US: Domestic Priorities for the Biden Administration in 2021

Vaccine rollout, pandemic support and infrastructure investment will likely be top priorities

- President-elect Biden’s first and most important priority will be containing the virus and accelerating vaccine rollout, which has been slower-than-expected thus far

- We expect additional pandemic relief and infrastructure spending to contribute significantly to real GDP growth in 2021 and 2022.

- The incoming administration will likely prioritize executive action and regulation targeting immigration, climate, finance, labor and competition, particularly for large technology companies.

We expect the incoming Biden administration to focus on containing COVID-19, primarily through vaccine rollout, and enacting significant fiscal stimulus in 2021.

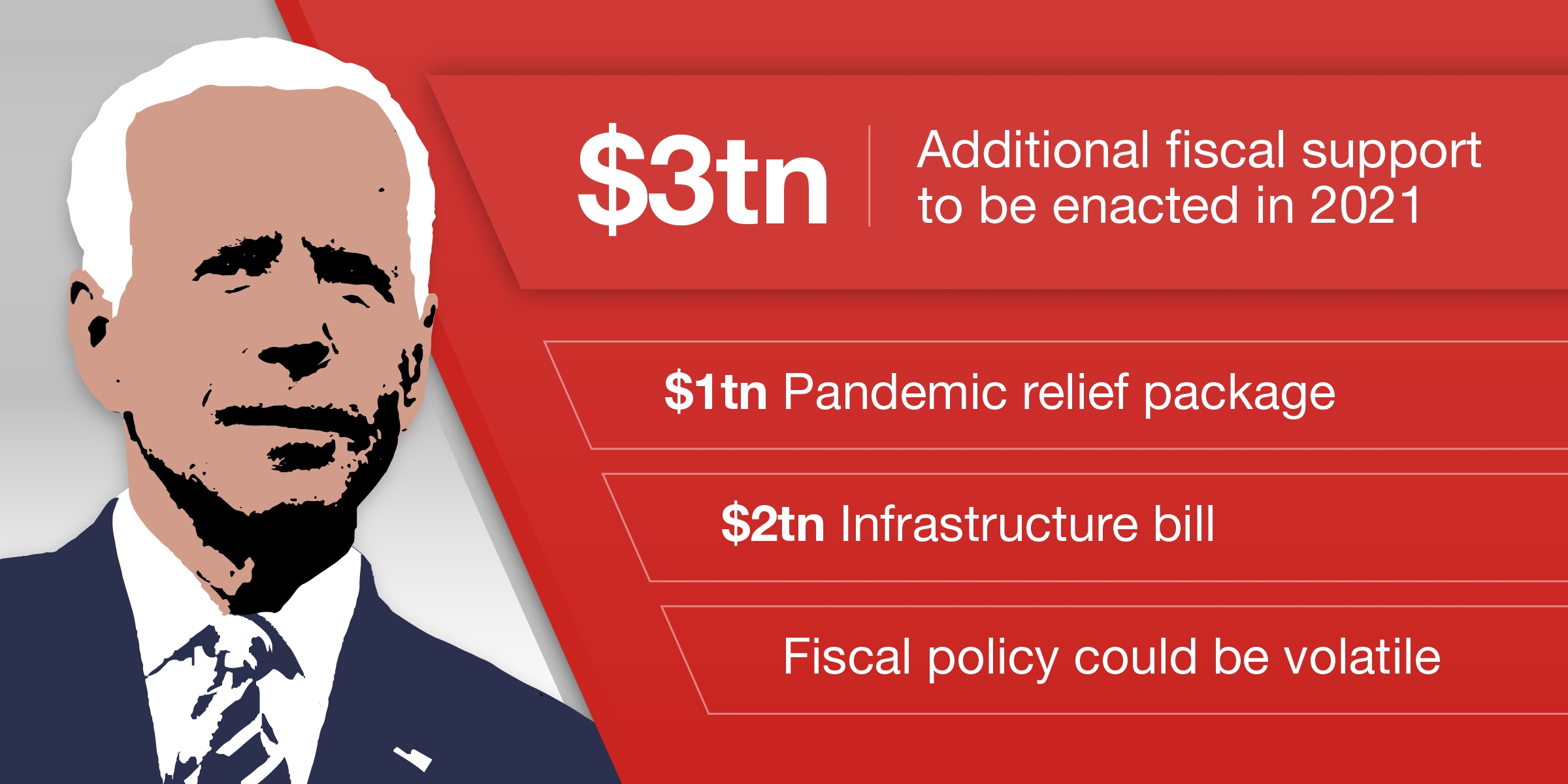

We expect $3tn in additional fiscal support to be enacted in 2021.

- We expect a $1.0tn pandemic relief package to pass around March. President Biden has proposed a $1.9tn pandemic relief package. However, narrow majorities in the House and Senate will likely limit what can be approved.

- To sustain a longer-lasting recovery, we expect a $2tn infrastructure bill to pass around Q3 2021, which will likely be spent over four years.

- Expectations for fiscal policy early in the Biden administration could be volatile given the scale of Biden’s agenda, the narrow Democratic majorities in Congress and the unique political circumstances of the transition.

The Democrats’ narrow majorities in the House and Senate will likely limit the administration’s ability to enact other policies outlined during the 2020 campaign.

- We do not expect significant tax policy changes considering congressional constraints, a still weak economy and the 2022 midterms.

- Senate rules will likely limit Democrats’ ability to affect policy outside of spending and taxes.

The incoming administration will likely prioritize executive action and regulation targeting immigration, climate, finance, labor and competition, particularly for large technology companies.

Biden’s economic agenda

With record highs in new daily deaths from COVID-19, President-elect Biden’s first and most important priority will be containing the virus and accelerating vaccine rollout, which has been slower-than-expected thus far. The Biden transition team has already outlined a new vaccine distribution plan that will seek to deliver 100mn vaccine doses over the administration’s first 100 days

To provide longer-lasting economic support, we expect the administration to announce a significant infrastructure package, totaling $2tn over four years, that will likely pass sometime in Q3 2021.

Spending: Pandemic support first, infrastructure second

With the legislative and executive branches under Democratic control for the first time since 2010, we expect additional pandemic relief and infrastructure spending to contribute significantly to real GDP growth in 2021 and 2022.

We expect the Biden administration and congressional Democrats to prioritize another round of pandemic fiscal support of around $1tn. That will likely include another round of means-tested tax rebates, likely totaling $1,400 on top of the $600 provided at end-December, along with support for state and local governments, small businesses, unemployed workers and healthcare-related spending

On 14 January, Biden outlined his “American Rescue Plan” (ARP) that would provide $1.9tn in additional pandemic support. We believe the final version will need to be scaled back in order to secure support from moderate Democrats and some Republicans

Aside from pandemic support and infrastructure spending, the Biden administration may seek to weave different proposals on caregiving, education and healthcare into these initiatives. A significant portion of the ARP, as proposed, is devoted to tax credits for childcare and expanded paid sick leave, for example.

Shifting expectations for the size and scope of additional fiscal support could be a significant source of volatility in the early weeks and months of the Biden administration

Taxes: Low expectations but high uncertainty

We believe there are three factors that will limit Democrats’ ability to significantly increase taxes over the next two years.

- Historically narrow majorities in both chambers of Congress make enacting tax increases, which will rely on moderate Democrat support, more difficult; Republicans are even less likely to join Democrats on tax increases relative to pandemic spending, putting focus again on budget reconciliation, and creating a more overtly partisan environment.

- The economy remains relatively weak and we believe the Biden administration will prioritize recovery.

- The 2022 midterm elections pose a significant risk to Democratic House and Senate control given already narrow margins in both chambers and the historical pattern of first-term presidents losing seats in the midterms.

There is significant uncertainty for the trajectory of tax policy changes under Democratic control. While passing tax legislation could prove difficult under narrow majorities, that may not stop Democrats from trying.

Regulation and executive action

While additional fiscal spending on pandemic support and infrastructure will take months to enact, the Biden administration will be able to move much more quickly on executive actions and, to a lesser extent, regulation. President Biden already has signed executive actions rescinding Trump’s travel ban affecting predominantly Muslim countries, extending student loan forbearance and the eviction moratorium beyond end-January, rejoining the Paris climate accord and revoking the Keystone XL pipeline permit, consistent with our expectations that Biden’s executive actions during his first term will include a focus on immigration and mitigating climate change. However, executive action is limited, and cannot affect revenues or spending.

The administration more broadly will likely take a more active role in regulation compared to the Trump administration, including labor, financial, environmental and competition, particularly for the large technology companies.

Tech sector regulation will be a high priority given bipartisan support and the recent developments following the 6 January attack on the Capitol. Investigations from the Department of Justice (DOJ) and FTC and state/federal lawsuits are already targeting a few large tech companies, and that trend is likely to intensify over the next few years.

Finally, Biden’s cabinet appointments will also be able to affect policy at an early stage, including Janet Yellen for Treasury Secretary, Antony Blinken for Secretary of State and Katherine Tai as US Trade Representative.

We do not expect the incoming administration to rapidly unwind the flurry of executive actions President Trump has recently taken targeting China, including investment restrictions and diplomatic changes with respect to Taiwan. Existing tariffs put in place under the Trump administration’s Section 301 investigation into China’s trade practices are also unlikely to be unwound immediately. The deterioration of US-China relations under the Trump administration may be one of the more long-lasting policy changes, along with a notable shift away from multilateral trade deals and an open embrace of globalization.

Contributor

Lewis Alexander

Chief US Economist

Aichi Amemiya

Senior US Economist

Robert Dent

Senior US Economist

Kenny Lee

US Economist

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.