Download the PDF to read the full white paper

What will be the role of Quantum Computing in the future of finance?

Tech giants like Google and IBM are racing to be the first ones to create the next generation of supercomputers, but how will they impact the world of finance?

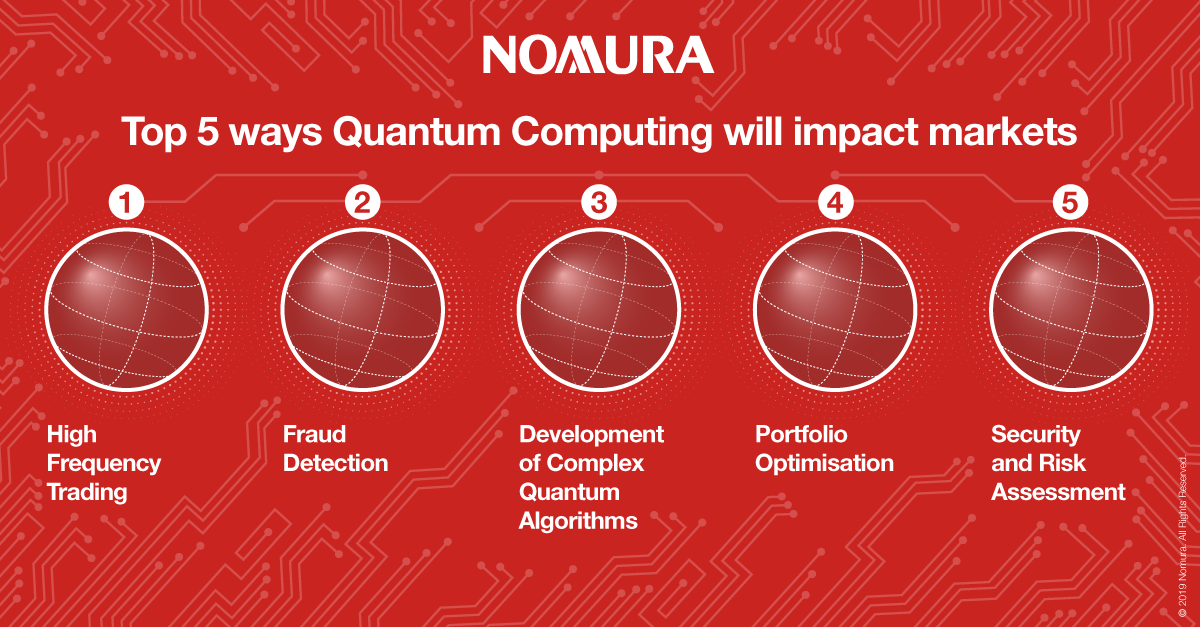

- Quantum computing is able to exploit the unique ability of subatomic particles to exist in more than one state at any one time.

- Recent developments in mathematics, computer science, physics and engineering have enabled quantum computers to threaten classical computers we all use today.

- Tech giants like Google and IBM are racing to be the first ones to create the next generation of supercomputers, but how will they impact the world of finance?

With its promise of incredible power, quantum computing (QC) is a game-changing prospect for financial players. It’s a breakthrough that will reduce risk and create bigger profits by analysing market situations faster and in infinitely more detail.

“One of three emerging technologies that will radically reshape the world, along with artificial intelligence and augmented reality”.

Some analysts believe that the quantum tipping point has arrived and that within a decade, quantum computers will make today’s fastest supercomputer look like an abacus.

"[QC is] a completely different way of computing, a different beast entirely, and the most significant improvement in computation in the last century. It offers the opportunity to rethink so much of what we've achieved."

When you consider what the financial industry wants and combine it with quantum computing’s phenomenal increase in the availability of processing capability for probabilistic algorithms, it’s a disruption made in heaven.

“In less than 10 years, quantum computers will begin to outperform everyday computers, leading to breakthroughs in AI. The very fast computing power given by QC has the potential to disrupt traditional businesses.”

How does quantum computing actually work?

Optimisation is at the core of many financial problems. In portfolio optimisation, the problem exists in selecting the best assets to invest in to balance the risk with the expected returns. This is known as a NP-Hard problem, meaning it is extremely difficult, if not impossible, for classical computers to solve efficiently. Professors of both physics and mathematics at MIT are working together on Quantum algorithms that could provide the required processing capacity to viably identify optimisation solutions.

Consider that every time a large asset manager rebalances their portfolio, investors lose out as a consequence of transaction costs and slippage. In an environment where most funds struggle to make single digit returns, losing three percent on rebalancing costs is problematic. QCs could create portfolios that are globally optimal over multiple investment horizons, hence significantly reducing the need for rebalances and their associated losses.

Financial derivatives contracts have a payoff that depends on the future price trajectory of a given asset. Brokers must know how to assign a price to the derivatives from the state of the market. The current approach to this problem is via simplified scenarios, such as the Black-Scholes-Merton model and Monte Carlo sampling. Due to the growing number of derivative products, only Monte Carlo simulations are viable but at a huge computational cost and with lengthy execution times. A quantum-accelerated Monte Carlo algorithm has been developed in the Department of Science at Bristol University, which could reasonably tackle this problem and provide a quadratic speedup.

Click the download button below to read the full article.

This article was produced in collaboration with