US: Updating our Forecast as the Covid-19 Outbreak Matures

Different ways to think about the contraction and the long road to recovery

- Social distancing successfully slowed the spread of COVID-19, but the US economy faces a long road to recovery from the worst downturn since the Great Depression.

- We employ a variety of data sources, including industry-level output, resident mobility changes, labor market activity and high-frequency industrial data, to measure the unique nature and unprecedented magnitude of the COVID-19 shock.

- We expect additional monetary and fiscal support from the Fed and Congress but at a slower pace relative to the early days of the pandemic.

Updating our forecast at an important pivot point for COVID-19 in the US

Based on recent data, we are now at an important pivot point in the COVID-19 outbreak. The momentum of the outbreak appears to have stalled, and social distancing is starting to ease.

We have also started to get some economic data that reflect the full scope of the collapse in activity. This note updates our forecasts for the US economy as it responds to the evolving COVID-19 pandemic.

Incoming data and new analysis suggest that the immediate contraction in economic activity is greater than we had previously thought. We now believe Q2 US real GDP will be about 16.0% below its level in Q4 of last year, compared to a decline of 12.5% in our previous forecast.

However, social distancing is being reversed more rapidly than we had assumed. Consequently, we think the rebound in activity in coming months will be stronger than we had originally expected. Our forecast for the level of Q3 GDP is little-changed from our previous forecast.

The long road to recovery lined with persistent risks

Looking beyond Q3 we are more cautious about how quickly the economy can recover. The policy response has been very aggressive. However, we expect COVID-19 to linger. As many states move to re-open their economies a second wave of infections is possible. Moreover, the damage being done to workers and businesses in the immediate contraction will be a drag on growth for many quarters. We now think real GDP at the end of 2021 will be 5% below where we thought it would be as recently as January.

Our forecast attempts to capture the impact of social distancing on US industries and regions over time, but it also tries to take into account changes in fiscal and monetary policy, financial conditions, and the impact of COVID-19 on the rest of the world. Given the unique nature of current circumstances our outlook is highly uncertain. Our forecast is just one plausible path for the economy, which could turn out better, or worse, than we assume.

We continue to expect the contraction in economic activity to generate outright declines in core prices. However, after reassessing the way the COVID-19 shock is affecting the labor market, how labor market slack translates into inflation and how BLS is responding to challenges of measuring prices in current circumstances, we now expect somewhat less deflation

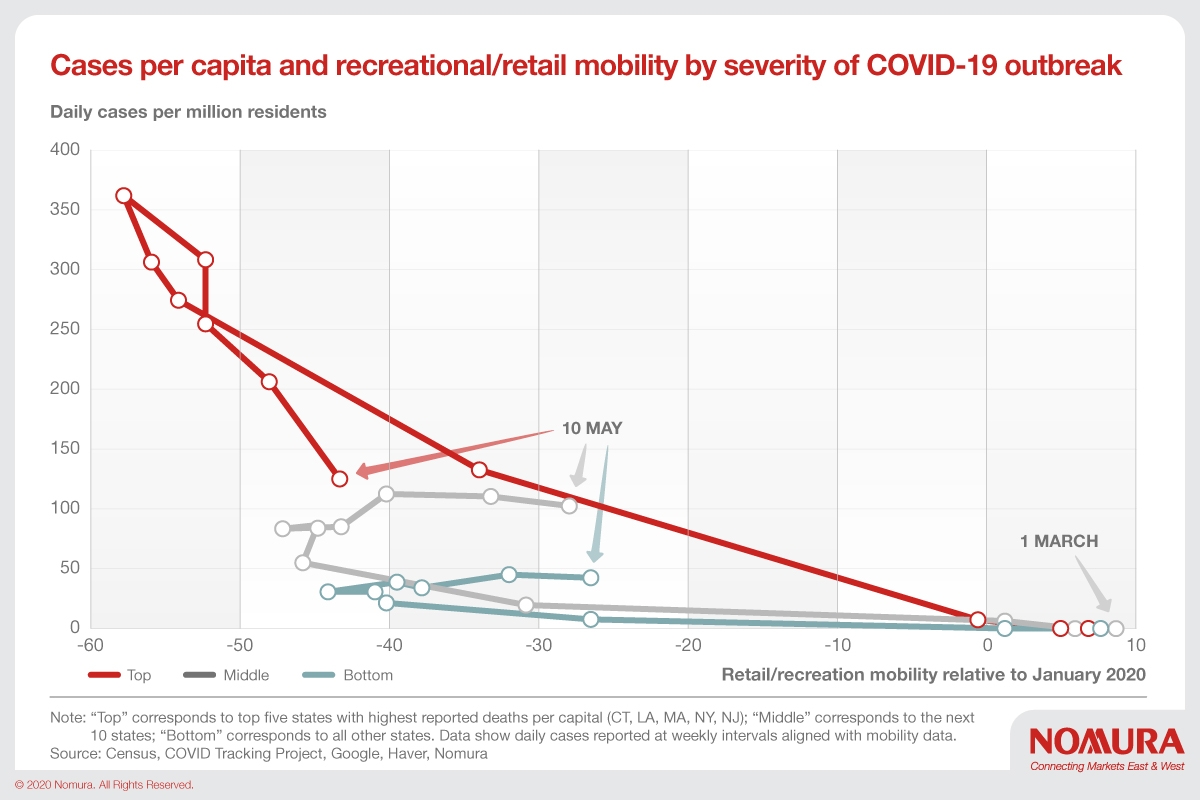

Unique and unprecedented nature of the COVID-19 shock requires multiple approaches

The unique nature of the COVID-19 shock, and the sheer magnitude and speed of its impact on the US, and other economies, makes it difficult to assess. We address this challenge by using a variety of techniques to estimate where the US economy is right now and where it is going. Our forecast for the current deep contraction and the immediate recovery are built up from specific assumptions about how COVID-19 and the efforts to contain it are affecting output in particular sectors of the economy across individual states. Those assumptions are informed by information from location tracking on how individuals are reducing their contacts with others. We also combine available weekly data to track the activity at a high enough frequency to capture the collapse in output in recent weeks, and, we hope, the recovery, when it takes hold. Some of the best information we have on economic activity right now comes from the labor market. We use an Okun’s law framework to assess what labor markets are telling us about overall economic activity. We use information from all these sources to calibrate our forecast for the economy.

Additional policy support ahead, but at a more gradual pace

Last, we discuss the outlook for fiscal and monetary policy and their contribution to our outlook. We expect additional monetary and fiscal support, albeit at a more gradual pace than earlier in the COVID-19 outbreak. The Fed will likely focus on establishing and expanding previously announced emergency credit facilities while working to keep long-term interest rates from constraining the recovery. We expect the Fed to buy another $500bn in US Treasurys between now and the end of September. Over the same period we expect the Fed’s other assets, including lending under its new 13(3) credit and liquidity programs, to increase by $1tn. After a burst of bipartisan policy-making, we expect Congress to return to partisan form later this year, especially with a quickly approaching federal election, managing only to replenish existing stimulus programs by about $500bn, as opposed to establishing any new major initiatives

Read our full report with our updated forecast here.

Contributor

Lewis Alexander

Chief US Economist

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.