US Economy- A Closer Look at Inflation Expectations

Most measures of inflation expectations remain at a level consistent with the Fed’s 2% flexible average inflation targeting (FAIT) framework

- A faster-than-expected economic recovery and severe supply bottlenecks have exerted significant inflationary pressure in recent months. It could take time for these pressures to ease even if they are temporary, making it difficult to have a high degree of confidence in the view that high inflation is transitory.

- Against this backdrop, policymakers are more closely monitoring long-term inflation expectations as a useful guide for assessing where inflation will settle over coming years.

- Despite a lack of comprehensive measures of inflation expectations, we think, on balance, the current level of long-term inflation expectations appears consistent with the Fed’s inflation mandate.

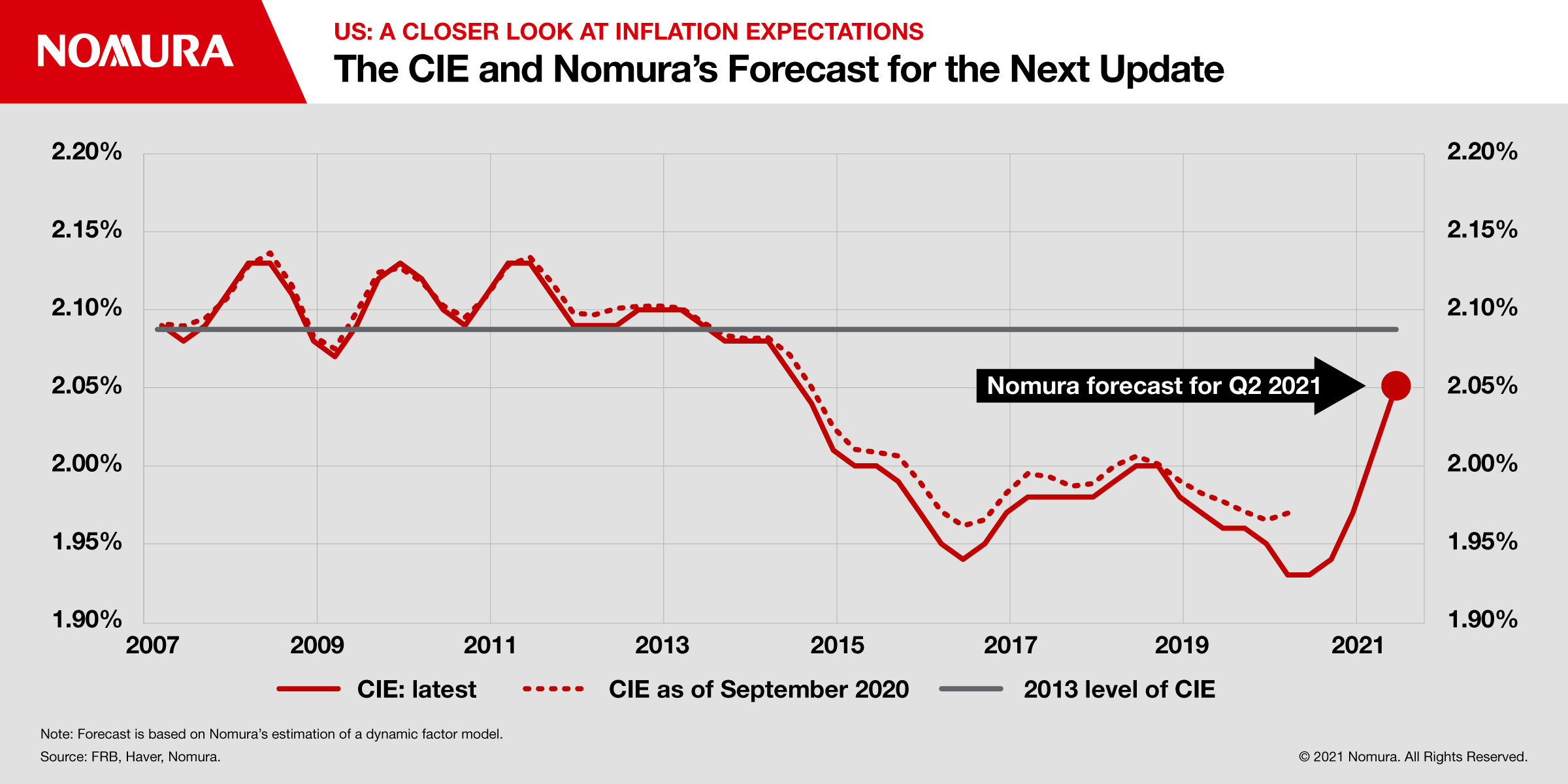

- Specifically, we expect the Fed’s index of common inflation expectations (CIE), which summarizes major indicators of inflation expectations, to edge up a few basis points at the next update on 16 July. However, we do not expect the CIE to increase to a level where the Fed would judge inflation expectations as being unanchored.

Recent and upcoming developments with inflation expectations

In recent months, core PCE inflation accelerated sharply. However, policymakers have so far maintained their long-held view that the recent acceleration will be transitory, pointing specifically to well-anchored inflation expectations. There are many indicators to gauge inflation expectations, each with its limits. Against this backdrop, the Fed staff developed the quarterly index of common inflation expectations (CIE). Although the CIE is a helpful way of summarizing various expectation measures, the quarterly frequency is a notable drawback. As a result, we estimate a similar model to replicate the index with available data. We estimate that the CIE will increase moderately 4bp to 2.05% in Q2, up from 2.01% in Q1. Although the recent rebound has been a bit faster than we had previously expected, 2.05% would remain below the levels that prevailed prior to 2014, when inflation expectations started trending lower. Despite some divergence among major inflation expectations measures, we think inflation expectations are now closer to the center of the range consistent with the Fed’s inflation mandate after remaining at the bottom of that range in recent years.

Implications/risks to the monetary policy outlook

Although we judge that policymakers are comfortable with current levels of inflation expectations (see discussion of individual indicators below), the Fed’s reaction function to higher inflation expectations is an important input when considering removing monetary accommodation. Past remarks by Fed officials suggest the Fed believed long-term inflation expectations were too low as of early 2016. In our view, this suggests the Fed would only consider accelerating the process to remove monetary accommodation if the CIE exceeds 2.10%, the level that prevailed until 2013, and remained elevated for a couple of quarters. Importantly, most inflation expectation indicators have not reached a point where inflation risks would lead to the Fed’s pivot to reduce monetary accommodation aggressively.

Taking stock of different inflation expectations

Inflation expectations across consumers, professional forecasters/economists and market-based measures are all important inputs for the CIE. However, we judge that these metrics remain at a level consistent with the Fed’s 2% flexible average inflation targeting framework.

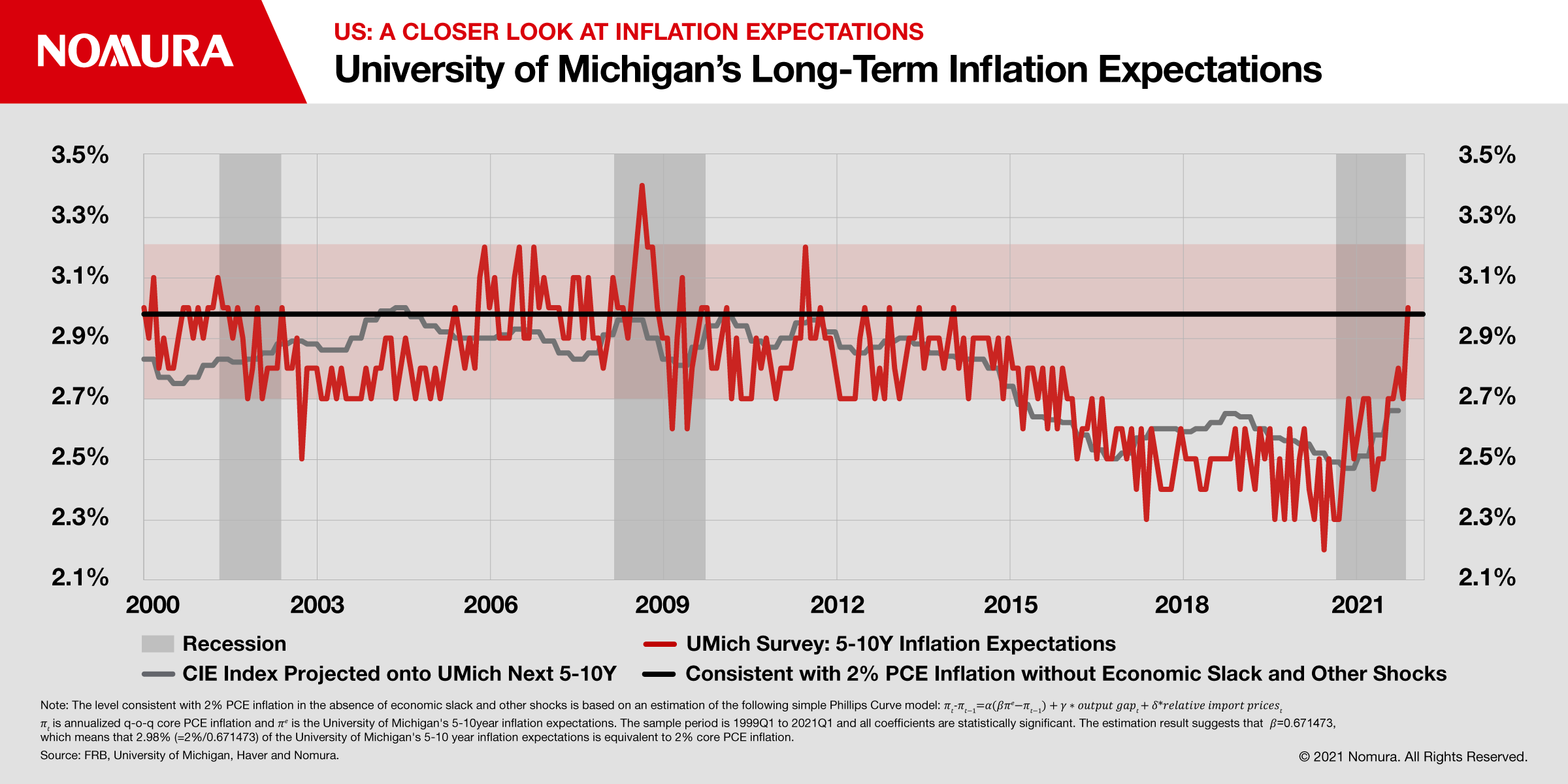

- Consumer expectations: Among long-term inflation expectations that are incorporated into the CIE, the University of Michigan’s 5-10 year inflation expectations, derived from a consumer survey, jumped in recent months to the highest level since 2013. However, we think its current level is now more aligned with levels consistent with 2% PCE inflation than it was prior to the recent rebound.

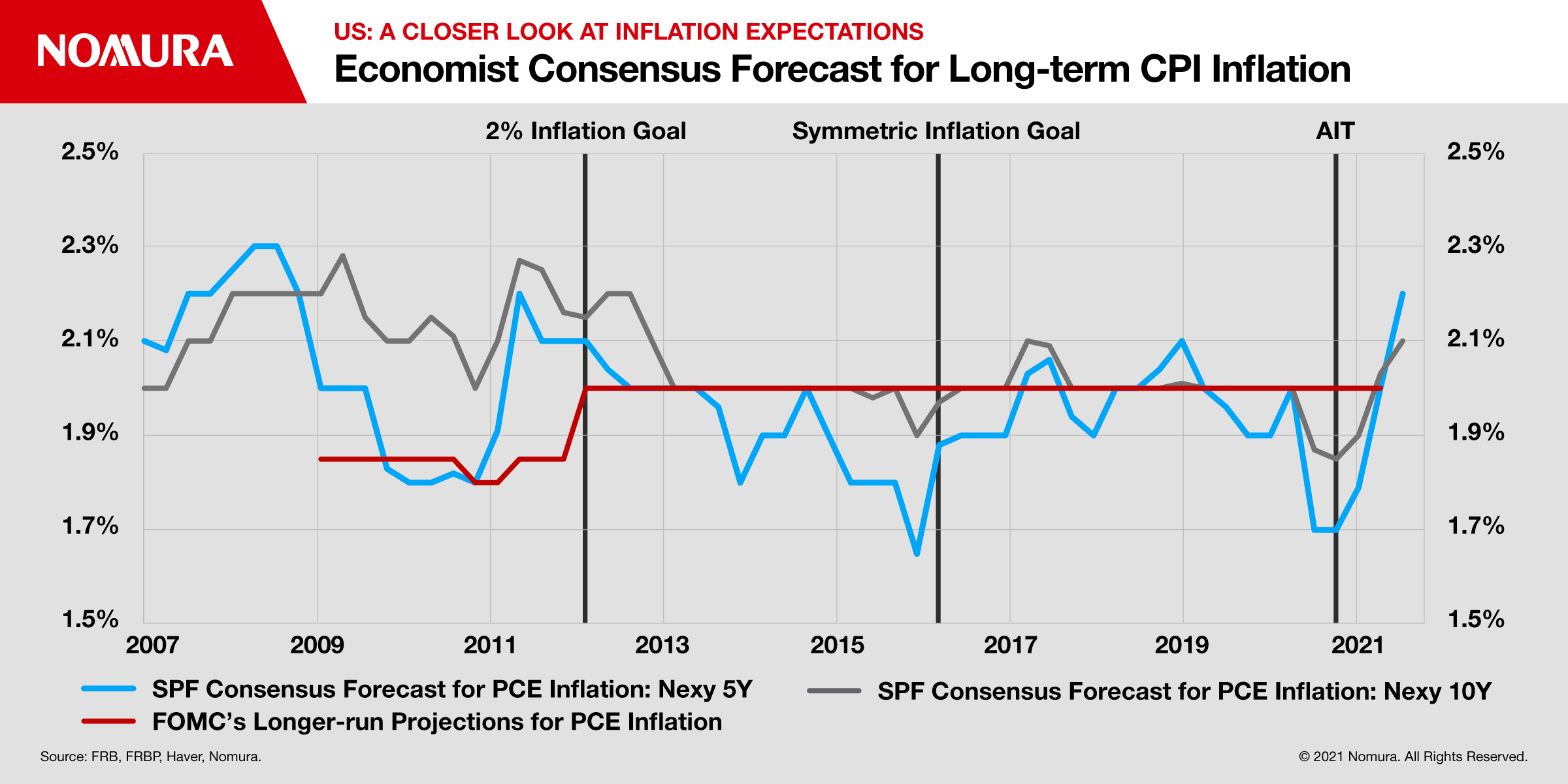

- Economist expectations: The Fed’s CIE index incorporates several inflation expectations based on economists’ consensus forecast surveys. One notable characteristic of forecast-based measures is their responsiveness to changes in the central bank’s inflation targeting regime. In this context, the recent moderate overshoot of economists’ expectations above 2% may reflect the Fed’s intention to achieve “inflation moderately above 2% inflation for some time” under their new flexible AIT framework.

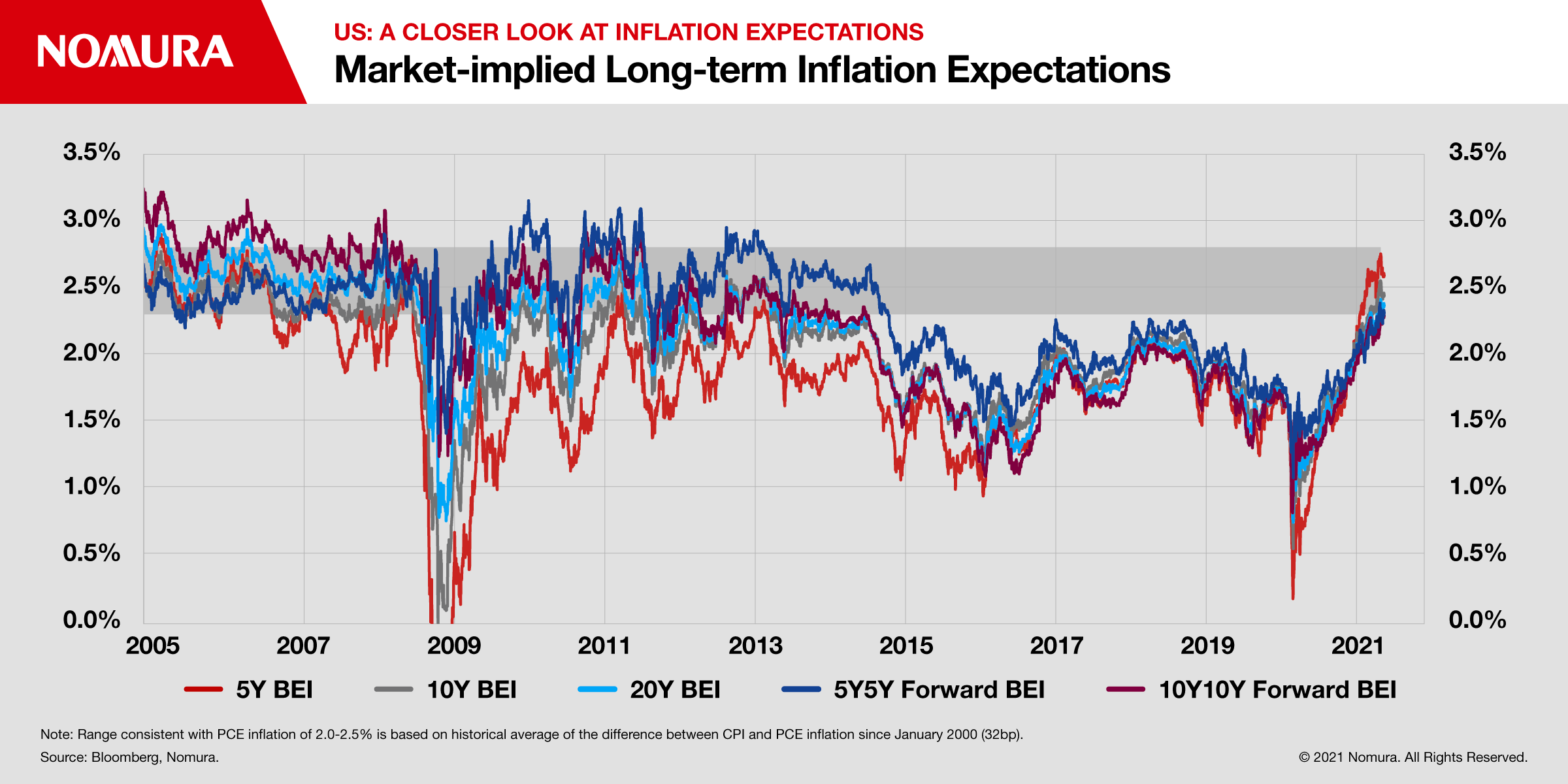

- Market-based expectations: Another type of inflation expectations is breakeven inflation, derived from nominal and inflation-protected (TIPS) Treasury securities. Given that TIPS are linked to headline CPI and CPI inflation tends to be higher than PCE inflation, we have to discount breakeven inflation to get a sense of market expectations for PCE inflation. As the average difference between CPI and PCE inflation since January 2000 is 32bp, 5-year, 10-year, 5-year/5-year forward and 10-year/10-year forward inflation expectations, which are inputs for the CIE, all fall within a range which corresponds to 2.0-2.5% of PCE inflation. Thus, roughly speaking, breakeven inflation has not deviated from levels which can be acceptable for the Fed officials, in our view.

Contributor

Aichi Amemiya

Senior US Economist

Robert Dent

Senior US Economist

Kenny Lee

US Economist

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.