US Economic Weekly Update

Our weekly update of the developments and key themes around the US economy

- Chair Powell is likely to emphasize patience at the May FOMC meeting

- Increased downside risks to growth and a more front-loaded inflation shock are likely to lead the Fed delivering three consecutive cuts from December 2025 through March 2026.

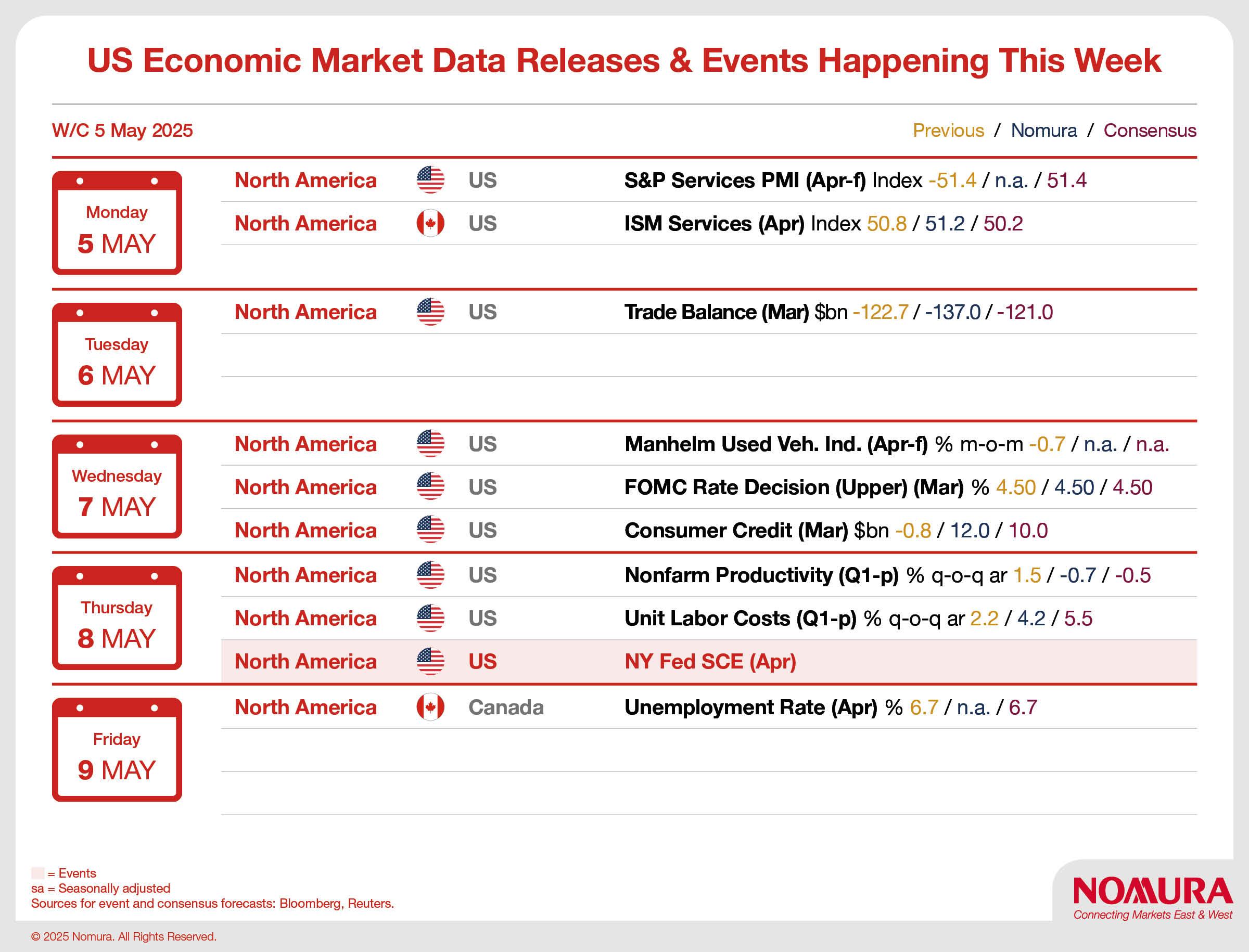

- Our overview highlights the key releases of US economic market data

US Economic Weekly Key Insights

- Employment data remained resilient in April, with headline job gains slowing only modestly and the unemployment rate stable at 4.2%. The April Employment report is backward-looking, with the NFP survey reference week occurring just one week after Liberation Day tariff announcements.

- Solid employment data will encourage the Fed to remain patient about resuming rate cuts.

- We expect an uneventful May FOMC meeting, with Powell continuing to prioritize the inflation mandate over growth concerns.

- Real GDP contracted in Q1 printing -0.3% q-o-q ar, but real final sales to private domestic purchasers rose a solid 3.0%. The Q1 print was noisy due to trade and inventory adjustments by the BEA.

- The Trump administration continued to de-escalate on trade policy this week. Scheduled tariffs on auto parts were postponed along with new exemptions. Administration officials continue to sound confident on bilateral trade deals, although there have still been no agreements announced.

Read our full US Economic Weekly report here.

Contributor

David Seif

Chief Economist for Developed Markets

Aichi Amemiya

Senior US Economist

Jeremy Schwartz

Senior US Economist

Ruchir Sharma

US Economist

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.