Will Covid-19 tip the Japanese economy into recession?

- The COVID-19 outbreak has started to kick in fully in Europe and North America.

- Financial markets, governments, and central banks are shifting their focus to whether the virus outbreak will trigger a global economic recession if prolonged.

Will COVID-19 tip the Japanese economy into recession?

We think the key to whether the COVID-19 pandemic brings about a recession is if the outbreak proves prolonged. Adverse economic effects from the COVID-19 outbreak have already been felt in China, and some economic data for Japan for February also appears to reflect the effects of the outbreak.

The situation regarding the COVID-19 outbreak is changing rapidly and the outlook for the global economy is uncertain. However, we note three specific points: there are signs that the outbreak in China is starting to be brought under control; governments and central banks around the world are rolling out policy responses to the outbreak; and global economic indicators were largely healthy prior to the COVID-19 outbreak.

The longer the outbreak persists, the more likely it is that corporate and household cash flow will dry up. From this perspective, Japan's approach of prioritizing the avoidance of a breakdown in the healthcare system and bringing the virus under control after a certain period of time requires due consideration of the potential impact on the demand side of the economy. This makes a third set of emergency measures in the form of a supplementary budget for FY20 all the more important.

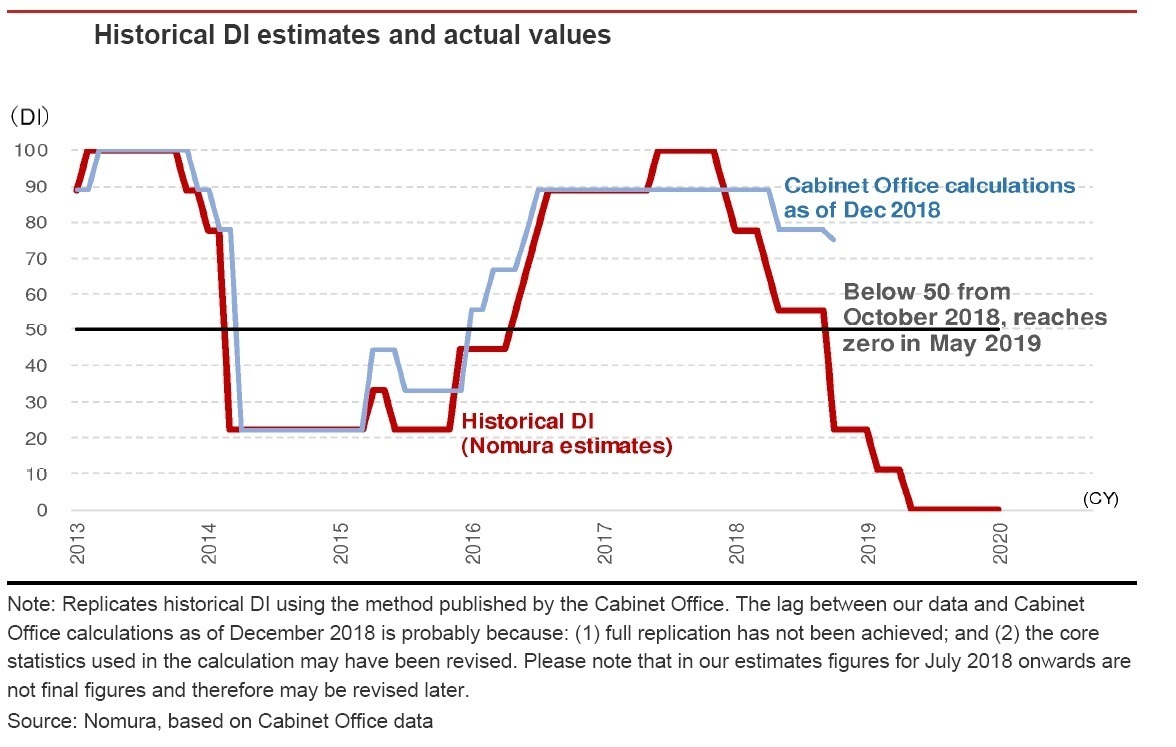

Japan's economic cycle is largely determined based on the historical DI in the Indexes of Business Conditions coincident index. Since the peak or bottom of the cycle is determined to be the month immediately prior to when the DI crosses the 50 threshold, this means Japan's start of the most recent recession was September 2018.

Following the consumption tax hike in April 2014, the Japanese economy entered a sluggish phase, but that period was not classified as a recession since the job openings-to-applicants ratio did not move into a downward phase. As the Japanese population started to decline in earnest, the Japanese economy assumed a structure that is more likely to see a tightening in labor supply-demand. The job openings-to-applicants ratio is currently used to determine whether the economy is expanding or contracting, but we think it is worth reconsidering whether it should still serve as an economic indicator as the ratio rises readily without any growth in real GDP.

After entering a recession the economy has been further buffeted by the consumption tax rate hike and the turmoil stemming from the COVID-19 outbreak. We therefore expect the government to draw up a supplementary budget for FY20.

Why the Fed's emergency interest rate cut did not work

The decline in global equity prices and yen appreciation versus the dollar continued even after the Fed decided on an emergency interest rate cut on 3 March.

We see one factor triggering that change as confirmed cases of coronavirus infection starting to be seen on the US mainland, and that leading to the US dollar and US dollar-denominated assets no longer being necessarily considered to be safe assets. In addition, stronger financial regulations after the 2008 financial shock resulted in a substantial decline in brokers' and dealers' net positions in bonds, and we think they lost their previous market-making capabilities. Telling investors rushing to sell corporate bonds because of concerns that buyers on the market will disappear that money will be supplied or interest rates cut is unlikely to stop them.

We think it should be seen as evidence that the market is starting to become uneasy to a degree that is in excess of concerns about economic deterioration in the US and globally owing to the spread of coronavirus.

Read our full report here for a breakdown.

Contributor

Takashi Miwa

Chief Japan Economist

Masaki Kuwahara

Senior Economist, Japan

Kohei Okazaki

Senior Japan Economist

Kengo Tanahashi

Economist, Japan

Yuki Takashima

Japan Economist

Makoto Arai

Economist, Japan

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.