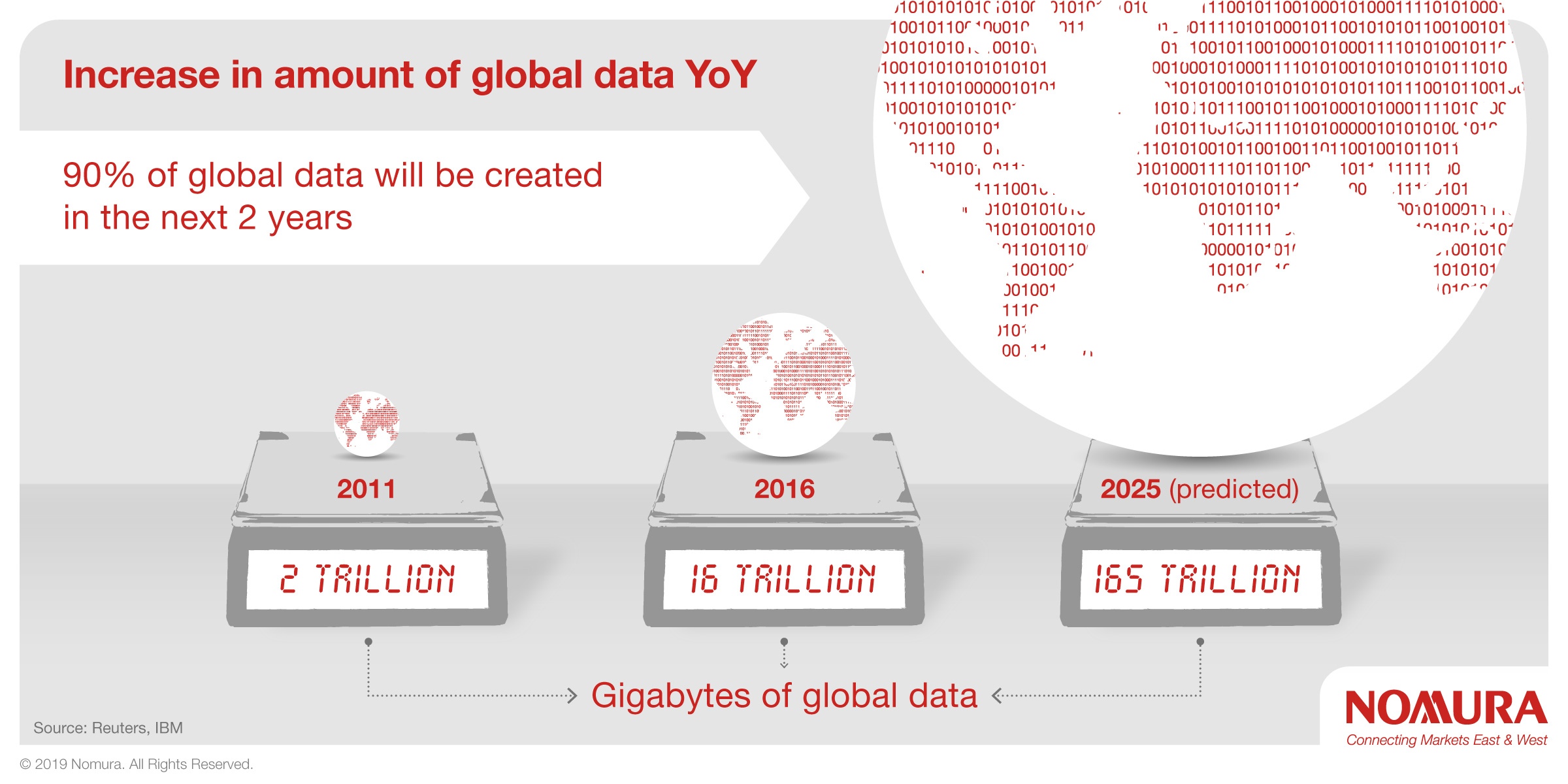

- The amount of global data available to asset managers is growing at a rapid rate.

- Technology changes will be big and rapid but may not actually be revolutionary.

- Technology and expertise are overlapping to create new opportunities at all levels within asset management.

Asset management’s next phase of disruption has arrived with big data creating the imperative for a radical re-imagination of technology in the investment processes.

Tom Hill, Chairman of Blackstone Asset Management, observes: “If a fund manager is not actively thinking about how they are going to change their business model, they are standing still and may become obsolete.”

Tech changes will be big and rapid but may not actually be revolutionary. “While some commentators frame the use of big data as a paradigm shift, it is really a gradual evolution that has been going on for a long time as quantitative managers have been seeking out more and more relevant data using a variety of statistical techniques,” says the New York Stern School of Business’ Professor Lasse Pedersen.

There may not be revolution on the way but we must accept that the reality of “big and rapid” will lead to considerable change. In 2011 there were two trillion gigabytes of global data, in 2016 we hit 16 trillion and by 2025 it’s projected that there will be 163 trillion gigabytes.

It’s the investment in the hiring and development of tech employee expertise to process increasing amounts of data that will decide in business terms who evolves and who falls by the wayside.

Quantitative techniques and forms of machine learning to collate and categorise data into the meaningful advantage it offers will have to develop as exponentially as the raw material.

Ray Carroll, Chief Investment Officer at Neuberger Berman Breton Hill, predicts that in the coming years machine learning will become “your ticket to the game, and your ticket just got more expensive”.

There are few aspects of people’s lives that aren’t being mined for information and the seeds of the great tech leap forward are already offering an analytical edge that can be tasked with what was until recently unimaginable. A fund manager can gauge the sentiment of a company’s customers by scanning social media posts and deciding whether those posts are positive or negative, thus creating a dataset with the number of each type of post. This data can be then be harnessed to inform decisions around whether to invest or divest accordingly.

Additionally, a fund manager looking to invest in a retail company can analyse satellite imagery and determine whether there are people lining up in front of that store’s locations to assess demand for a new product launch and gauge to overall health of the business.

Alternatively, firms could use machine learning to collate data on the use of credit cards at every retail outlet in any given country and subsequently feed that information into trading algorithms.

Blackstone’s Tom Hill observes: “There’s an arms race around how asset management firms collect data and how they slice and dice it.”

This is a sentiment which, along with these datasets, is bringing another wave of disruption led by developments in artificial intelligence. Luke Ellis, CEO of Man Group, says: “What humans are not doing better is processing large amounts of data trading into markets and trying to build a small edge across many markets.”

Humans are not capable of analysing a thousand pieces of information at the same time. AI, fuelled by big data, can and will be harnessed to provide descriptive market insights and, with help from machine learning, throw up increasingly prescriptive actions for the future that maximise return on investment.

AI will soon evaluate investment options by collating environmental, social and governance scores for companies, which will act as an indicator of their long-term sustainability. A very human headline generator in the vanguard of AI in asset management is the robo-advisor. An application that provides clients with investment advice, without human intervention.

However, if there is to be a rise of the machines, robo-humans or any other tech advances that game change asset management, it’s more rather than less people that will be needed to make the future happen. The discipline needs more hires that are capable of creating the new statistical and computational technologies essential to competing in an evolving industry.

Nomura’s Wholesale Chief Digital Officer Jezri Mohideen is looking for his asset managers of the future “to be increasingly automated, data-led, open and agile”.

“Nomura will increasingly be targeting physicists rather than economists and will look to hire employees with a deeper understanding of statistics, mathematics and computer science straight from university.”

Sir Paul Marshall, Chairman of Marshall Wace, supports this vision: “The shift towards the industry hiring people with more mathematical backgrounds is only going to increase … This is not to say that the demand for conventional financial talent will disappear.”

Professor Jim Liew Assistant Professor of Finance at Johns Hopkins Carey Business School, argues: “The fund firm which successfully integrates employees who are experienced in markets with employees experienced in analysing data - thus creating a ‘quantamental’ capacity - will have a winning combination.”

Success in the future, Professor Liew believes, will come from having “someone who is seasoned to the market, and surrounding them with people who can code up ideas and access data”.

This need for tech innovation and hiring more quantitative talent is a pivot that is moving the asset management industry into direct competition with the technology sector.

“Getting the best out of the ML/AI revolution requires people who really understand the datasets which are being used. You can be the best data scientist on paper but if you do not understand the key features in the data, it is unlikely that you will converge on the best models.”

Investment firms may start looking more like Silicon Valley - becoming structurally flatter, more collaborative and morally accountable will help attract the best new minds.

However, here lies an issue that could cause asset management leaders sleepless nights. Professor Liew sees the potential for technology companies to disrupt investing. He says: “Google, with the amount of information it has and the things it can do with it, would have an amazing advantage if it started a fund. The same thing for Amazon or Baidu. They all have the capacity to do it.

“They have the best data scientists in the world with many researching and inventing some of the most exciting next-generation machine learning/AI algorithms.”

To compete with the likes of Google, even if they don’t decide to disrupt the asset management industry, diversity in hiring will increasingly be seen as essential. A business made up of individuals who think more or less the same is not going to make the cut in the future. Visionaries are already revisiting their processes, eliminating bias that might exist towards taking only from the elite and creating systems that help them acquire employees based entirely on their skill and individual merit.

Long-term, human expertise in the industry will without doubt become more numerate, more diverse and more collaborative. Technologies like AI, powered by big data and secured by blockchain, will become effective at making asset management decisions and executing them. However, functions like devising long-term strategy, making complex decisions and governing the technology mandate human contribution.

“The adoption of technology by wealth managers should actually enhance their business not destroy it,” observes MIT’s Professor Robert Merton.

“With the evolution of AI and fast machines, the real value is to come with thousands of small to medium diversified alpha strategies as opposed to relying on handful of high alpha strategies.”

But however useful, machines are not about to take over and allow asset managers to hit the slopes while the technology does all of the work.

Tom Hill agrees: “At the end of the day, you need to have machines and humans working in partnership to make key investment decisions.”

It’s clear the most pressing question the asset management industry needs to ask itself isn’t, ‘How do we build a fully automated approach?’, it’s the slightly more prosaic, ‘How do we attract the talent to create and integrate the data crunching technology that makes portfolio managers better at their jobs?’.

Get that right and the future looks very bright. Sir Paul Marshall concludes: “We are in an era where there is an unparalleled explosion in the availability of information. Whoever embraces that opportunity will do extremely well. It does require a complete shift of your mind set and your business model and it requires a significant investment in resources.”

So, while asset management itself might not be undergoing a revolution, it’s absolutely a case of evolve or die.

This article was produced in collaboration with

Contributor

Jez Mohideen

Global Chief Digital Officer, Wholesale

Matthew Hampson

Global Deputy Chief Digital Officer, Wholesale