World after reopening and ideas for Japanese equities

Basic strategy likely to involve shift to sectors with high intrinsic growth rate (alpha)

- Sectors relatively insensitive to overseas economic conditions and achieve self-driven growth are likely to perform robustly in the slow growth economy after the crisis, just as they did after 2008 global financial turmoil

- Key phrases for post-coronavirus world are "low growth", "high tech", and "acceleration of existing trend"

A look at Japanese equities after virus response measures end

While it is difficult to forecast when this emergency situation will end, it is meaningful to consider the post-coronavirus world. We think the most plausible scenario is that of a change in trends similar to after the global financial crisis. Put simply, we see the priority on business growth that is consistent with the direction of sustainable development goals (SDGs) and see the possibility of long-term outperformance by Japanese equities in related sectors.

Decline in growth rate resulted in growth stock outperformance paradox

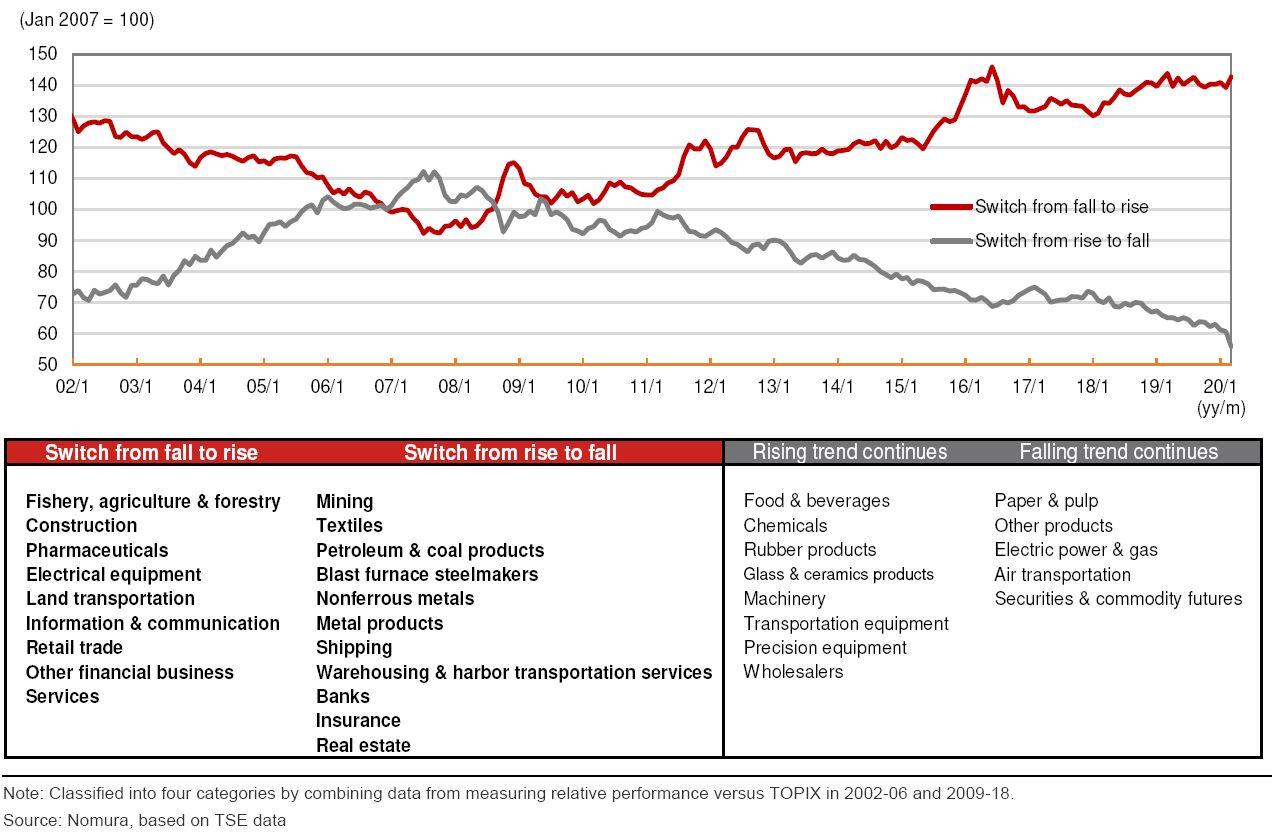

The global economy looks increasingly likely to enter its first full-scale recession since the 2008 global financial crisis. We looked at relative performance for the 33 TSE sectors around that time and classified them into four categories according to these data.

Many of the sectors for which the crisis triggered a change in direction from down to up were growth sectors that were relatively insensitive to overseas economic conditions and more likely to achieve self-driven growth. Meanwhile, sectors whose relative performance changed direction from up to down included many cyclical sectors. We expect the former group to show tenacious performance in the post-coronavirus low-growth economy.

A characteristic of the former group is that many were sectors with little environmental impact, for example low CO2 emissions. In contrast, latter group were generally those that are having to adopt environmental initiatives. If governments around the world shift from policies focused on economic growth toward welfare and sustainability, the polarization between post-financial crisis winners and losers could become clearer.

Basic strategy for post-coronavirus period is shift to sectors with high intrinsic growth rate (alpha)

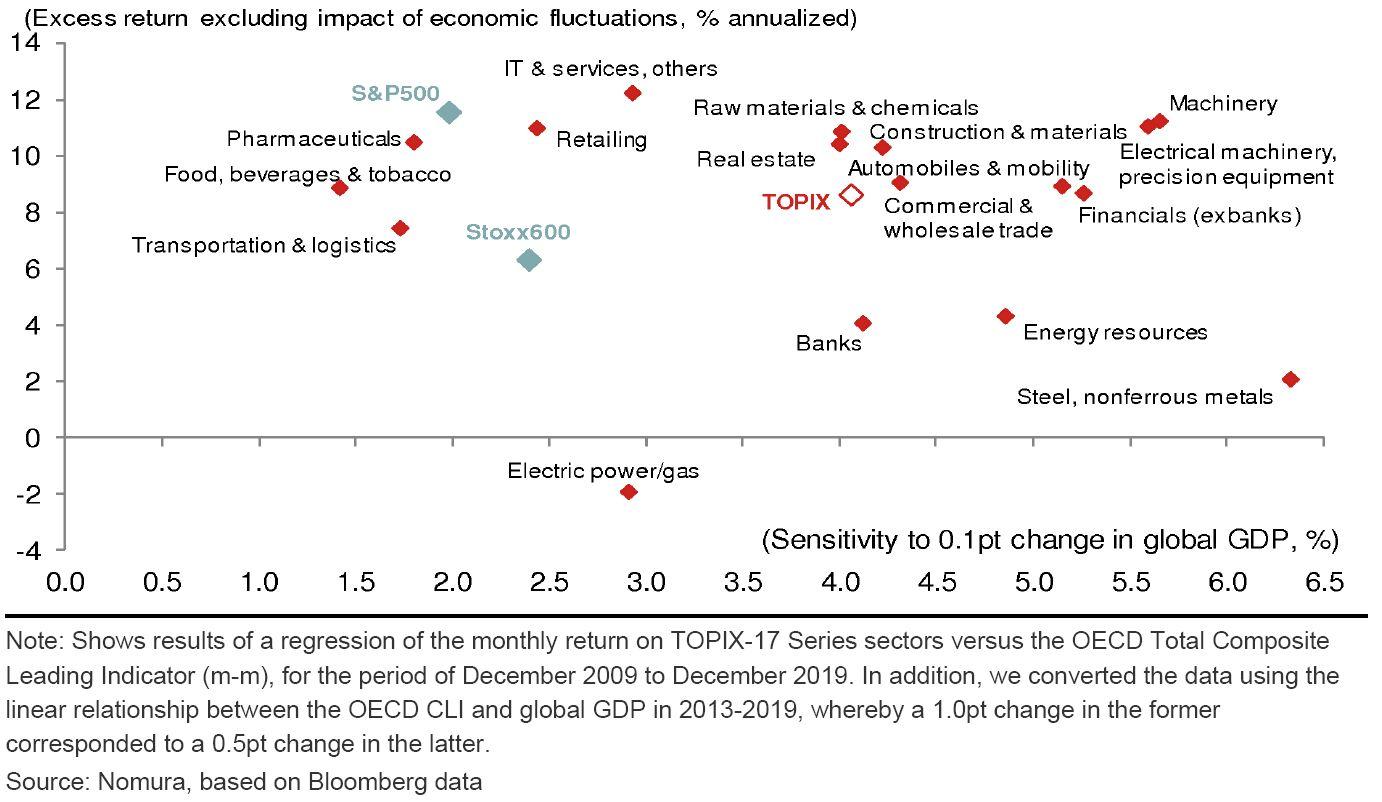

We expect a period of clear outperformance by cyclical sectors initially as expectations of a recovery start to grow. However, over a three- to five-year time frame, we think continuous stable growth is more likely to be seen in sectors that achieved continuous growth, through their own efforts, during the period of weak economic growth after the financial crisis. If we map sensitivity to the global economy (beta) on the horizontal axis against the intrinsic growth rate (alpha), calculated as excess return, on the vertical axis, the sectors that are higher up along the vertical axis are those that we see as promising under our basic post-coronavirus strategy.

In the post-coronavirus period too, low growth, high-tech, and acceleration of existing trends are likely to be key to growth

Sectors that grew after the global financial crisis, both in Japan and around the world, are those that took advantage of the slowdown in growth (weak income growth) and technological advances. The emergence of the sharing economy (Uber, Airbnb, etc) is a clear example. The global economic downturn led to rapid growth in the sharing market, as consumers started borrowing instead of buying, or lending instead of throwing away. Another key contributing factor was a dramatic fall in information management costs as a result of the development of the internet. We think it is a good idea to bear in mind the key phrases of "low growth", "high tech", and "acceleration of existing trend" in order to identify sectors likely to see continuous growth in a post-coronavirus world.

Read our full Japanese equities investment strategy (April 2020) here

Contributor

Yunosuke Ikeda

Head of Macro Strategy, Japan

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.