What Drives the Oil Price Rise Matters

- Rising oil prices affect emerging markets more than they affect developed markets

- Within EM economies, winners and losers are more clear-cut due to a number of factors

- The economic impact of the change in oil prices is much more apparent in EM than in DM

In a previous report, we found that a sustained rise in oil prices affects emerging markets (EM) more than developed markets (DM), and can drive major differentiation in EM economic performance. In the event that oil prices continue to rise, there are likely to be clear winners and losers in EM.

What drives the oil price rise matters. For a demand-driven rise in oil prices, the macroeconomic cost to net oil importers, especially in small, open economies, can be cushioned by stronger exports. But if the rise in oil prices is driven more by supply-side factors, it tends to be more damaging to large net oil importers. This is because, in the absence of a strong pick up in exports, the higher import cost of oil could sharply worsen current account positions, compress profit margins and, to the extent that firms pass on higher production costs, raise CPI inflation.

Net imports of crude and refined petroleum scaled by GDP are a useful metric for assessing the trade exposure to large changes in oil prices, while the weighting of energy-related items in the CPI basket can provide an indication of inflation exposure.

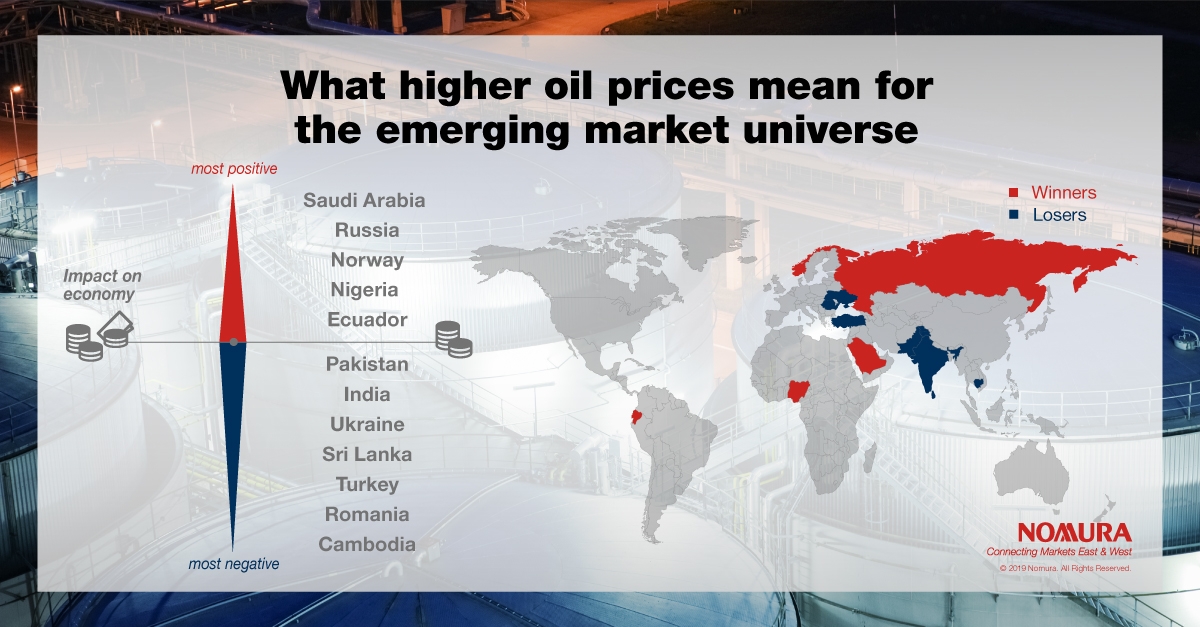

Our assessment based on countries’ latest GDP growth, CPI inflation and IMF projections of current account and fiscal positions in 2019, subject to the continuous rise of oil prices, is shown in the following infographic:

We can see that the economic impact of the change in oil prices is much more apparent in EM than in DM, where EM economies are much more exposed to change than those in DM. This is because EM economies are: home to the bulk of the world’s largest net exporters and importers of oil, more energy-intensive, and less energy-efficient.

Within EM economies, there are likely to be more clear-cut winners and losers, due to the risk of non-linear economic effects, or vicious spirals, to large net oil importers that have weak economic fundamental starting positions. The prospect of even larger twin current account and fiscal deficits could trigger sizeable net capital outflows and currency depreciation which could subsequently add further upward pressure to inflation, and narrow the choice of policy responses to unsavory options. These include: hiking interest rates at the cost of even weaker growth, stepping aside and letting net capital outflows depreciate the currency at the cost of higher inflation, or – in the more extreme case – imposing capital controls at the cost of likely sovereign credit rating downgrades.

The risk from a supply-side driven rise in oil prices is negative for Asia markets and especially for India, the Philippines, and Thailand.

Read more about how rising oil prices will affect Asian markets here.

Contributor

Rob Subbaraman

Head of Global Macro Research

Craig Chan

Global Head of FX Strategy

Michael Loo

Macroeconomic Research Analyst, Asia ex-Japan

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.